Category: Press

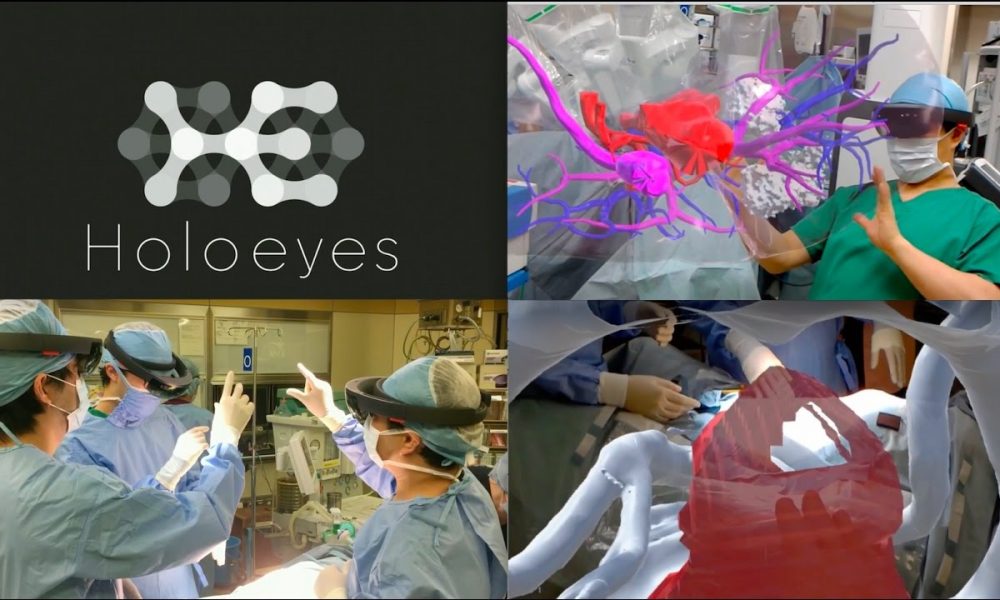

HoloEyes raises US$1.3 million Series A to help surgeons stimulate operations in VR

Japanese Virtual Reality (VR) startup HoloEyes, which develops surgical simulation content for doctors, announced recently that it has raised 150 million yen (about US$1.3 million) in a Series A round from Nissay Capital.

This follows a 10 million yen (about US$89K) seed round the company has secured from Japanese VR-focused acceleration program Tokyo VR Startups (TVS) after graduating from its 2nd batch. The investment proceeds from the round have been used for product and business development.

Founded in October 2016, HoloEyes was set up by app developer Naoji Taniguchi, surgeon and visiting associate professor Dr. Maki Sugimoto, and Kenichi Shinjo who has previously worked as the producer of AllAbout and COO of Appliya.

Developed for medical use, the startup’s VR content solution known as HoloEyes VR is designed to provide 3-dimensional images for surgeons and other medical staff to understand the surgical procedure more intuitively.

The technology is based on cloud services that can convert a specific patient’s medical diagnoses, such as CT scans, MRIs, and X-rays into polygons for the medical staffs to freely view then in 3D space using VR devices.

Collecting and accumulating the data from CT scans, HoloEyes eventually plans to form 3D human body models based on its medical VR database. Moving forward, the startup may assume a business model based on a search database to retrieve 3D images based on certain keywords.

For example, it could be possible to search “60s male prostate cancer” and retrieve the 3D images for a similar case which can be used by a doctor for diagnosis or surgery training. The possible use cases could also include sharing surgical plans and easier explanation for patients.

In December 2016, the team won the Tech Lab Paak award at the event’s 6th Demo Day, while in January 2017 they were awarded the Amazon AWS prize at the Demo Day of the 1st batch of Brave – the acceleration program by Tokyo-based life science-focused startup VC/ accelerator Beyond Next Ventures.

With the proceeds from Series A, HoloEyes plans to build the system and business base for HoloEyes VR and expand its staff.

Myanmar Online Creations secure Series A funding from BOD Tech

Myanmar Online Creations (MOC), one of the country’s first online publishers which provides local content recently announced that venture capital firm BOD Tech has joined its six-digit Series A round closed earlier this month.

The deal was finalized in mid-June, and others who participated in the round include Yangon-based financial advisory firm Trust Venture Partners, and Thaung Su Nyein, the CEO of Information Matrix which produces the 7 Day Journal.

MOC said that the capital from the Series A is intended for its plan to launch up to 10 applications and to set up a broader business plan for 2018.

In fact, the startup already owns five local platforms and applications launched to date since February 2017. These include Onlyinburma.com, a Burmese content portal for the locals in Yangon and Lolburma.com, a social media content platform which allows users to upload funny videos and pictures.

The remaining three sites are Langyaung.com, a business directory listing page which includes accurate GPS mapping for all local businesses; serious dating site Phoosar.com; and ezdin-gar.com, a billing payment system based on QR codes.

“We feel a great synergy and opportunity between the current content and technology of the properties within the BOD portfolio and MOC’s current 5 online sites,” said Win Ohn, the Founder and CEO of Myanmar Online Creations.

Meanwhile, BOD Tech owns flymya.com – a one-stop platform for flight and travel bookings. Aside from MOC, the company has also backed a number of tech-based startups including shopmyar.com, Yangondoor2door, Laundary.com.mm and Star Ticket.

Mike Than Tun Win, the Founder of BOD Technology Company said, “We will be contributing our content and do cross products partnership with MOC products.”

IFC commits up to US$25 million in North Haven Thai Private Equity

International Finance Corporation (IFC), a member of the World Bank Group is making an equity investment up to US$25 million in North Haven Thai Private Equity L.P.

IFC said the private equity fund is looking to raise up to US$300 million in total commitments, and the company will not hold more than 20 percent of the Thai investment vehicle.

Managed by Morgan Stanley Private Equity Asia Inc, North Haven Thai Private Equity is a newly-formed PE fund with an initial 10-year term.

The fund targets mid-market companies with significant operations in Thailand and is jointly led by two co-heads Eric Ma and Chong Toh.

Last October, Morgan Stanley’s North Haven Private Equity Asia Angel made its first Thai investment by acquiring a 25.63 percent stake in baby-and-adult diaper maker DSG International.

“We believe that the Thai market overall is one of the most attractive markets with positive long-term potential,” said Kingsley Chan, the managing director of Morgan Stanley Private Equity Asia.

Equis to sell entire stake in green energy platform Energon, exit from India

Renewable energy developer and infrastructure investor Equis Energy is looking to sell its entire India portfolio after a strategic review of its renewable energy portfolio in Asia.

The portfolio is made of two green energy platform, Energon and Energon Soleq, which amounts to almost a gigawatt of wind and solar energy installations.

Energon has 414 megawatts of operating assets which focus on wind power projects, while Energon Soleq works in the solar sector and is developing projects totaling 260 megawatts in Telangana and Karnataka.

Besides, Equis Energy has another 300 megawatts of capacity under development which is also up for sale.

“Equis Fund has put up Energon and Energon Soleq for sale. It is seeing a lot of interest. The exercise is underway as part of their Asia portfolio strategy with them planning to run an auction process,” said a source from Livemint who requested anonymity.

Another source confirmed the development and also adds that there are several firms who expressed interest in Equis’ assets.

The plan to sell is a result of the growing consolidation in India’s green energy sector as well as the declining energy tariffs which bring a concern to the uphold of electricity offtake commitments.

Established in 2012, Equis Energy has 4.7 gigawatts of renewable energy generation assets across Asia-Pacific, with an additional 6.3 gigawatts under development in Australia, India, Indonesia, Japan, the Philippines, Taiwan, and Thailand.

The clean energy firm has earlier appointed Credit Suisse (Singapore) Limited and JP Morgan (SEA) Limited to conduct its strategic review, with a particular focus on its renewable energy portfolio in mid-April.

David Russell, the board chairman of Equis said, “Equis is considering a restructuring of its entire renewable energy business with long-term investors looking to support management’s growth strategy. The process involves a 100% restructuring of Equis Energy.”

Chinese children’s stories startup Kaishu Story tells a US$13 million funding tale

Children’s storytelling startup Kaishu Story, otherwise known as Kaishu Jianggushi in Chinese has raised RMB 90 million (about US$13 million) for its Series B funding round.

New Oriental Education & Technology Group Inc., one of the largest private educational services in China led the investment.

The round also saw the participation from Chinese growth capital firm Trustbridge Partners, Shanghai-listed Zhejiang Daily Digital Culture Group and iResearch Capital.

Kaishu Story was launched by former CCTV host Wang Kai and represents a children’s content brand focusing on children’s stories, with additional products such as audio series and online parenting courses.

To date, the platform has expanded to a total of 2,033 audiobooks which amounts to 23,363 minutes played over 1.5 billion times. Some of the titles include “Kaishu’s Journey to the West”, “Little Prince”, and “Kaishu’s 365 nights”, to name a few.

The startup claims that it has six million users on its content platform through a WeChat public account, a mobile app and audio shows. It targets to generate the revenue of RMB200 million (about US$29 million) in 2017.

Kaishu will use the latest capital to build a national children’s brand, investing in a wider range of product development related to children’s content and moving on to the parenting industry.

“We are making memories, memories of the people,” said Wang Kai. “We hope that through us, every little kid from the age of two can start building on happy childhood memories.”

This funding round comes in lieu with the emergence of a new generation of content and knowledge-sharing platforms in China that have sparked investor enthusiasm.

In January, Q&A knowledge sharing platform Zhihu has raised US$100 million in a Series D round. While Shanghai Bajiulin, a new media and knowledge sharing startup founded by well-known Chinese financial writer Wu Xiaobo also raised RMB 160 million (about US$23 million) in the same month.