November 2016

-

DBS, Bank Of Singapore Seize Opportunities For More Acquisitions In Asian Wealth Mission

Singapore banks are scaling up with DBS Group Holdings Ltd and .Bank of Singapore, Asia’s largest home-grown private bank among those in the lead as they are considering for more acquisitions.

-

Asia Climate Partners Invest US$20 Million In US-Based Fluidic Energy To Expand Renewable Energy Access In Southeast Asia

Asia Climate Partners, a joint venture between the Asian Development Bank, ORIX and Robeco, has invested US$20 million in Fluidic Energy.

-

Philippines To Have Its Own Shark Tank Style Funding Show – I’m In

The Philippines own “Shark Tank” concept funding show – I’m In is going to connect crowdfunding and venture funding on a TV show, to find the upcoming investment-ready startup.

-

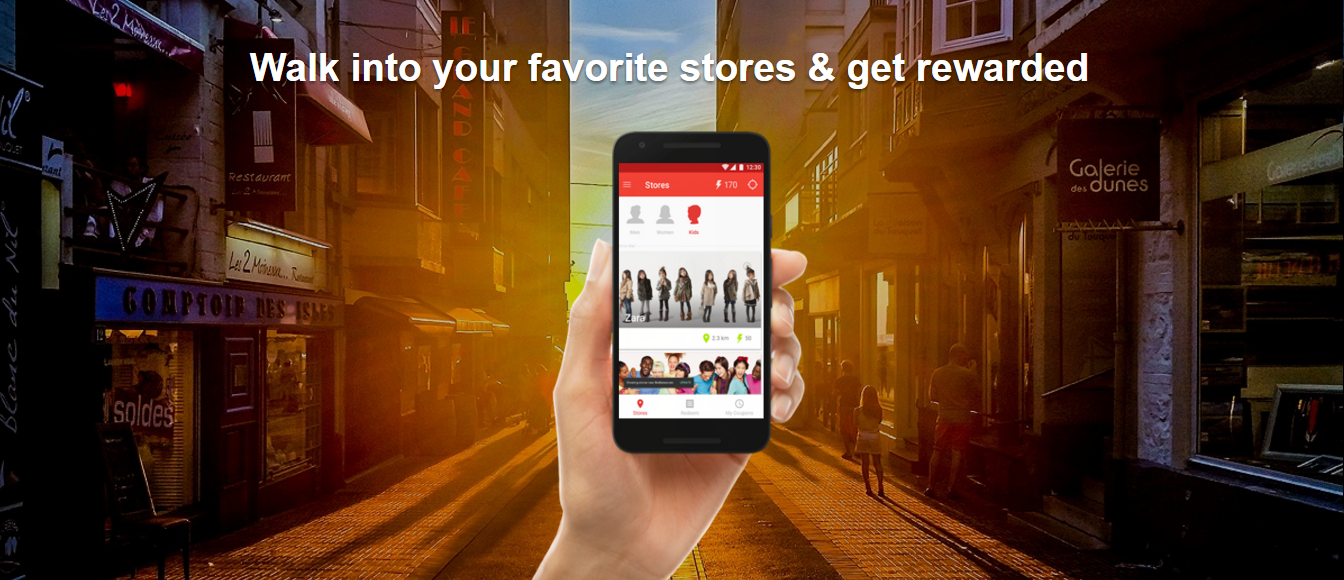

ShopsUp, An Online-To-Offline (O2O) Shopping App Secures US$1 Million In Seed Funding

ShopsUp, a virtual shopping buddy which empowers customers to find the best local fashion and shopping spots has raised US$1 million in its seed funding round from two individual investors, one of which is the…

-

KFit Acquires Groupon Malaysia To Expand Beyond Fitness Into Local Services

After purchasing Groupon Indonesia in August, KFit Group now acquires the company’s Malaysian operation as it pivot to become a full-fledged online-to-offline (O2O) platform.