Others

-

Nvidia is all in on AI, as it announces a historic quarter with record-breaking results.

In the wake of Wednesday’s announcement that Nvidia’s earnings have significantly outperformed expectations, Reuters has disclosed that Nvidia’s CEO, Jensen Huang, foresees the enduring growth of the AI industry extending well into the next year.…

-

The latest contender to ChatGPT, known as Claude 2, has officially entered the open beta testing phase

On Tuesday, Anthropic unveiled Claude 2, a substantial language model (LLM) akin to ChatGPT, proficient in coding, text analysis, and composition creation. In contrast to the initial Claude version launched in March, users can now…

-

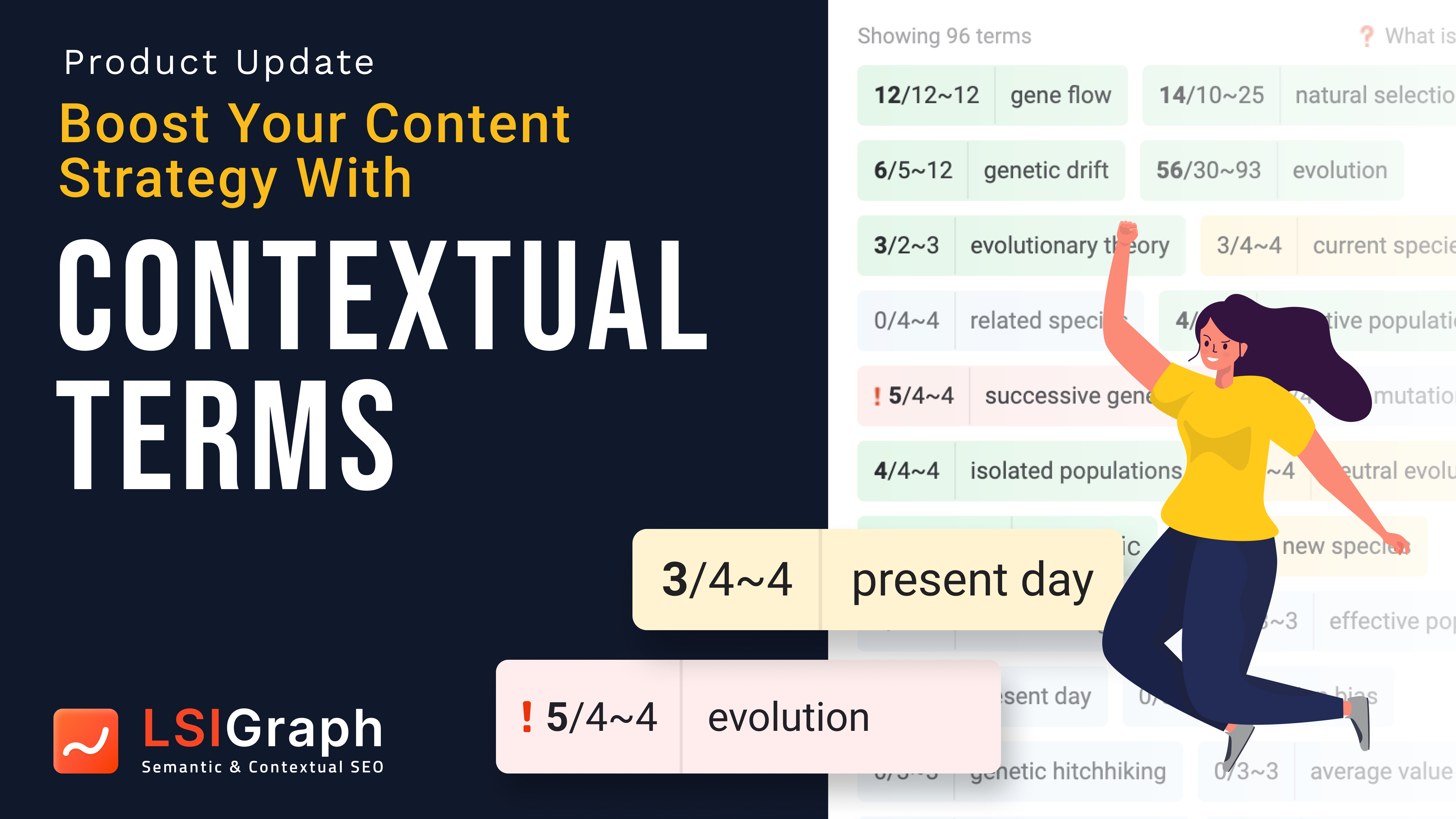

LSIGraph Launches New Contextual Terms Feature For Improved Content Optimization

With its latest update, LSIGraph encourages its users to add contextual terms for improved SEO content, allowing higher search engine rankings and traffic growth. Kuala Lumpur, Malaysia – November 16, 2022 In its determined effort…

-

Grab Announces A $988 Million Financial Loss In Q3 Due To A Drop In Ride-Hailing During Lockdowns

The Singapore unicorn expects its SPAC deal to finalize in Q4 of this year. Grab, the Southeast Asian unicorn reported a net loss of $988 million for the July-September quarter, increased from a loss of…

-

Carousell Achieved Unicorn Status, With a Valuation of US$1.1B Thanks to a US$100M Investment From Korea’s STIC Investments

Carousell Group, a Singapore-based classifieds startup with operations in nine countries throughout Asia and Canada, revealed yesterday that it had secured US$100 million (RM415 million) to accelerate expansion. The media announcement made no mention of…