Press

-

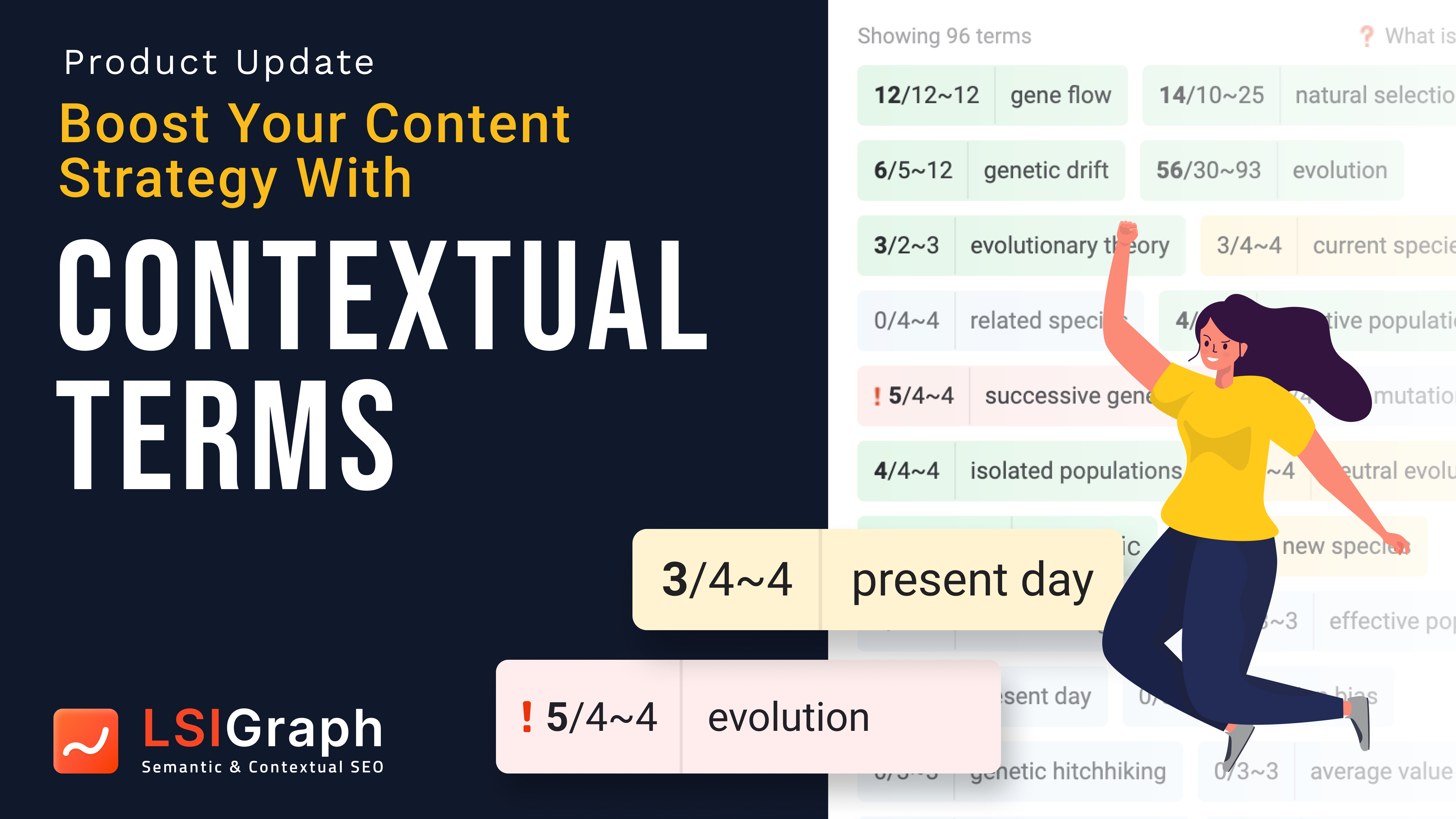

LSIGraph Launches New Contextual Terms Feature For Improved Content Optimization

With its latest update, LSIGraph encourages its users to add contextual terms for improved SEO content, allowing higher search engine rankings and traffic growth. Kuala Lumpur, Malaysia – November 16, 2022 In its determined effort…

-

TikTok’s Failure To Protect Children’s Privacy Lands In £27 Million Fine In The UK

TikTok, a Chinese short video platform, is quite popular among young users, which has led to a slew of privacy-related issues. The UK’s Information Commissioner’s Office (ICO) found the video-sharing platform may have processed the…

-

JAS Asset acquires cafe chain Casa Lapin to set up joint venture Beans and Brown

JAS Asset’s new joint venture – Beans and Brown will take over coffee house chain Casa Lapin, with plans to strengthen the brand overseas and list the subsidiary within 3 years.

-

Myanmar’s search technology startup Bindez secures six-digit USD round from Vulpes Investment

Bindez will use the capital to scale up its business in order to meet the growing demand in Myanmar.

-

Japanese startup Ambient Intelligence raises funding to develop submersible underwater drone

The startup will use the capital to accelerate their underwater drone production and begin their drone rentals by November 2017.