Category: Business

Cybersecurity startup Kratikal Tech raises US$500k in seed funding

Cybersecurity startup Kratikal Tech Pvt. Ltd. on Monday announced that it has closed a seed funding round from former director of Microsoft India, Praveen Dubey; along with former managing director of Juniper Networks India, Amajit Gupta; and the chief executive of ImpactQA, J.P. Bhatt.

As per details of the round, Kratikal has raised about US$500k in which the company will use for product development and building training modules.

“I had a really good experience working with Kratikal. They are a very professional team who are clearly very knowledgeable in their space. They work dedicatedly for any projects they received and supported me throughout the terms with them,” said JP Bhatt, the Chief Executive Officer of ImpactQA who is similarly a client of Kratikal.

Founded in 2013 by five alumni of Allahabad’s National Institute of Technology – Pavan Kushwaha, Paratosh Bansal, Dip Jung Thapa, Prashant Pandey, and Ankit Singh – Kratikal Tech works to provide cybersecurity services for large corporations and Fortune 500 Enterprises, protecting their brands and businesses from cyber attacks.

Additionally, the company offers various services such as vulnerability assessment, security auditing, cyber forensics, emergency response, web and mobile application testing, and others.

“We aim to provide world-class cyber security solutions globally and work on building the environment and train the IT (information technology) professionals and digital community in India about how to build secure systems,” Kratikal said in a statement.

The tech startup claims to provide training sessions to corporates, law enforcement agencies, and education institutes, in addition to having trained over 5,000 candidates from over 131 countries through its online modules.

With a team of 15 employees, Kratikal services over 20 clients across corporate houses, police departments, law enforcement agencies and individuals in India, US, Australia, New Zealand and South Africa.

Its client portfolio includes information technology company Unisys, global manufacturer operator Terex, and internet marketing service Dawailelo among some.

Besides, the Delhi-based company is developing a software-as-a-service (Saas) tool to automate its security testing services with the help of built-in artificial technology.

“This automated tool will bring down the high cost of security testing and make it economically feasible for all the SMEs (small and medium enterprises) to be secure,” said Kratikal.

The company competes with Chandigarh-based TAC InfoSec Pvt. Ltd and Delhi-based Lucideus Tech Pvt. Ltd. In 2016, TAC raised an undisclosed amount of pre-series A funding in August, while Lucideus had received an undisclosed angel funding from Amit Choudhary, director of Motilal Oswal Private Equity Advisors Pvt. Ltd.

By Vivian Foo, Unicorn Media

Chinese used car dealership Uxin secures US$500 million funding co-led by TPG, Jeneration, and China Vision

Uxin, an online auction house for used cars in China has managed to secure a US$500 million funding round co-led by investors private equity giant TPG, Chinese multi-family office Jeneration Capital and newly established value investment firm China Vision Capital.

Existing and new investors Warburg Pincus, Tiger Global Management, Hillhouse Capital, KKR & Co. L.P. and Huasheng Capital also participated in the round, which brings Uxin’s total fundraising to around US$1 billion.

China Renaissance Partners and China International Capital Corporation (CICC) will also act as the firm’s financial advisor.

With these latest proceeds, Uxin will continue its investment in business development, product services as well as branding awareness – a move to provide better user experience and to position themselves ahead from their competitors.

In September 2016, a similar online platform Guazi.com raised US$250 million, just six months after completing a US$204.5 million round. Another industry player, RenRenChe, raised US$150 million, while Tiantianpaiche and Souche.Com each raised US$100 million last year.

Founded in 2011, Uxin operates a business-to-business used car auction platform Uxin Pai (www.youxinpai.com) and a business-to-consumer used car transaction platform Uxin Ershouche (www.xin.com), as well as Uxin Finance, which provides financial services focused on used car transactions.

The company also employs over 1,000 specialists in 50 Chinese cities, who inspects and certify the quality of user vehicles for sale on Uxin’s platform. Uxin makes use of its proprietary “CheckAuto” system and advanced vehicle identification capabilities to ensure the quality of vehicles sold through its platform.

Additionally, the used car dealership offers all buyers a full guarantee and will refund their purchase within 15 days if they were to discover any undisclosed issues with all vehicles bought through Uxin.

In 2015, Uxin recorded monthly revenue of RMB150 million (about US$21.7 million), with monthly transaction volume reaching 50,000 used car purchases in December alone, according to an announcement by the company.

Uxin’s chief executive officer Dai Kun told Chinese media that the company had reached profitability in July 2016, and is expected to reach total transaction volume of 800,000 with aggregate transaction value of RMB60 billion (about US$8.7 billion) in 2017.

“TPG has tracked the used car sector in China for three years,” said Derek Chen, a partner at TPG. “After research and comparison, we found Uxin to be the company with the only proven business model in terms of user demand, market size and financial performances.”

Julian Cheng, co-head of China at Warburg Pincus, said Uxin had established a business model suitable for the Chinese market after studying the experiences of the United States and Japan’s used car e-commerce platforms.

The company previously raised venture funding worth US$400 million in 2015 from Baidu, KKR, Coatue Management LLC, Warburg Pincus, Tiger Global Management LLC, Legend Capital, Bertelsmann Asia Investments (BAI), DCM and Tencent Holdings Ltd.

By Vivian Foo, Unicorn Media

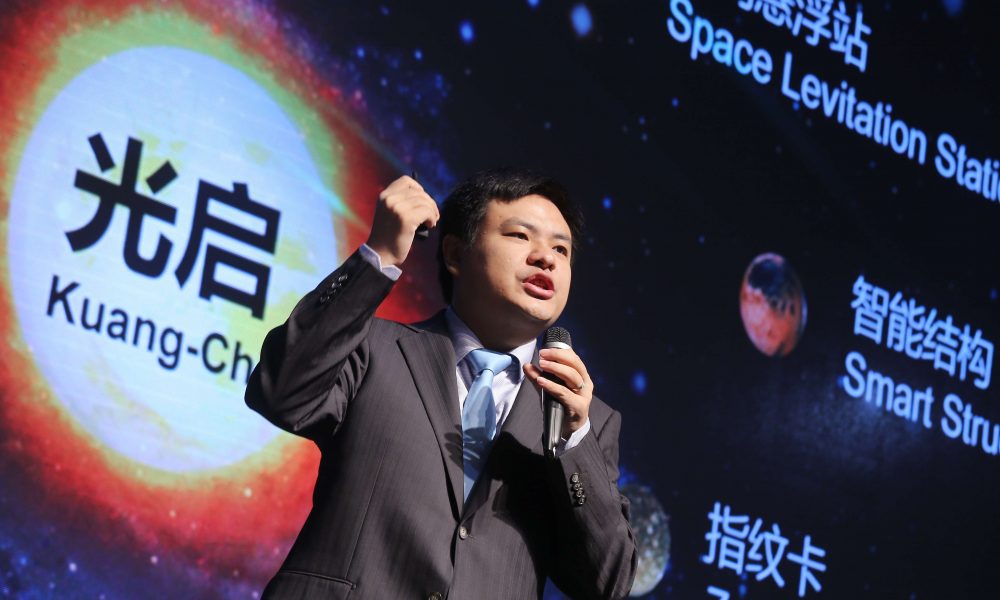

China-based tech corp Kuang-Chi launches US$250 Global Tech Fund

Shenzhen-based Chinese technology conglomerate Kuang-Chi Group announced on January 11 that is has launched a US$230 million fund that will be used to invest in global technology companies.

The fund is known as Global Community of Innovation (GCI) Fund II and is accompanied by the opening of its Israel-based International Innovation Headquarters.

As one of the first Chinese fund of its kind, GCI Fund is targeted at Israel technology companies that are looking to collaborate with local Chinese firms for entry and expansion into their domestic markets.

GCI Fund II will invest US$250 million in global technology companies active in sectors of smart city and home, computer vision,Internet of Things (IoT), artificial intelligence, VR/AR and robotic.

The selected startups will be supported by a new China-based incubator, established by Kuang-Chi to help bring its portfolio companies to the Chinese market.

“We were able to quickly deploy the US$50-million GCI Fund I in exceptional companies that operate in sectors we know well and we’d like to build on this momentum with Fund II,” said Dr. Liu Ruopeng, the chairman of Kuang Chi.

“Working with our partner in Israel, we’ve identified a wealth of opportunities to expand our portfolio and give our joint investment team an expanded strategic and financial mandate,” he added.

Earlier, the first GCI fund established in 2016, has seen stakes in several Israeli companies, including computer vision pioneer eyeSight, voice analytics developer Beyond Verbal, and video intelligence and analytics provider AgentVi.

Besides, the fund has also invested in Norwegian biometric authorization innovator Zwipe, Canadian aviation company SkyX, SolarShip and Australia’s Martin Jetpack.

“We have moved from success to success in Israel, and I’m delighted by the pace of our good progress showed in our recent investments in eyeSight, AgentVi and Beyond Verbal,” the Kuang-Chi co-founder and CEO of KuangChi Science, Yangyang Zhang said.

Within six months of its investment, Kuang-Chi and eyeSight jointly built a local team in China to provide markets with the most advanced embedded computer vision solutions currently available.

While in December, Beyond Verbal signed its first cooperation agreement in China, with the Second Affiliated Hospital Zhejiang University School of Medicine in Hangzhou.

“GCI portfolio companies will share access to cutting-edge technology that includes over 2,000 patents and R&D from around the world. Each of these investments comes with an opportunity to expand their business in China and establish relationships with global market leaders across multiple industries,” added Liu.

Founded in 2010 by a five-person team, Kuang-Chi has created a Global Community of Innovation of more than 2,600 employees which spread through 18 countries and regions.

The fund is dedicated to disruptive innovation and principal investment in cutting-edge technology sectors including communications, metamaterials, and space technology.

By Vivian Foo, Unicorn Media

Mekong Capital invests in Vietnam-based F88 pawn shop chain

Private equity firm Mekong Capital announced on January 10 that the Mekong Enterprise Fund III (MEF III) has invested an undisclosed amount into Vietnam-based pawn shop chain F88.

The terms and value of the investment were not disclosed, although the fund is said to be an eight digit number and Chris Freund, a partner at Mekong Capital, will join the management board of F88 as part of the deal.

This also marks the third investment made by the PE firm’s US$112.5 million fourth fund since its launch in May 2015. Prior to this financing, MEF III had closed investments in restaurant chain Wrap & Roll and cold chain logistics company ABA Corporation.

Founded in 2013, F88 is a pioneer in Vietnam’s pawn service chain which leverages on a tech platform. It provides transparency in operation and offers an effective alternative to traditional borrowings which brings a reliable financial solution to consumers.

The IT platform within F88 covers data about management tasks, deposited items, and most importantly product valuation. “For this model to work, it is very difficult to agree on the valuation of the products. Our technology solutions are the key to this problem,” said Phung Anh Tuan, the chairman and CEO of F88.

“This combination facilitates us to strengthen our management team, approach to the world’s best practices and improve service quality to ready us for a rapid and sustainable growth,” Phung Anh Tuan added.

F88 currently operates 15 stores in Hanoi and several surrounding provinces while aiming to have 70 outlets in the north of Vietnam by the end of this year and as many as 300 stores across the country by 2020.

“F88’s competitive edge is its entrepreneurial co-founders, professional management team, IT infrastructure, and strong corporate governance. We believe that with Mekong Capital’s well-proven approach towards adding value, called Vision Driven Investing, and our extensive network of international experts and resources, F88 will continue to improve their operations and successfully execute an ambitious nationwide expansion plan,” said Freund, the Mekong Capital partner at F88.

This is said to be an established business model found around the world, according to the fund partner. However, the risk associated with it in the Vietnamese market is how to scale the size of the market opportunities.

Freund also mentioned that the firm’s strategy did not include investing in new disruptive technologies. However, Mekong Capital will continue to search for companies with proven business and strong teams that can successfully execute their models, irrespective of sectors.

The chain currently provides loans on diverse assets such as cars, motorcycles, mobile phones, laptops, and jewellery. With the investment by Mekong Capital, F88 plans to go for an IPO within the next five years.

“We are very proud and excited that F88 is the third investment we’ve announced for the Mekong Enterprise Fund III,” Freund added.

MEF III, which focuses on investments in Vietnamese consumer-driven businesses such as retail, restaurants, consumer products, and consumer services, targeting investments ranging from US$6 to US$15 million each.

By Vivian Foo, Unicorn Media

Bank of Jiujiang seeks to raise US$500 million IPO in Hong Kong

Bank of Jiujiang, a lender in eastern China’s Jiangxi province, plans to raise a US$500 million initial public offering (IPO) in Hong Kong, according to a report from Bloomberg.

Based in a city on the southern banks of the Yangtze River, the Bank of Jiujiang has already begun reaching out to investment banks about the potential listing, in which is scheduled to list in the second half of 2017.

The lender’s move in seeking a Hong Kong listing follows other regional banks, which includes Guangzhou Rural Commercial Bank Co. and Jilin Jiutai Rural Commercial Bank Corp., and is aimed to boost its profile and raise funds for expansion.

According to data compiled by Bloomberg Show, financial institutions have completed US$18.2 billion of first-time share sales in the city last year, accounting for 72 percent of fundraising from new listings in 2016.

Founded in 2000 and operating as an urban commercial bank, Jiujiang Bank currently has 12 branches in China, with 10 of its branches located in the Jiangxi Province while 2 are situated in Guangzhou.

Backers of the Bank of Jiujiang includes the local government, state-owned Beijing Automotive Group Co. and Industrial Bank Co. The lender’s net income fell 0.6 percent in 2015 to 1.78 billion yuan (about US$257 million), according to its annual report.

Details of the IPO are still in deliberations, and there is no certainty that this potential listing will lead to a share sale.

By Vivian Foo, Unicorn Media