Investment

-

EVISU buys back rights to China retail and franchise at US$40 million

EVISU Group Limited, a Japanese high-end denim brand, has announced today that it has bought back the retail and franchise rights for the Chinese market at a price tag of US$40 million.

-

Global Brain launches US$175 million sixth fund

At the annual Global Brain Alliance Forum, founder and CEO Yasuhiko Yurimoto has announced the creation of a sixth fund to be valued at Us$175 million. The fund made its first close at US$130 million,…

-

Malaysian PE firm Creador closes Fund III at US$ 415 million

Malaysian private equity firm, Creador closes Fund III at US$ 415 million, that is US$ 35 million short from its initial targeted US$ 450 million.

-

Singapore-based Rewardz secures US$2.1 million strategic investment from Japan’s Benefit One for expansion plan

A Singapore-based startup, Rewardz managed to raise US$2 million from Japan’s Benefit One. The fund will be used to fuel profitability and a possible market expansion plan into Japan.

-

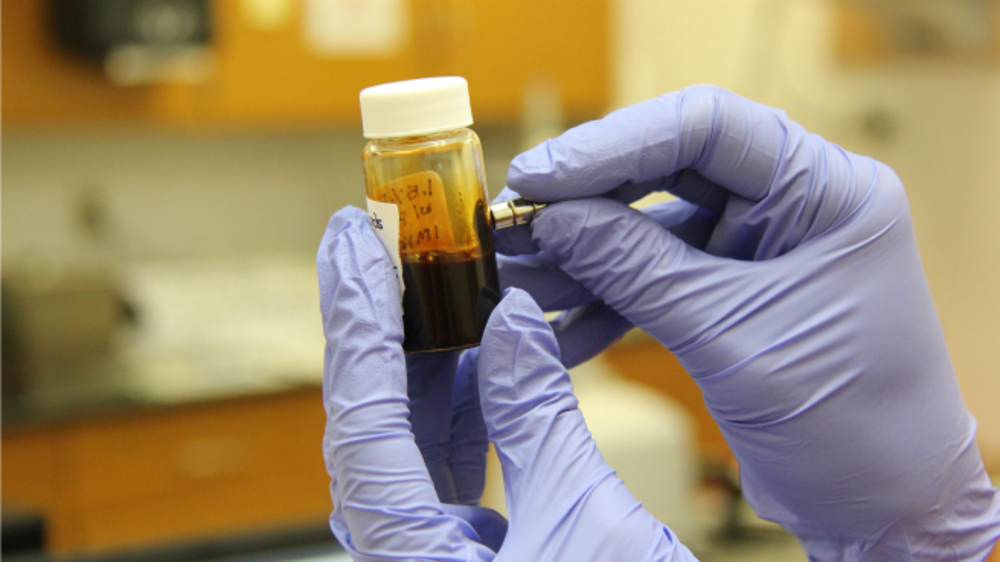

Three VC firms to launch US$375 million Biomedical Translation Fund

The Australian government has selected three venture capital (VC) fund managers, namely Brandon Capital Partners, OneVentures Management and BioScience Managers to manage its A$500 million (about US$375 million) Biomedical Translation Fund which is aimed to…