Category: Finance

Launch of MSP Guide: Offering Managed IT Services Tailored for Banks and Financial Institutions

Intelligent Technical Solutions (ITS) has unveiled its latest guide, shedding light on the potential advantages of opting for managed IT services for organizations operating within the financial sector. This guide underscores the viability of managed IT solutions, emphasizing their cost-effectiveness, adaptability, and enhanced security, making them a compelling choice for those aiming to streamline operations, boost efficiency, or establish robust tech infrastructure resilient against cybersecurity threats.

While primarily tailored for decision-makers within the financial sector, the ITS guide also extends its reach to educate other stakeholders interested in delving into the world of managed IT services. It offers a succinct overview of managed IT, encompassing the wide array of solutions proffered by managed IT service providers (MSPs) and critical considerations to ponder before engaging with any MSP.

The guide elaborates on the diverse spectrum of IT services that can be outsourced to an MSP, encompassing facets such as communication management, data analytics, managed security, cloud-based services, and VoIP-managed solutions. According to the guide, these services are adaptable, capable of scaling up or down in accordance with the unique requirements of clients.

Managed IT solutions present a distinct advantage for banks and financial institutions, granting them access to a provider’s comprehensive cybersecurity expertise and infrastructure, all without the need for acquisition, operation, or maintenance.

Addressing a pivotal concern, ITS has outlined a four-step framework in the guide to assist financial businesses in evaluating potential MSP partners and their ability to deliver on their commitments.

About Intelligent Technical Solutions

Intelligent Technical Solutions is dedicated to assisting clients in effectively managing their technology, providing rapid responses and support to minimize downtime. The company boasts numerous industry accolades, including the prestigious 2023 CRN Security 100 Award, recognizing it as a top MSP specializing in cloud-based security services.

A spokesperson from the company commented, “At ITS, we empower countless clients to make informed decisions regarding their technology. If you are interested in assessing the current state of your financial business and exploring how we can assist you in finding a suitable IT solution, we invite you to schedule a complimentary network assessment with us.”

Mind Network Secures $2.5 Million in Seed Funding, Forms Key Web3 Security Partnerships.

Mind Network, a pioneering force dedicated to advancing data security and privacy within the Web3 ecosystem, proudly announces the successful culmination of its seed round fundraising, securing a substantial $2.5 million in investments. This significant milestone was achieved with the participation of prominent backers, including Binance Labs, Comma3 Ventures, SevenX Ventures, HashKey Capital, Big Brain Holdings, Arweave SCP Ventures, Mandala Capital, and other noteworthy investors.

Mind Network has emerged as a frontrunner in the Web3 realm, empowering users with comprehensive control over their personal data, financial transactions, and user interactions through state-of-the-art end-to-end encryption. The platform assures formidable protection and access control within the decentralized landscape, seamlessly integrating Zero Trust Security, Zero Knowledge Proof, and exclusive Adaptive Fully Homomorphic Encryption techniques.

Mason, representing Mind Network, expresses gratitude, stating, “We are deeply honored by the support and trust placed in us by these distinguished investors. This infusion of funding will propel us towards further innovations in our groundbreaking technology, expediting the widespread adoption of our platform across diverse industries, ensuring data privacy and ownership for users worldwide.”

As a proud member of Binance Incubation Program Season 5, Mind Network has gained invaluable insights and guidance from Binance Labs, the VC and incubation arm of Binance. Furthermore, the company has earned the esteemed privilege of participating in the prestigious Chainlink BUILD Program, reaffirming its commitment to establishing a Web3 ecosystem firmly rooted in data privacy and ownership.

Oliver Birch, Global Head of Chainlink BUILD, welcomes Mind Network into their ecosystem, stating, “We are enthusiastic about the addition of Mind Network to our network. Their innovative approach to data security impeccably aligns with our mission, and we eagerly anticipate collaborating with them to shape the future of decentralized applications.”

In addition, Mind Network has strategically joined forces with industry titans such as Chainlink, Consensys, and Arweave, laying a robust foundation for the platform’s expansion. These strategic alliances have also paved the way for early support from global financial institutions, insurance companies, and various decentralized applications and protocols.

Mind Network has meticulously assembled a formidable team comprising highly accomplished leaders in their respective domains, ensuring that the project possesses the requisite expertise to realize its objectives.

With the successful culmination of the seed funding round and the unwavering support of partners and investors, Mind Network finds itself in an optimal position to fulfill its mission of elevating data security, privacy, and ownership in the Web3 era.

SaaS Inclusology Launches 2.0 Platform, Speeds Up DEI Goal Achievement for Companies.

Inclusology is a robust comprehensive DEI management SaaS platform with a mission to foster workplace inclusivity and combat bias, ultimately enhancing employee retention. Recently, the platform unveiled its latest version, following a successful beta testing phase involving 16 diverse companies and thousands of employees spanning startups, nonprofits, Fortune 500, and Fortune 1000 enterprises, among others.

Dr. Cheryl Ingram, the CEO of Inclusology, expressed pride in the platform’s global impact on DEI initiatives across organisations of all sizes. She emphasised the uniqueness of their approach, which leverages demographic data to conduct in-depth Diversity, Equity, and Inclusion (DEI) assessments. In addition to analysis and reporting, Inclusology offers benchmarking, e-learning, development opportunities, certifications, and personalised recommendations to address DEI challenges. Their distinctive approach integrates DEI seamlessly into an organisation’s culture, rather than treating it as a standalone initiative or program.

Notable outcomes from the beta testing phase included an impressive up to 75% increase in employee retention and a notable up to 25% improvement in diverse employee recruitment within a single year.

Inclusology, which spent the last five years in beta development, offers a comprehensive DEI solution that includes:

- A curated bank of DEI assessment questions

- Industry-specific DEI benchmarking tools

- DEI training modules with certification options across various domains

- Automated strategic planning capabilities

- Direct access to industry experts

Inclusology’s overarching objective is to create a platform that accommodates individuals of all backgrounds and identities, fostering a secure and enjoyable work environment.

About Inclusology: Founded in 2018 by Dr. Cheryl Ingram, Inclusology initiated its first alpha test in 2019. Over the years, it has conducted assessments for renowned companies like Netflix and Parametrix. Originally based in Seattle, the company has since relocated its headquarters to Omaha, Nebraska. Presently, Inclusology employs a dedicated team of five professionals with extensive collective experience. The company’s core mission remains centered on creating an all-inclusive and safe workplace for everyone.

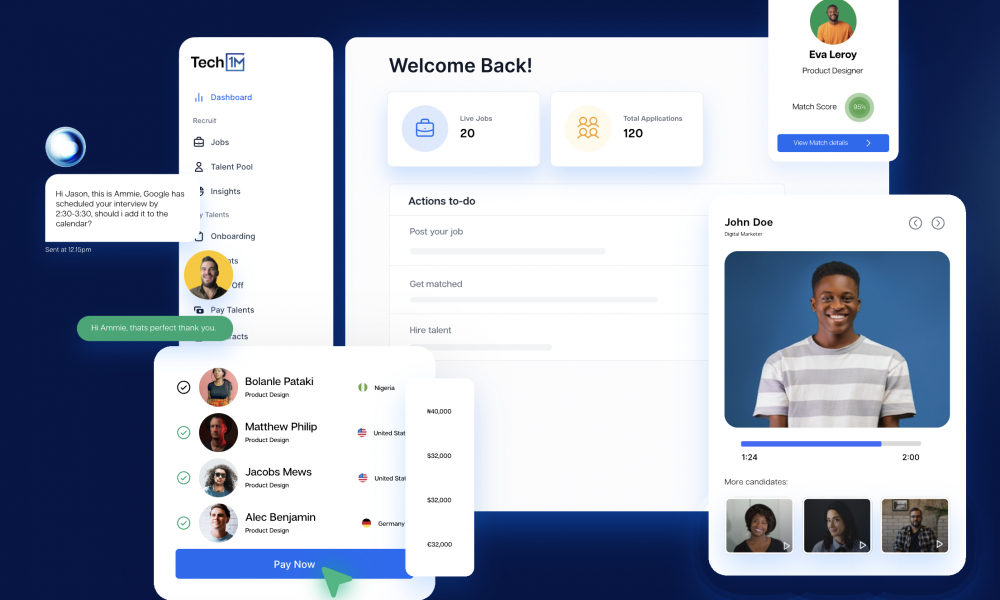

Tech1M Marks First Anniversary: Revolutionising the Global Hiring Landscape with Advanced AI Solutions

Tech1M, an AI-driven global hiring platform co-founded by Tommie Edwards (CEO) and Damilola Ogunmoye (CTO) in April 2022, celebrates its first anniversary, having made remarkable strides in the talent acquisition sector. Initially conceived as an edutech platform to develop one million tech talents through boot camps, mentorships, and work placements, Tech1M has since evolved into a powerful global hiring platform. The platform received over 5,000 applications from global talents at its outset and sponsored 600 candidates for training in various tech domains.

Leveraging its AI algorithm and video technology, Tech1M sources and matches talents for hiring managers, while also streamlining the hiring, onboarding, payment, and management processes. The platform ensures compliant hiring across 50+ countries while simplifying complex tasks related to compliance, taxes, benefits, and global remittance.

Tech1M has garnered accolades such as nominations for the Black Tech Achievement Awards (BTA Awards 2023) and the Great British Entrepreneurs Awards (GBEA 2022). Furthermore, Tech1M’s recent acceptance into the prestigious Techstars NYC, powered by JP Morgan accelerator program, highlights the company’s innovative vision and growth potential. CEO Tommie Edwards emphasizes Tech1M’s goal of streamlining job hunting and enhancing job satisfaction for over 800 million talents worldwide while providing hiring managers with a 4X better hiring experience. By integrating intelligent matching algorithms and an HR software suite, the platform offers businesses a seamless solution for global talent acquisition and management, complete with access to learning and mental well-being platforms.

With an eye on the future, Tech1M aims to disrupt the global workplace by simplifying the talent recruitment and retention process for hiring managers, while adhering to ESG principles.

About Tech1M

Tech1M is an intelligent hiring platform designed to source, match, hire, pay, and manage global talents for businesses worldwide. Founded in 2022, Tech1M is committed to helping companies of all sizes hire smarter and grow faster. For more information, visit https://tech1m.com.

Introducing the 2023 Launch of the Smart Money Concepts TradingView Indicator: Pioneering Cutting-Edge Technology

Smart-Money Trader is thrilled to announce the official launch date of its highly anticipated Tradingview indicator software. Rumors are already circulating among both seasoned observers and devoted Trading enthusiasts, as the momentous “release” date of the master pattern indicator has arrived. In 2023, Smart-Money Trader is unveiling three key aspects for its eagerly awaiting audience.

Foremost, anticipate an introduction to an innovative methodology seamlessly integrated into this financial charting system. The Master pattern indicator’s roots trace back over a century, drawing inspiration from the pioneering insights of renowned traders like Jesse Livermore and Wykoff. Their groundbreaking discoveries revolutionized trading systems, reshaping the landscape of financial markets. This revelation unlocked the understanding of the market’s three distinctive phases, enabling traders to decipher market movements and gauge market maker intentions.

Smart Money Trader’s commitment to delivering cutting-edge trading technology to a global audience makes this system’s availability to the masses hardly surprising. Their dedication to offering traders a significant advantage is abundantly clear.

Additionally, to celebrate the launch event, Smart-Money Trader will extend a substantial discount to early bird purchasers. This gesture aims to raise awareness among fellow traders about this groundbreaking technology.

For devoted industry enthusiasts, an insight into the creation of the Master pattern indicator is equally compelling. It has been a six-month journey from inception to the final product, a testament to the meticulous craftsmanship behind it. The Tradingview indicator software comprises three core components: contraction boxes, expansion lines, and liquidity lines. These elements form the bedrock of the market, unveiling the imprints left by market makers. This comprehensive approach promises to satisfy the discerning palates of Trading connoisseurs worldwide.

Seth Grey, Co-owner at Smart-Money Trader, adds, “The master pattern indicator is meticulously crafted to enable you to replicate the market makers’ strategies, ensuring you consistently align with the right side of the market.”