Startup

-

Slate Automotive Gears Up for Electric Revolution with New Leadership and Backing

As a newcomer to the electric vehicle (EV) industry, Slate Automotive is shaking up the landscape. The firm has been gracing headlines as it prepares to roll out its initial wave of vehicles. Christine Barman…

-

Microsoft Fires Employee Following Disruptive Protest at AI Event

Microsoft has not yet confirmed or denied having fired software engineer Aboussad. He crashed a recent launch party that celebrated the company’s latest AI offerings. While taking questions on a keynote address delivered by DeepMind…

-

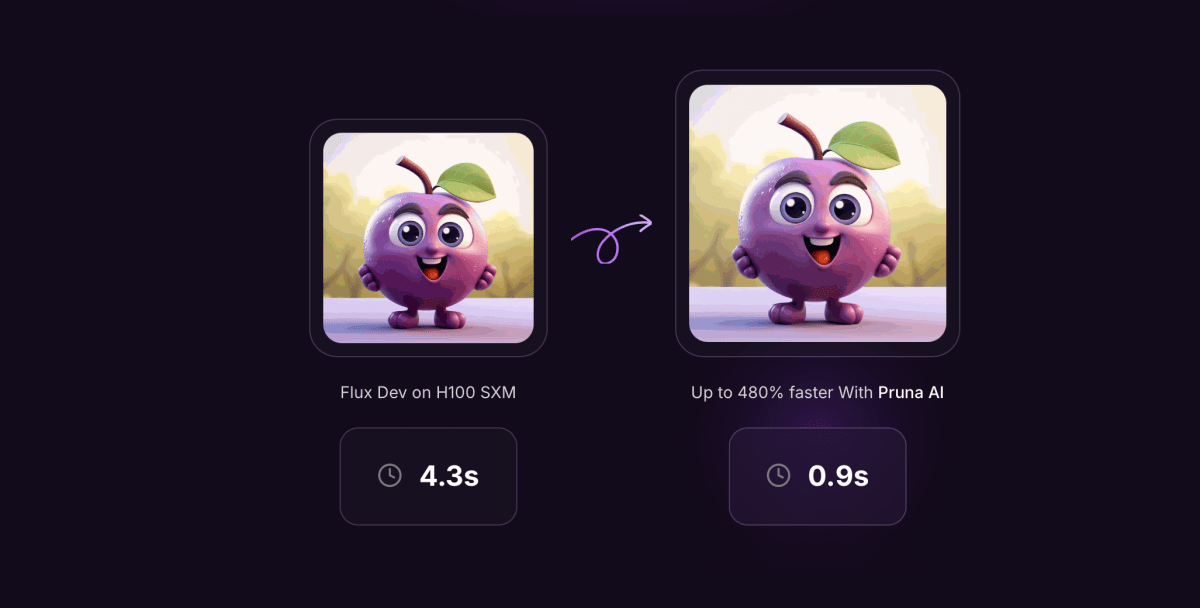

Pruna AI Launches Open Source Framework for Model Optimization

Pruna AI, a European startup specializing in AI model compression algorithms, has announced the open-sourcing of its AI model optimization framework. This launch, scheduled for Thursday, aims to provide enterprises with advanced optimization features, including…

-

Swedish Startup Evroc Secures $55 Million to Launch Hyperscale Cloud in Europe

Evroc, a forward-thinking Swedish startup, has successfully raised €50.6 million (approximately $55 million) in a Series A funding round aimed at establishing a hyperscale cloud company in Europe. The funding was spearheaded by a consortium…

-

Infinite Uptime secures $35M to expand AI-driven factory maintenance solutions

Factories aiming to reduce equipment downtime and improve efficiency have a growing list of AI-driven solutions, and Infinite Uptime is securing its place in the market. The Indian startup has raised $35 million in a…