Category: Finance

CapBridge and Gordian Capital to launch US$100 million rules-based CapBridge Investment Trust to invest in private securities

Singaporean CapBridge and investment manager Gordian Capital has formed a partnership to launch a pre-IPO fund – the first sub-trust fund in a series of CapBridge Investment Trust which is said to be a rules-based trust investing in private securities.

The pre-IPO Fund is targeting a US$100 million fresh capital to provide growth-stage startups and pre-IPO companies an opportunity to tap into additional funding as well as to provide accredited and institutional investors a greater access to venture capital-level returns.

CapBridge’s Co-founder and CEO Steven Fang explained, “Venture Capital consistently outperforms other asset classes and has some of the best returns in the investment industry. Traditionally, accredited and institutional investors have had limited access to these venture capital-backed growth companies.”

Established in 2015, CapBridge is an online capital-raising platform that enables institutional and accredited investors to invest in growth-stage enterprises companies via venture capital financing and pre-IPO placement. The firm has also formed partnerships with the SGX and Clearbridge Accelerator.

“While rules-based processes are applied in the trading of publicly-listed investments, this is the first time, as far as we know, that a rules-based structure is being applied to investments in venture-backed securities issued by private companies,” said Dr. Steven Fang.

“Given the efficiency of a rules-based trust structure, we believe that the Pre-IPO Fund has the potential to expedite pre-IPO capital raising, making Singapore an attractive fundraising destination for growth companies,” he further adds.

In a way, CIT enables qualified institutional and accredited investors the access to quality, diversified portfolios in a cost-efficient and effective manner with no management fee to carry. Over the next five years, the platform will target investments in venture-backed enterprises in pre-IPO investments.

The fund following a rules-based structure is typically defined as a fund that aims to generate exposure to a to a specific segment of the equities market but operates without consideration of stock market capitalisation or portfolio weighting. In the case of CIT’s Pre-IPO Fund, it is aimed is to increase exposure to securities issued by growth-stage companies.

“The rules-based nature of CIT ‘automates’ the selection criteria and removes the need for active discretionary management, which reduces the fund’s expense load,” Steven Fang explains.

The Pre-IPO Fund will also invest exclusively in convertible instruments issued by companies curated on the CapBridge platform. This will allow the company to preserve capital and maximise returns, allowing for a measure of downside capital protection and potential capital gains.

Commenting on the deal, Mark Voumard, the Founder and CEO of Gordian Capital Singapore Pte. Ltd said, “We are delighted to be working with CapBridge to help support the venture capital ecosystem in Singapore.”

By Vivian Foo, Unicorn Media

Israeli JOY Ventures launches US$50 million neuro-wellness fund

JOY Ventures, a new Israeli investment firm, has recently initiated a US$50 million vehicle centered on the emerging field of neuro-wellness, in addition to the inauguration of its office in Herzliya Pituach.

Founded by the Israeli-Japanese Corundum Open Innovation Fund, JOY Ventures will invest in developments offering scientifically validated technologies offering anti-stress and mood alteration solutions in addition to neuro wellness solutions, that can be turned into marketable products.

Additionally, the new fund will be headed by Avi Yaron, a serial entrepreneur, Founder of Visionsense and the inventor of a state-of-the-art instrument for complex brain surgery along with Beer-Sheva-based Incubit Technology Ventures’ Idan Katz.

Speaking on the vehicle, Yaron said, “Originally developed to make things easier for human beings, technology actually intensifies the tension we live in. For this reason, we decided to invest in neuro wellness by leveraging the large body of research and neuro developments in Israel.”

JOY Ventures will adopt a two-track approach, funding research grants of at least US$1.2 million per annum to academic research in the emerging field, startup companies, and technological incubators for entrepreneurs.

“We’re establishing a new ecosystem in the new industry of neuro-wellness,” Yaron said. “Our emphasis will be on the development of scientifically-proven products whose goal will be to help people manage and overcome chronic conditions.”

“Many years of being involved in the development of brain surgery technologies, made me realise the human need for joyful and relaxed moments and how critical they are for our health,” Yaron explains. “Many neuro researches show that the modern life intensity contributes to prolonged hostile emotions of sadness, anger, anxiety, guilt and more. These emotions, in turn, generate stress and collect a heavy toll from our health.”

By Vivian Foo, Unicorn Media

Indian telecommunications firm Tikona Digital gets US$171 million loan from US govt agency

Telecommunications firm Tikona Digital has recently received a funding of US$171 million in the form of a commercial loan from Overseas Private Investment Corporation, an independent US government development finance agency, according to a report in The Economic Times.

The loan comes as a chance for Tikona Digital, providing the firm with the required liquidity for revival while putting talks of M&A with Telenor to rest.

There were reportedly talks of Tikona’s merger with Norway’s Telenor and leading Indian telecom player Airtel because of the 4G airwaves that it had bought in 2010. However, valuations have been an issue, according to a statement by an investment banker.

“This could be the company’s second coming with renewed interest in the telecom sector and its ancillaries,” The Economic Times quoted a senior investment banker who wanted to remain anonymous.

In October 2015, Tikona Digital Networks, engaged in building the next generation wireless broadband services for home and enterprise customers in India, has announced that it would launch 4G broadband plans in 30 cities by the first half of 2016.

The telecommunications firm currently runs a pilot project in Varanasi to wire the city with 4G technology for home broadband. The company has 20 MHz of broadband spectrum in 5 telecom circles including Gujarat, UP=East, UP-West, Rajasthan, and Himachal Pradesh, for which it had paid Rs 1,058 crore during the 2010 Broadband Wireless Auctions.

Prakash Bajpai, a technocrat, started Tikona’s home WiFi service on free airwaves, but business did not shape up as earlier forecast. In 2012, Tikona consolidated resources shutting service in 12 out of the 38 cities and has now developed technology to provide broadband with 4G technology.

After its latest technology investments, Bajpai said the company can now produce 1GB of data for a mere Rs 5. It is looking to replicate this process in Varanasi in at least 60 more cities within the next 18 months.

“Mobile telecom operators produce a GB of data at about Rs 60 to 70,” said a senior telecom analyst. However, the cost structure for mobile operators and home broadband operators will always be disparate because maintaining mobile continuity is costly.

However, the company is not trying to complete with wireless operators, but instead challenges only BSNI, Tata Teleservices, and other local broadband operators such as Hathaway.

In Varanasi, Bajpai said the company has been able to take on competition and gained around half the market. It is not offering low-end solutions and instead wants to corner the multi-device, heavy users who consume tens of GB data. Bajpai also said the move has resulted in a seven-month break even for Varanasi.

“Varanasi is the first city where 4G services has been launched and plans are to launch 4G network in other cities and circles soon. We are hopeful that subscribers in Varanasi will get to experience world class home broadband services which they can use conveniently for various reasons,” said Prakash Bajpai, the Founder, MD and CEO of Tikona Digital Networks.

The company had earlier secured US$45 million in November 2014 from International Finance Corporation, Goldman Sachs, Oak Investment Partners, Everstone Capital Advisors and L&t Infrastructure Co Ltd.

Tikona plans to use the fresh funds for rolling out the 4G-based broadband services across the country.

By Vivian Foo, Unicorn Media

Malaysian venture capital firm TinkBig to launch US$30 million fund

Malaysian venture capital firm TinkBig Venture is seeking for potential startups to be part of their US$30 million investment that is said to launch towards the end of 2017.

As for details about TinkBig’s investment verticals, the VC firm’s second vehicle will allocate at least 10 percent for IoT Smart Homes focused companies in 2017.

“We will be targeting regional investment around Asia highly focused on marketing right and royalty deal structuring. We are currently looking into Taiwan and Shenzhen IoT players to bring these products to Southeast Asia market,” serial entrepreneur and TinkBig’s founding partner Andrew Tan said.

Founded in July 2016, TinkBig is a comparatively new venture capital firm in the country. In addition, the VC firm to date has invested about US$2.4 million in eight companies, mostly consumer-based.

Among its investment portfolio, includes BurgieLaw – an intermediary platform between startups and the legal industry, Refash – a Singapore-based pre-loved fashion portal; and GOtixs – a platform for promotion and savings.

For most of its investments, the VC firm had picked up a stake ranging between 7.5 percent to 15 percent while maintaining a general ticket size of between RM500k to RM3 million, which translates to approximately US$112k to US$672k.

Likewise, the new US$30 million fund will also maintain a similar ticket size whereby it will be targeting early-stage companies in their seed round which displays a good product/market fit.

Formed by a team of 11 seasoned entrepreneurs, the VC firm is led by Venture Partner Andrew Tan, Principal Partner Jin Tan and Tech Partner Nitin Gupta, who before TinkBig, each have about 20 experiences in business, investment and tech.

The team, through Tinkbig, aims to help startup throughout the process of ideation to commercialisation. Besides, the incubator process also involved a live pitching resembling a reality show which helps prepare startups.

Looking to raise the funds by the third quarter of 2017, TinkBig has completed just about 20 percent of the funding for this new vehicle largely from investors who include entrepreneurs, high net worth individuals, and listed companies.

“The market is getting soft as Limited Partners are getting cautious. However, this reluctance to invest is not because of a scarcity of good investment options,” Andrew Tan, the Principal Partner of TinkBig explained.

In fact, long exit windows and lack of sufficient secondary data to conduct due diligence along with diminishing returns have made limited partners become cautious. “It’s going to be a very challenging moment for 2017 to raise funds from LPs,” Tan adds.

“We are looking into the space of functionally designed prop that essentially becomes your smartphone’s best friend within seconds. Remote-controlled devices such as TV, air conditioner, sound system etc, and the user’s smartphone learns the device and lets the user control it from the phone itself using Bluetooth,” Tan also noted.

Besides, IoT Smart homes which are mostly based in Singapore, Japan, and China are increasingly becoming an area where many want to engage and invest.

“I would say IoT smart homes is a very promising area and billion dollar market,” Tan noted. “I believe 2017 will be the year that IoT is going to be one of the hottest topics in the investment scene with functional IoT devices that are going automated and provide convenient to daily lifestyle.”

TinkBig intends to fill the gap in Malaysia for a VC fund which not only supports its investments via a holistic approach but also to create an ecosystem for success rather than just providing capital.

“If we find interesting startups we will introduce them to relevant corporate partners. For example, we would introduce an IoT company who specialise in energy saving product we would connect them to our developer partners who have a lot of industry experience that can be leveraged to help the startup fine-tune its product,” he said.

With a focus on Southeast Asia, the firm has a strong foothold in Malaysia, Indonesia, Singapore, and Thailand. The company is also currently exploring opportunities in Vietnam.

By Vivian Foo, Unicorn Media

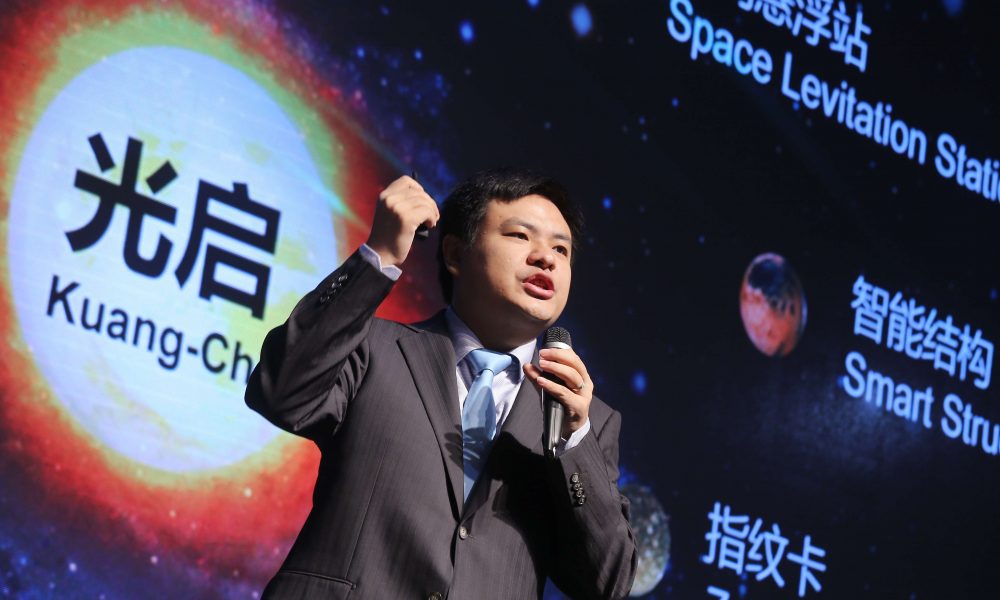

China-based tech corp Kuang-Chi launches US$250 Global Tech Fund

Shenzhen-based Chinese technology conglomerate Kuang-Chi Group announced on January 11 that is has launched a US$230 million fund that will be used to invest in global technology companies.

The fund is known as Global Community of Innovation (GCI) Fund II and is accompanied by the opening of its Israel-based International Innovation Headquarters.

As one of the first Chinese fund of its kind, GCI Fund is targeted at Israel technology companies that are looking to collaborate with local Chinese firms for entry and expansion into their domestic markets.

GCI Fund II will invest US$250 million in global technology companies active in sectors of smart city and home, computer vision,Internet of Things (IoT), artificial intelligence, VR/AR and robotic.

The selected startups will be supported by a new China-based incubator, established by Kuang-Chi to help bring its portfolio companies to the Chinese market.

“We were able to quickly deploy the US$50-million GCI Fund I in exceptional companies that operate in sectors we know well and we’d like to build on this momentum with Fund II,” said Dr. Liu Ruopeng, the chairman of Kuang Chi.

“Working with our partner in Israel, we’ve identified a wealth of opportunities to expand our portfolio and give our joint investment team an expanded strategic and financial mandate,” he added.

Earlier, the first GCI fund established in 2016, has seen stakes in several Israeli companies, including computer vision pioneer eyeSight, voice analytics developer Beyond Verbal, and video intelligence and analytics provider AgentVi.

Besides, the fund has also invested in Norwegian biometric authorization innovator Zwipe, Canadian aviation company SkyX, SolarShip and Australia’s Martin Jetpack.

“We have moved from success to success in Israel, and I’m delighted by the pace of our good progress showed in our recent investments in eyeSight, AgentVi and Beyond Verbal,” the Kuang-Chi co-founder and CEO of KuangChi Science, Yangyang Zhang said.

Within six months of its investment, Kuang-Chi and eyeSight jointly built a local team in China to provide markets with the most advanced embedded computer vision solutions currently available.

While in December, Beyond Verbal signed its first cooperation agreement in China, with the Second Affiliated Hospital Zhejiang University School of Medicine in Hangzhou.

“GCI portfolio companies will share access to cutting-edge technology that includes over 2,000 patents and R&D from around the world. Each of these investments comes with an opportunity to expand their business in China and establish relationships with global market leaders across multiple industries,” added Liu.

Founded in 2010 by a five-person team, Kuang-Chi has created a Global Community of Innovation of more than 2,600 employees which spread through 18 countries and regions.

The fund is dedicated to disruptive innovation and principal investment in cutting-edge technology sectors including communications, metamaterials, and space technology.

By Vivian Foo, Unicorn Media