Category: Analysis

Indonesia’s Bookkeeping Service Provider BukuWarung Secures Funding from Silicon-Valley investor Rocketship.vc

Indonesia’s BukuWarung, a digital bookkeeping startup for micro-enterprises, today revealed that it has raised an undisclosed amount of funding from Rocketship.vc and Indonesian retail giant Revolut.

Rocketship.vc, a Silicon Valley-based global investor is also a backer in Khatabook, an Indian market leader in the digital bookkeeping space which has reached a valuation of between US$275 million to US$300 million in its last funding round.

While the financial terms of BukuWarung’s round remain unknown, the startup did share that the funds raised were greater than the previous funding it received after joining the Y Combinator program in September 2020. Sources from DealStreetAsia also note that this latest funding round brings the total investment received by BukuWarung to US$20 million.

To date, the startup backers including Y-Combinator, Quona Capital, East Ventures, AC Ventures, DST Global Partners, Golden Gate Ventures, and Tanglin Venture Partners.

As a matter of fact, the startup has become a portfolio of several well-known venture capital companies including East Ventures, AC Ventures, Quona Capital, Golden Gate Ventures, DST Global Partners, and Tanglin Venture Partners. Meanwhile, angel investors such as Michael Sampoerna and Plaid Co-founder William Hockey are also known backers of this startup.

Founded in 2019 by Chinmay Chauhan and Abhinay Peddisetty, BukuWarung provides a bookkeeping application, payment solutions, and online sales for Micro, Small & Medium Enterprises (MSMEs) through its applications.

Specifically, BukuWarung’s technology helps merchants improve the bookkeeping process by tracking transactions including credit, expense, sales, and cash flow visibility through business reports.

In total, the startup has more than 3.5 million merchants registered on its platform from tier 2 and 3 locations, and BukuWarung’s co-founder Chinmay Chauhan said that the startup has started making revenues through its payment solutions.

“We launched a digital payments solution for our merchants, which has seen strong adoption and is already processing over US$500 million in payment volumes. Our focus this year is to enhance our payment offerings and enable more digital payment use cases for our merchants,” added Chauhan.

BukuWarung recently forged a partnership with WarungPintaar and few others to create an ecosystem to better serve the MSME needs for digitizing. The startup has also launched Tokoko, a Shopify-like tool that lets merchants create online stores through an app, and says the platform has been used by 500,000 merchants so far.

With these latest fundings, BukuWarung will expand its technology and product team in Indonesia, India, and Singapore.

With its large number of SMEs, Indonesia is often seen as a desirable market for companies helping the drive toward digitization

Based on a report by Jakarta Post, SMEs employ 97% of their domestic workforce and contribute about 60% of Indonesia’s gross domestic product. These businesses however face difficulties in accessing financial services for scale.

Through digitizing their financial records, startups like BukuWarung not only streamline business bookkeeping processes but in turn also make it easier for them to apply for working capital loans and credits.

In this segment, the startup currently competes with BukuKas and CreditBook. In January 2021, BukuKas has also raised a US$10 million round led by Sequoia Capital India to build an end-to-end software stack catering to Indonesian SMEs.

How the United States and China became a Unicorn Factory

What do Beijing and Silicon Valley have in common?

More than two-hundred spawning billion-dollar unicorn companies, according to the latest report by Hurun Research Institute based in China that compiled the listed unicorn startups from around the world.

In this report, unsurprisingly, China and the United States took the top 2 spots with 206 and 203 unicorn startups respectively. Together, both countries account for more than 82 percent of the total unicorn count globally at 494.

Note that the report only considers unicorn companies that received the billion-dollar valuation as a snapshot in June 2019, and doesn’t take into account firms that have already been acquired or listed on the stock exchange board.

“We have found just under 500 unicorns in the world,” said Hurun Report Chairman and Chief Researcher Ruper Hoogewerf, who is also known by his Chinese name Hu Run.

“The Hurun Global Unicorn LIst 2019 is designated to inspire entrepreneurship among wannabe entrepreneurs and encourage investors. These young companies, only 7 years old on average, are the world’s most exciting startups, leading a new generation in disruptive technology.”

The top 3 highest valued companies being online payment systems Ant Financial (US$150 billion), content discovery platform ByteDance (US$75 billion), and taxi-hailing platform Didi Chuxing (US$55 billion).

This is followed by three unicorns based in the United States which are software cloud products Infor (US$50 billion), electronic cigarette company JUUL Labs (US$48 billion), and travel tech startup Airbnb (US$38 billion).

Of course, unicorns can be born anywhere, but why are the spotlights for these two countries in particular? Well, there’s the demographic and startup maturity factor, but ultimately it depends on the industries where investors are placing their bets on.

In China, the finance sector has produced the biggest unicorns, such as Ant Financial and JD Finance, a subsidiary of e-commerce giant JD.com.

Logically, these startups are successful in being supported by internet giants paired with the nation’s march to become a digital cashless society.

At the same time, with fintech growing massively and generating huge revenues for the country, this disperses into China’s ecommerce sector driven by the rapidly expanding number of online shoppers and changing purchasing culture.

In the United States, however, things are a bit different. While they have Amazon and Paypal, most of the current unicorns are corporation service provides, such as Infor Inc. a provider of enterprise software and service worldwide.

The country has a habit of paying for external corporation services, which will help improve their work efficiency and cut operation costs. Besides, the demand is not just locally, Chinese firms also prefer US corporation service providers over domestic companies.

In terms of venture capital firms, the report found the US venture capital firm Sequoia to be one of the most farsighted unicorns. It has invested in 92 of the 494 unicorns,

Meanwhile in second place is China’s internet giant, Tencent Holdings which also holds 46 investments and SoftBank which also has 42 counts of investment.

Kept in View: India at 3rd Place

With just 21 startups valued at more than a billion dollars, you may think that India is way too far behind China and the United States.

Anas Rahman Junaid, the Chief Researcher of the Hurun Global Rich List had told Hindu BusinessLine that, “India can quickly catch up with Big 2, only if the regulatory and business environment is poised to capture the demographic dividend.”

What sets India apart from other hot startup ecosystems like Singapore or Indonesia is the country’s startups pace at entering the unicorn club.

As this report cuts-off at the end of June this year, it does not cover the four additional unicorns that were added to India between the months of July and September.

If you look at the timeline of Indian unicorns, it is the country’s time of harvest as it has long passed the first wave of startups in the country for those that took early-stage risks. And now with better infrastructure and smartphone penetration beyond metropolitan cities, the larger target area and demographic has also present large opportunities for startups.

With large exits like Flipkart which was sold to American retail giant Walmart for US$16 million, this has further boosted investors’ confidence and brought their focus to India.

Moving forward, it’s best we keep an eye out for India as well.

Indonesian unicorn Go-Jek may enter Malaysia soon

Malaysia’s youth and sports minister Syed Saddiq Syed Abdul Rahman is planning to bring Go-Jek into Malaysia.

On August 19, Syed Saddiq said he had managed to bring Go-Jek’s founder, Nadiem Makarim, whom he had previously met in July, to meet with Prime Minister Dr. Mahathir Mohamad and Transport Minister Anthony Loke.

“The presentation was accepted kindly, and we will finalize the discussion in the upcoming Cabinet meeting this Wednesday,” Syed Saddiq recounted.

The youth and sports minister mentioned that these efforts are aimed at providing more job opportunities to motorcyclists.

“Motorcyclists want jobs, not just one-off programs or race tracks,” Saddiq said his Twitter post which features a one-minute video.

Golongan mat motor mahukan pekerjaan & pembelaan,

Bukan sahaja program one-off/Litar.Mereka wajib dibela. Jangan perlekehkan sumbangan mereka kepada negara.

Alhamdulillah, berita baik selepas perjumpaan dengan Tun M & Minister Anthony. Let’s work even harder.#Gojek#Matmotor pic.twitter.com/VtnrDtlQy4

— Syed Saddiq (@SyedSaddiq) August 19, 2019

In an interview, Syed Saddiq also mentions that Go-Jek has been successful in Indonesia, with an employment of over two million motorcyclists in Indonesia, and hundreds of thousands more in Thailand, Singapore, and Vietnam.

Through this proposal, Syed Saddiq believes that Go-Jek entry into Malaysia will create hundreds of thousands of job opportunities for motorcyclists, in addition to boosting the businesses of small entrepreneurs.

In a separate Twitter post on August 18, Syed Saddiq has also started a poll asking netizens to vote if they support or oppose Go-Jek e-hailing services.

Overall, the poll saw 56,000 responses with 88% agreeing to the statement.

A Brief Introduction to Go-Jek

If you are unfamiliar with the startup, Go-Jek is an Indonesian e-hailing company backed by Tencent, JD.com, Google, and Temasek Holdings.

Founded in 2011, the startup has since then moved beyond ride-hailing services, developing into a one-stop app where users can order on-demand services such as grocery delivery and beauty treatments.

In Indonesia, Gojek has expanded to offer more than 20 services, including e-payment, house cleaning, and laundry services. It is known for its very affordable pricing, which analysts say is possible because the company pays for part of the costs out of its coffers.

Go-Jek also claims to be the largest food delivery service in Southeast Asia, beating even regional competitors in India, which has a population which is more than four times that of Indonesia’s 260 million.

The startup said it currently has more than two million partner drivers and 400,000 partner merchants in Southeast Asia.

Nadiem Makarim, Go-Jek’s Founder and Group Chief Executive said: “When we first launched Go-Food in Indonesia, we became the biggest player in the food delivery service in the country within six hours.”

Go-Jek vs Grab in Malaysia

Anyhow, if cabinet discussions held this week are to go well and Go-Jek entry to Malaysia is successful, the ride-hailing consumers are most likely the first to benefit.

Because after Uber ended its services in Southeast Asia, Singapore-based Grab has basically become the sole player in the Malaysian ride-hailing market.

At least with Go-Jek, the two will extend the competition, giving way to a free market and bringing choice back to the ride-hailing market in Malaysia.

Then again, this matter also reminded many of the homegrown Go-Jek known as Dego Ride which similarly offers motorcycle ride-hailing services in Johor.

Dego Ride and its thousands of riders were dissolved and brought to a halt by the Barisan Nasional government last year, after saying that its service is not needed as Malaysia already provides a comprehensive public transportation system.

The service was also previously criticized by transport minister Anthony Loke Siew Fook saying that, “we will never legalize Dego Ride in Malaysia because we disagree with any types of ride-sharing services that involve motorcycles.”

“In Malaysia, there are too many accidents involving bikes that we just can’t take the risk,” he told reporters.

Then again, with narratives changing now, we just might see a revival of Doge Rides? But first and foremost, this will all rely on the cabinet discussions for Go-Jek.

Southeast Asia sees more exits as unicorns appetite for acquisition grows

Southeast Asia unicorns have emerged as the biggest drivers of exits in the region.

Just last week, Indonesian e-commerce unicorn Tokopedia bought over wedding marketplace Bridestory, as revealed in a romantic video where both parties said I do.

This was followed by Singapore unicorn Trax announcing that it had acquired US-based shopping rewards app Shopkick on June 25.

But it’s not just a surge in June. Reports show that exits have been increasing in the past 3 years.

According to the State of Southeast Asian Tech report compiled by Monk’s Hill Ventures and Singapore’s Slush, the region had seen 66 startups achieve exits as of June 2018.

While the report did not specify the profile of acquirers over the last three years, the period coincided with a rise in acquisitions by the region’s unicorns.

Gojek’s Super App Project is driving exits of regional startups

Unsurprisingly, a bulk of these acquisitions has been made by car-hailing giant Gojek in lieu of its plan to build a super-app.

In fact, Gojek by far has been the most active, having acquired as many as 11 startups since 2016, according to the data by Crunchbase.

The companies include local payments company MVCommerce, ticketing platform LOKET, and its most recent being Indian recruitment platform AirCTO, which are all intended to ramp up its engineering capabilities.

“The companies looking to be super apps are acquiring smaller startups because they, well, all of us, cannot be an expert in everything,” Teddy Oetomo told Nikkei Asia. “The easiest way to build a new vertical is acquiring it. In addition, acquiring is faster than developing,”

With that said, Go-Jek has been steadily adding new features and services ranging from grocery deliveries, haircuts, and even games for entertainment.

While Gojek is at the forefront of the acquisition activity so far, its competitor Grab is also on an acquisition spree, though more focused on minority stakes.

Though the Singapore ride-hailing giant has only made 2 acquisitions – iKaaz and Kudo – it holds minority stakes in multiple startups including Singapore’s Ninja Van, Vietnam’s Moca, and Indonesia’s Ovo among some.

Besides, Grab is reportedly looking for more acquisition, as it plans to raise US$2 billion more this year to fund an investment of at least six tech startups in 2019.

According to several sources, one of the companies Grab has identified as a potential acquisition target is HappyFresh, in which it already owns a minority stake.

“Whether we invest or acquire will depend on many factors, including, but not limited to, the synergies a company has with Grab’s ecosystem, the growth potential of the company, and the valuation of the company,” Nicholas Anthony, Head of M&A and Investments at Grab said.

Indonesia Unicorn Traveloka is also seeking Faster Growth

Holding the very same concept of having everything “in one single app”, a bulk of acquisitions are made by Indonesia’s travel unicorn Traveloka.

The travel tech unicorn was reported to have acquired three online travel companies in the past year, which are: Travel Book, Mytour, and Pegipegi.

Just today, it has also lead an investment in Singapore-based event tech platform PouchNation which offers a range of solutions for event organizers.

These acquisitions and partnerships further show Traveloka’s commitment to strengthen itself within the travel vertical to grow beyond its core business of flight and hotel tickets.

Similarly, other Indonesian unicorns have also been flexing their buyout muscles.

Besides its recent acquisition Bridestory, Alibaba-backed ecommerce unicorn Tokopedia is also currently in talks to acquire multiple startups including Sayurbox. While Bukalapak in 2018 has also sealed a deal with second-hand marketplace Prelo to acquihire their talent and technology.

Singapore startups have not been far behind, with NYSE-listed Sea buying three undisclosed companies in 2017 for US$19.875 million, according to an SEC filing.

Razer, before its IPO on the Hong Kong Exchange, has also made several acquisitions such as Nextbit Systems, THX, and Ouya to amp up their tech.

New unicorns like Singapore’s Trax has also gotten into the action, having acquired US-based Quri last year and China’s LenzTech this year, before the latest Shopkick purchase.

Southeast Asia Unicorns have made almost 40 Acquisition

So far, the unicorns in Southeast Asia are responsible for close to 40 acquisitions, including both regional startups and abroad.

It’s not hard to see why. Instead of building things from scratch, it is highly attractive for these unicorns to acquire smaller startups at conservative valuations and gain access to the startup’s technology and/or talent.

Regional unicorns such as Grab and Gojek are even launching their own investment vehicles to become both a source of funding and potential exit point for early-stage startups.

Moving forward, it’s most likely that we will continue to see an uprise trend in these unicorns creating more exits for startups.

Uber IPO-ed and here’s what it means for Grab and Go-Jek

After a decade of disruption in urban transportation, Uber has finally gone public.

The company has been the highest valued tech IPO since Alibaba and Facebook, and is one of the main highlights among the wave of Silicon Valley unicorns going public this year.

But in the end, Uber’s IPO was a bumpy ride.

As its public offering closed in, the ride-hailing startup’s valuation began to slip, finally settling on US$45 per share, the lower end of the expected range between US$44 to US$50.

This puts its valuation at about US$75.46 billion, which is a 38% drop from its initial US$120 billion valuation late last year.

Uber’s low valuation comes as it met with setbacks of data scandals, the fatal car crash in Arizona, as well as Uber driver demonstrations 2 days before their IPO.

Besides, Uber’s competitor Lyft market debut in March has not been smooth. The shares tumbled over 20% since its debut and plunged to US$56.11 on April 15, 35% below its first trading day highs and 22% below its IPO price.

That’s not all. Lyft has also reported a loss of US$1.14 billion for the first quarter, a sharp increase from the loss of US$234.3 million in 2018.

Similarly, it also hasn’t been very good for Uber.

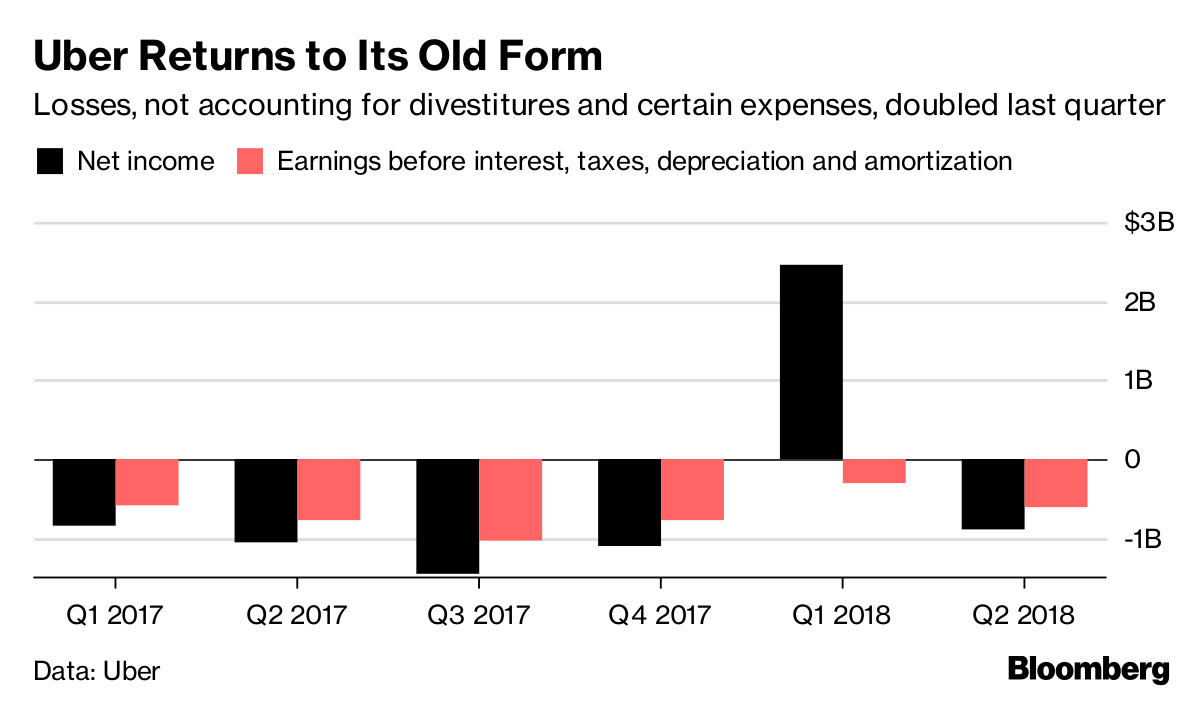

Source: Bloomberg

If you look closely at the financial structure of Uber, while the company’s income indeed rose 43% to reach US$11.3 billion in 2018, it has never recorded a net profit.

“To be absolutely practical, a lot of these startups are not going to start making money within a 10-year period,” said Sze-Hui Goh, a partner at Evershed Harry Elias to BusinessTimes.

These companies need a longer run, and more than ever a solid business model if they want to display a positive company performance in the future.

You see, this situation in Amazon which while going public, still recorded losses. However, its growth was high and now the ecommerce company has exceeded a US$1 trillion market cap.

But still, investors have to remain cautious and attentive when it comes to ride-hailing. Because, in terms of fundamentals, these companies are still handing in a red report card.

The same goes for China’s Didi Chuxing, Southeast Asia’s Grab and Go-Jek, India’s Ola, the Middle East’s Careem and Russia’s Yandex have been burning cash at an impressive rate while showing little or even negative operating leverage.

A decade after ride-hailing services were first launched, they makeup just 0.4% of total vehicle miles traveled in the US and indeed much lower elsewhere.

The Atlantic magazine noted in a recent opinion piece that, “Uber almost doesn’t feel like a business, but rather some essential service that investors believe should exist, so they have kept injecting money into it.”

Okay, so enough with the backstory. With Uber and Lyft now public, what does this mean for Grab and Go-Jek in Southeast Asia?

Well, it is a reality check for the Southeast Asian unicorns when it comes to their turn to follow Uber and Lyft steps to becoming public companies.

With the conservative pricing in the initial public offering for Uber, on top of the lackluster stock market performance for Lyft – this could encourage venture funds to rethink their investments in the future.

“In general, startup valuations have been stretched especially at an early stage. This is a good reflection on how valuations normalize as money becomes more scarce,” Rachel Lau, the managing partner at Malaysian investment firm RHL Ventures told BusinessTimes.

“What people will be more concerned about is startups’ performance versus valuation; and whether their performance is consistent… There is likely to be a pullback once the market becomes fatigued with companies without strong profit fundamentals,” she added.

Startups simply have to find a way to make money before going public, especially amidst the public capital market being skeptical of the profitability of ride-hailing companies.

But profits aside, publicity is also equally important. These companies also have to take the right business strategy and signal to investors of a positive clean image.

But for now, it looks like both startups are more focused on stepping up competition with each other for market share rather than considering IPO.

So far, Grab CEO and Co-founder Anthony Tan said that Grab is not going to be listed anytime soon, even though the startup is already a decacorn with a valuation above US$10 billion.

“We will continue exploring potential strategic partners to invest further into Grab. IPOs are not needed in the near future,” Anthony Tan said in Jakarta on March 6.

Go-Jek also stands in line with Grab as it mentioned that IPO is not a top priority for the startup at the moment. The company instead, is more focused on strengthening its application and services in Indonesia and other targeted countries for expansion.

One point that makes a difference between these Southeast Asian ride-hailing apps is their movement towards becoming a superapp.

Unlike Uber which focuses solely on ride-hailing, Grab and Go-Jek have expanded beyond ride-hailing and are trying to create a comprehensive superapp that offers customers everything from food delivery to financial services.

However, when you have the same or similar cars and mostly the same drivers, riders will use whichever service that is cheapest. Almost everyone will have both apps on their phones, and when it comes to choosing, the decision is often made based on which is the cheapest or offers the most discounts.

There’s no brand distinction between Grab and Go-Jek, and things such as loyalty card points are definitely not enough to differentiate one ride-hailing service from another, they need to bring it out from the battle of prices.

In the end, coming to IPO. It is ultimately not just for branding or more capital, rather it is an objective market test for a startup’s true valuation and potential.

So let’s look forward to the development of these ride-hailing unicorns and see which company is going to be the first in figuring out that successful business model.