Category: Funding Rounds

Cybersecurity startup Kratikal Tech raises US$500k in seed funding

Cybersecurity startup Kratikal Tech Pvt. Ltd. on Monday announced that it has closed a seed funding round from former director of Microsoft India, Praveen Dubey; along with former managing director of Juniper Networks India, Amajit Gupta; and the chief executive of ImpactQA, J.P. Bhatt.

As per details of the round, Kratikal has raised about US$500k in which the company will use for product development and building training modules.

“I had a really good experience working with Kratikal. They are a very professional team who are clearly very knowledgeable in their space. They work dedicatedly for any projects they received and supported me throughout the terms with them,” said JP Bhatt, the Chief Executive Officer of ImpactQA who is similarly a client of Kratikal.

Founded in 2013 by five alumni of Allahabad’s National Institute of Technology – Pavan Kushwaha, Paratosh Bansal, Dip Jung Thapa, Prashant Pandey, and Ankit Singh – Kratikal Tech works to provide cybersecurity services for large corporations and Fortune 500 Enterprises, protecting their brands and businesses from cyber attacks.

Additionally, the company offers various services such as vulnerability assessment, security auditing, cyber forensics, emergency response, web and mobile application testing, and others.

“We aim to provide world-class cyber security solutions globally and work on building the environment and train the IT (information technology) professionals and digital community in India about how to build secure systems,” Kratikal said in a statement.

The tech startup claims to provide training sessions to corporates, law enforcement agencies, and education institutes, in addition to having trained over 5,000 candidates from over 131 countries through its online modules.

With a team of 15 employees, Kratikal services over 20 clients across corporate houses, police departments, law enforcement agencies and individuals in India, US, Australia, New Zealand and South Africa.

Its client portfolio includes information technology company Unisys, global manufacturer operator Terex, and internet marketing service Dawailelo among some.

Besides, the Delhi-based company is developing a software-as-a-service (Saas) tool to automate its security testing services with the help of built-in artificial technology.

“This automated tool will bring down the high cost of security testing and make it economically feasible for all the SMEs (small and medium enterprises) to be secure,” said Kratikal.

The company competes with Chandigarh-based TAC InfoSec Pvt. Ltd and Delhi-based Lucideus Tech Pvt. Ltd. In 2016, TAC raised an undisclosed amount of pre-series A funding in August, while Lucideus had received an undisclosed angel funding from Amit Choudhary, director of Motilal Oswal Private Equity Advisors Pvt. Ltd.

By Vivian Foo, Unicorn Media

Chinese used car dealership Uxin secures US$500 million funding co-led by TPG, Jeneration, and China Vision

Uxin, an online auction house for used cars in China has managed to secure a US$500 million funding round co-led by investors private equity giant TPG, Chinese multi-family office Jeneration Capital and newly established value investment firm China Vision Capital.

Existing and new investors Warburg Pincus, Tiger Global Management, Hillhouse Capital, KKR & Co. L.P. and Huasheng Capital also participated in the round, which brings Uxin’s total fundraising to around US$1 billion.

China Renaissance Partners and China International Capital Corporation (CICC) will also act as the firm’s financial advisor.

With these latest proceeds, Uxin will continue its investment in business development, product services as well as branding awareness – a move to provide better user experience and to position themselves ahead from their competitors.

In September 2016, a similar online platform Guazi.com raised US$250 million, just six months after completing a US$204.5 million round. Another industry player, RenRenChe, raised US$150 million, while Tiantianpaiche and Souche.Com each raised US$100 million last year.

Founded in 2011, Uxin operates a business-to-business used car auction platform Uxin Pai (www.youxinpai.com) and a business-to-consumer used car transaction platform Uxin Ershouche (www.xin.com), as well as Uxin Finance, which provides financial services focused on used car transactions.

The company also employs over 1,000 specialists in 50 Chinese cities, who inspects and certify the quality of user vehicles for sale on Uxin’s platform. Uxin makes use of its proprietary “CheckAuto” system and advanced vehicle identification capabilities to ensure the quality of vehicles sold through its platform.

Additionally, the used car dealership offers all buyers a full guarantee and will refund their purchase within 15 days if they were to discover any undisclosed issues with all vehicles bought through Uxin.

In 2015, Uxin recorded monthly revenue of RMB150 million (about US$21.7 million), with monthly transaction volume reaching 50,000 used car purchases in December alone, according to an announcement by the company.

Uxin’s chief executive officer Dai Kun told Chinese media that the company had reached profitability in July 2016, and is expected to reach total transaction volume of 800,000 with aggregate transaction value of RMB60 billion (about US$8.7 billion) in 2017.

“TPG has tracked the used car sector in China for three years,” said Derek Chen, a partner at TPG. “After research and comparison, we found Uxin to be the company with the only proven business model in terms of user demand, market size and financial performances.”

Julian Cheng, co-head of China at Warburg Pincus, said Uxin had established a business model suitable for the Chinese market after studying the experiences of the United States and Japan’s used car e-commerce platforms.

The company previously raised venture funding worth US$400 million in 2015 from Baidu, KKR, Coatue Management LLC, Warburg Pincus, Tiger Global Management LLC, Legend Capital, Bertelsmann Asia Investments (BAI), DCM and Tencent Holdings Ltd.

By Vivian Foo, Unicorn Media

Mobile app management platform Hansel.io raises US$1.35 million round led by IDG Ventures

Mobile application management platform, Hansel.io, has secured US$1.35 million in a funding round led by IDG Ventures with participation from existing backer Endiya Partners, the company said in a statement on Wednesday.

“What made us excited about Hansel.io was the ease with which the product can help mobile developers solve major production issues at runtime. At a time when customer acquisition and retention costs continue to skyrocket, a product like Hansel.io comes as a big boon for a great end-user experience,” Venkatesh Peddi, the Executive Director at IDG Ventures said.

With the latest proceeds, the Bengaluru-based firm will use the funds for team expansion, product development, and growth in overseas markets – that is specifically the expansion of the company presence in the North American market.

This round follows Hansel.io seed funding in February 2016 from Endiya Partners, Tracxn Labs, along with a group of angel investors including Rajesh Sawhney and Mekin Maheshwari.

“With this round of funding, the focus will be to go global, go cross-platform, and help mobile developers be as responsive to their end users as possible,” the co-founder and CEO Varun Ramamurthy explains.

Founded in 2015 by former Flipkart employees – Varun Ramamurthy, Parminder Singh, and Mudit Maur, Hansel Software Pvt. Ltd. develops crash analytics for mobile applications, offering a developer-friendly toolkit that helps them to diagnose, resolve and communicate customer issues on their application.

In other words, Hansel.io allows mobile developers to fix bugs, update configurations, edit user interfaces, and manage security policies of mobile apps at runtime. The platform is currently available on both Android and iOS.

“Despite the abundance of use cases the product provides for, for the developer, it is a simple configure-and-deploy product, where companies can go live in less than 15 minutes. We have built the product to be as intuitive and effortless to use as possible,” said Parminder Singh, one of the co-founders of Hansel.

Hansel.io can help developers start managing their live apps at runtime, with just a five-minute integration process and no code change required, developers can start managing their live apps at runtime using Hansel.

The company claims that it currently has an installed app count of more than 140 million across client such as redBus.in, Toppr, nearbuy, Voonik and ShopX among others. The firm also claims that it has impacted nearly 20 million devices, helping the users by fixing a bug, changing the UI or security permissions.

By Vivian Foo, Unicorn Media

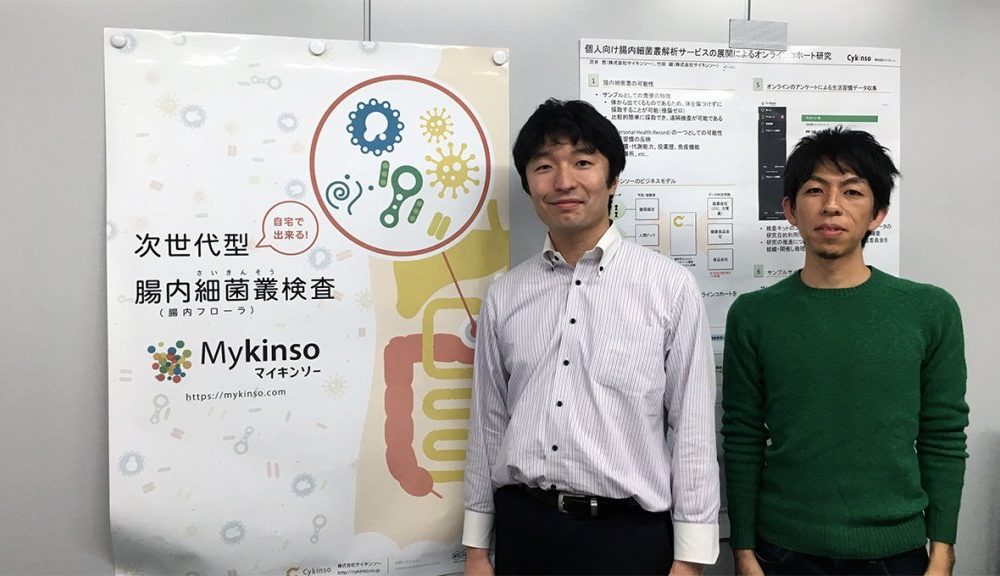

Japan’s healthcare startup Cykinso secures US$2.3 million investment to provide intestinal health advice

Tokyo-based Cykinso, which develops and sells Mykinso – a test kit for intestinal flora, has announced that it has secured 270 million yen (about US$2.3 million) from the Regional Health Care Industry Support Fund and other investors in its seed round.

The GP for the Regional Health Care Industry Support Fund are REVIC Capital and AGS Consulting under the jurisdiction of the Regional Economic Revitalization Support Organization, with banks being the funds’ limited partners (LPs).

This fund follows an earlier round of angel funding from individual investors and grants secured from numerous government agencies such as the Ministry of Economy, Trade, and Industry’s “Project to Encourage the Creation of SMEs and New Business” as well as a grant from Kanagawa Prefecture for the “Project to Promote the Creation of the Preventive Medicine market”.

Despite being grants, Cykinso has, in terms of business stages, labeled the proceeds received as their seed round, making their most recent funding essentially a series A round.

According to Cykinso. these latest proceeds will be used to finance business development, including using the data collected from the intestinal flora tests to develop a system for offering nutritional guidance. This platform will focus on gut microbiomes is unique, given the crucial role and impact it has on an individuals’ health.

Founded in November 2014 by CEO Yu Sawai, who has previously worked at a genome research company, the venture is conducting joint research with RIKEN Innovation Center’s Benno Laboratory and Osaka University’s Research Institute for Microbial Diseases’ Department of Infectious Metagenomics.

In August 2015, the Japanese startup was accredited as a RIKEN Certified Venture. Three months later, the firm released “Mykinso” – a home-testing kit for intestinal flora which allows people to test the state of their intestinal bacteria (i.e. gut biome).

Following this, there is also the release of “Mykinso Pro” for the professional market which enables medical institutions and clinics to register patient examination data and manage specimens. Data provided will be presented to the user or the user’s doctor in the form of a cloud or paper report.

The company claims that it has collected intestinal flora data from around 2000 people through both services, receiving permission from users beforehand and the assurance that users will remain anonymous. Depending on the scale of the accumulated data regarding intestinal floral, the services to be offered and the business stage will be adjusted accordingly.

In October 2016, Cykinso has along with dispensing pharmacy big name Aisei Pharmacy (TSE:3170) and leading mobile service provider MTI (TSE:9438) held an event called “Intestinal Summit” to promote awareness among general consumers about intestinal flora and services.

Additionally, this week the Japanese startup will move offices from the Kanagawa Science Park, where they have resided for the two years since inception, to the Good Morning Building in Shibuya, Tokyo. For Cykinso this signifies its transformation from a purely academic venture into the business domain.

By Vivian Foo, Unicorn Media

Comic art platform Kuaikan Manhua closes US$36 million Series C round led by Tiantu Capital

China’s Tiantu Capital has led a 250 million yuan (about US$36 million) Series C round funding in Kuaikan Manhua, an online and mobile platform for original online comic artwork targeting young readers.

The financing round was reportedly completed in October last year and other investors who also participated in the round include Sequoia Capital, GX Capital, Engage Capital and Chinese news reader app, Toutiao.com. This brings the value of the Beijing-based startup at over 1 billion yuan (approximately US$140 million).

“China’s animation and comics content market are in the initial development stage. It is also an area that the Chinese government encourages,” said Neil Shen, the founding managing partner at Sequoia Capital China. “Kuaikan Manhua focuses on a niche market and has successfully established a leading position.”

Founded in 2014 by a well-known animation artist Chen Anni, Beijing-based Kuaikan Manhua currently has active monthly readers of 24.6 million while daily viewership reaching 7.27 million. The platform has signed over 1000 works and more than 500 comic artists, where some of the popular authors has a fan base of over one million.

Aside from the increase in the magnitude of users and works, the comic artwork startup has also recently moved their office to Wangjing Soho as well as an increase in company size, increasing from the original 40 employees to a recruitment of more than 100 people.

Upon the completion of this financing round, the capital will mainly be used in the cooperation with the external CP as it can be difficult to solve the problem of creating self-published content which requires professionals as well as the expenditure of energy in order to build a solid team.

Besides, the platform will still retain its original intents of providing light comics, targeting the new generation of young readers and their fragmented time in reading comics – that is an average daily usage of about 40 minutes, according to the data from Kuaikan.

The company previously raised 100 million yuan (about US$14 million) in a series B financing round from unnamed investors in 2015.