Month: February 2017

Indian packaged foods startup Sattviko acquires outfits curation platform StylSpot

Rays Culinary Delights Pvt. Ltd, the parent company of packaged foods startup Sattviko, has recently acquired fashion stylist curation portal StylSpot in order to strengthen its technology platform.

This makes StylSpot the third acquisition by Sattviko following the deals where it has acquired packaged food maker FYNE Superfood in August 2016 and food delivery startup Call A Meal in November 2015.

Financial details and terms of the deal were not disclosed but one of the four co-founders of StylSpot, Sumeet Chilwal will join Sattviko’s core team following the acquisition.

Founded in 2015 by four IIT (ISM), Dhanbad graduates — Sumeet Chilwal, Gaurav Goyal, Amit Verma and Jalaj Dagar, StylSpot is a platform that brings users completed branded outfit looks for the occasion handpicked by fashion stylists.

While Sattviko, on the other hand, was launched in 2014 as a healthy lifestyle brand. At present, it operates a chain of quick-service restaurants (QSR) in three cities, including Gurgaon and Jaipur, ventured into the online delivery of packaged foods in February 2015.

The e-commerce arm sells a range of products, including traditional snacks such as makhanas, flax seeds, raisins, jaggery, and chana. “Since Sattviko is now into e-commerce, StylSpot’s product discovery platform will help us scale up,” said Prasoon Gupta, the Co-founder of Sattviko.

Last November, Sattviko had raised an undisclosed amount of angel investment from a number of individual investors including Raman Roy, the Founder of Quattro Global Services, Ashish Gupta, former CEO of Evalueserve and Vinnie Mehta, executive director at ACMA.

Other investors who also participated include Yogesh Andlay, founder of Nucleus Software Ltd; Kevin Freitas, the HR leader at Inmobi; N Ravikiran, the former head of product at Wipro; G Ravishankar, an ex-CEO of Jet Airways and former CFO at GE Healthcare; Gaurav Khurana, a Microsoft employee; and Vaibhav Jain, Swastika Company’s founder.

By Vivian Foo, Unicorn Media

CapBridge and Gordian Capital to launch US$100 million rules-based CapBridge Investment Trust to invest in private securities

Singaporean CapBridge and investment manager Gordian Capital has formed a partnership to launch a pre-IPO fund – the first sub-trust fund in a series of CapBridge Investment Trust which is said to be a rules-based trust investing in private securities.

The pre-IPO Fund is targeting a US$100 million fresh capital to provide growth-stage startups and pre-IPO companies an opportunity to tap into additional funding as well as to provide accredited and institutional investors a greater access to venture capital-level returns.

CapBridge’s Co-founder and CEO Steven Fang explained, “Venture Capital consistently outperforms other asset classes and has some of the best returns in the investment industry. Traditionally, accredited and institutional investors have had limited access to these venture capital-backed growth companies.”

Established in 2015, CapBridge is an online capital-raising platform that enables institutional and accredited investors to invest in growth-stage enterprises companies via venture capital financing and pre-IPO placement. The firm has also formed partnerships with the SGX and Clearbridge Accelerator.

“While rules-based processes are applied in the trading of publicly-listed investments, this is the first time, as far as we know, that a rules-based structure is being applied to investments in venture-backed securities issued by private companies,” said Dr. Steven Fang.

“Given the efficiency of a rules-based trust structure, we believe that the Pre-IPO Fund has the potential to expedite pre-IPO capital raising, making Singapore an attractive fundraising destination for growth companies,” he further adds.

In a way, CIT enables qualified institutional and accredited investors the access to quality, diversified portfolios in a cost-efficient and effective manner with no management fee to carry. Over the next five years, the platform will target investments in venture-backed enterprises in pre-IPO investments.

The fund following a rules-based structure is typically defined as a fund that aims to generate exposure to a to a specific segment of the equities market but operates without consideration of stock market capitalisation or portfolio weighting. In the case of CIT’s Pre-IPO Fund, it is aimed is to increase exposure to securities issued by growth-stage companies.

“The rules-based nature of CIT ‘automates’ the selection criteria and removes the need for active discretionary management, which reduces the fund’s expense load,” Steven Fang explains.

The Pre-IPO Fund will also invest exclusively in convertible instruments issued by companies curated on the CapBridge platform. This will allow the company to preserve capital and maximise returns, allowing for a measure of downside capital protection and potential capital gains.

Commenting on the deal, Mark Voumard, the Founder and CEO of Gordian Capital Singapore Pte. Ltd said, “We are delighted to be working with CapBridge to help support the venture capital ecosystem in Singapore.”

By Vivian Foo, Unicorn Media

Chinese online dress rental platform MSParis raises US$18 million funding led by Northern Light Venture

China’s online dress rental platform MSParis, on Thursday, announced that it has raised a US$18 million series A round led by Northen Light Venture Capital, with participation from Matrix Partners China, existing investor China Growth Capital and a number of international fashion brand investors.

“In 2016, the apparel industry in China has a market size of several trillion RMB, this shows that it is already a mature sector in the e-commerce industry,” said Jiang Haotian, the managing director at Northen Light Venture.

“But over the past ten years, the industry has faced several problems including high return rates, inventory risks, and low online customer volume. Yet again, MSParis’ innovative business model manages to optimize the operating model and supply chain, which is the main reason why we are optimistic about MSParis,” Jiang adds.

Northern Light Venture Capital is a China-focused venture capital firm targeting early stage opportunities of innovation and disruptive technology. Since its inception in 2005, Northern Light has backed over 180 ventures.

Established in 2015, Shanghai-based MSParis allows users to rent top brand and luxury women’s dresses ranging from Vera Wang, Valentino to Lavin, Hermes etc. at up to 90 to 95 percent discounts on the purchase price.

The company targets the so-called gold-collar workers in the financial and media industry who may require high-end evening dresses and other formal attire regularly. However, in March 2016, the dress rental platform expanded its range of clothing from its initial focus on high-end evening gowns to include daily apparels as well.

“The platform initial strategy was to build up an acceptance of MSParis brand image based off evening gowns Expanding into everyday wear, on the other hand, is aimed at converting our customers into long-term users, as well as to enhance the company’s cash flow,” said the founder of the MSParis, Xu BaiZi who is christened Paris.

Following the completion of the financing round, MSParis will also welcome two new talents into their management team. One will be in charge of the firm’s strategy-making while the other is responsible for the supply chain management. Additionally, Meikailong products VP will also join the company over the same period.

MSParis also claims that within a year of its inception, its new clothes on average manages to recover their cost within s 2 months period, while 20 percent of their customers has paid a few thousand in RMB to upgrade into an annual membership status.

The clothing rental platform has a 3000 square meters integrated warehousing and laundry center that can complete their complete their retrieval, cleaning, and distribution process within 5 hours.

By Vivian Foo, Unicorn Media

Korean Soft Power launches real-time interpreter app ManTong, translating Korean into 10 different languages

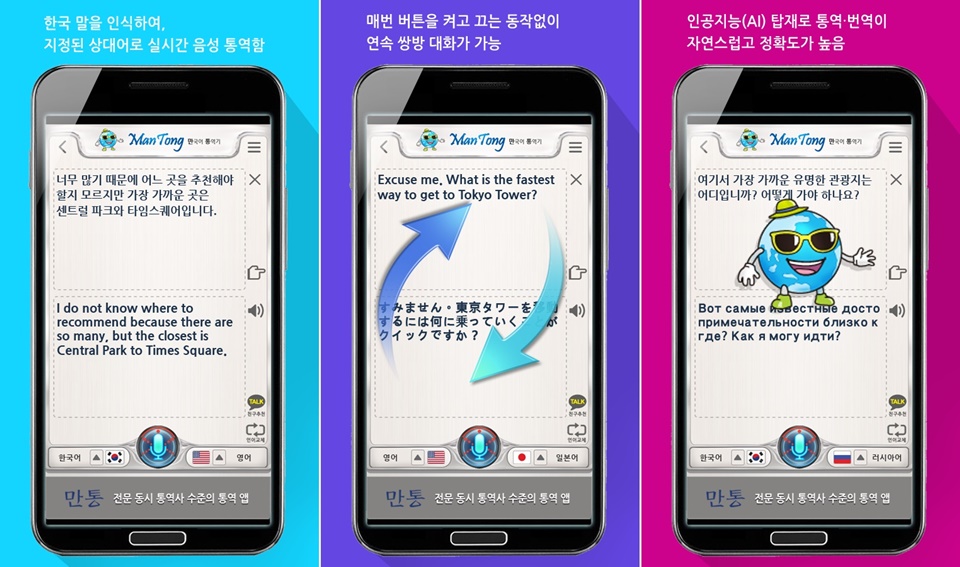

Soft Power, a Korean software engineering company has recently released a real-time interpreting application that translates Korean into 10 different languages based on AI technology.

The application is known as ManTong and users can activate it by simply talking into their mobile phones, and the app utilising Google Translate API, which applies a Neural Machine Learning AI (NMT) technology will translate the sentence instantaneously at the level of a professional interpreter.

The application is also especially useful in noisy environments, which makes it suitable to use when abroad for short conversations. Since the app translates voice messages, one can simply talk into headphones that they are wearing and show the translated content to the other person without much hassle.

Soft Power CEO Kim SuRang said, “Some interpretation or translation applications that exist in the market either cannot handle long sentences or directly translate voice recognized sentences. The users have to press the buttons for every sentence they would like to translate, which is very inconvenient in the situation where you are given instructions or counseling.”

He further explained, “In this way, ManTong app solved the fundamental problem that occurs in existing interpretation and translation app, we created a technology that will tackle the problem at its root, as ManTong guarantees high quality and applicable interpretation and translation that supports a simultaneous two-way interpretation.”

Software engineering expert Park JinHo, the director for Software Education Research Lab in Soongsil University also commented on the app, saying that “In fact, ManTong did not require a single line of code. It utilized ‘SmartMaker’, a software solution that expands upon language processing AI, and this technology can be used in a variety of other relevant fields such as voice recognition and speech synthesis to easily develop new applications.”

Mantong is free for any personal use and can be downloaded via both the Google PlayStore and Apple AppStore. Hence, with a ManTong application on their smartphone, one is no longer restricted by a language barrier.

By Vivian Foo, Unicorn Media

Mobvista secures US$100 million credit facility from Bank of China

China’s mobile marketing platform Mobvista Co. Ltd. has on Wednesday, obtained a credit facility worth nearly US$100 million from Bank of China, which marks the largest credit facility ever granted by a bank in the mobile marketing industry in China.

“For an asset-light Internet company, the trust behind the strategic cooperation with Bank of China wasn’t easy to build,” said Mobvista’s Founder and CEO Wei Duan. “The credit facility represents not only Bank of China’s recognition of Mobvista’s past performance, but also its confidence on Mobvista’s future.”

Established in 2013, Mobvista is an Asian mobile marketing platform that focuses on providing user acquisition and traffic monetization services to mobile app developers across the world. On November 2015, the company completed its listing on China’s National Equities Exchange and Quotations (NEEQ), raising an amount of nearly US$1 billion.

Mobvista is also recognized by TUNE as the “Top 25 Mobile Advertising Partner Report for 2016“, having targeted traffic from 243 countries and regions with a daily amount reaching over 10 billion. Prior to this, the company which houses 500 employees in 12 offices spread across the world is backed by NetEase (Hong Kong) Ltd., Midas Capital, Shanghai Media Group, Haitong Securities and China Securities,

In May 2016, the company raised nearly US$80 million via its first private placement deal to finance acquisitions, buying U.S. advertising company NativeX and European mobile game analytics platform GameAnalytics for an undisclosed amount in February and July last year.

“Across the world, over 80% Internet users are connected via smartphones and the rapid growth mobile Internet over the past three years offers historic opportunities to global mobile marketing industry. This credit facility from Bank of China will further help us accelerate expansion in overseas markets,” said Wei Duan

Mobvista’s revenue reached US$118.174 million while its net profit reached US$11.525 million for the six months ended on August 31, 2016, according to disclosure filings, in which has allowed it to maintain its No.1 position in the mobile marketing industry.

Providing financial services in China and 46 other countries and regions, Bank of China within the three years period from 2012 to 2015, has increased its overseas assets by 54.06% and continued to diversify, strongly supporting its cross-border M&As and M&A financing and loan businesses in the trend to internationalise.

“Mobile marketing is an emerging industry with great momentum. Today’s credit facility is based on the recognition to the mobile marketing industry, which is in line with Bank of China’s commitment to an efficient and professional partner addressing all demands of small and medium businesses,” said a spokesperson from the Bank of China.

Bank of China is Mobvista’s largest bank partner in 2016 looking at the perspectives of RMB deposit and loans, USD loans, as well as cross-border settlement. With the support from Guangdong Branch of Bank of China, Mobvista has built a connection with Bank of China’s branches in Seoul, Brussels, Hong Kong, New York and Chicago.

From Vivian Foo, Unicorn Media