Investment

-

China-Based MegaRobo Raised $300 Million In Series C Funding Round

MegaRobo Technologies is a China-based company that uses robotics and artificial intelligence for life science research. The company has recently led a Series C funding round which was led by Goldman Sachs’ private investment arm,…

-

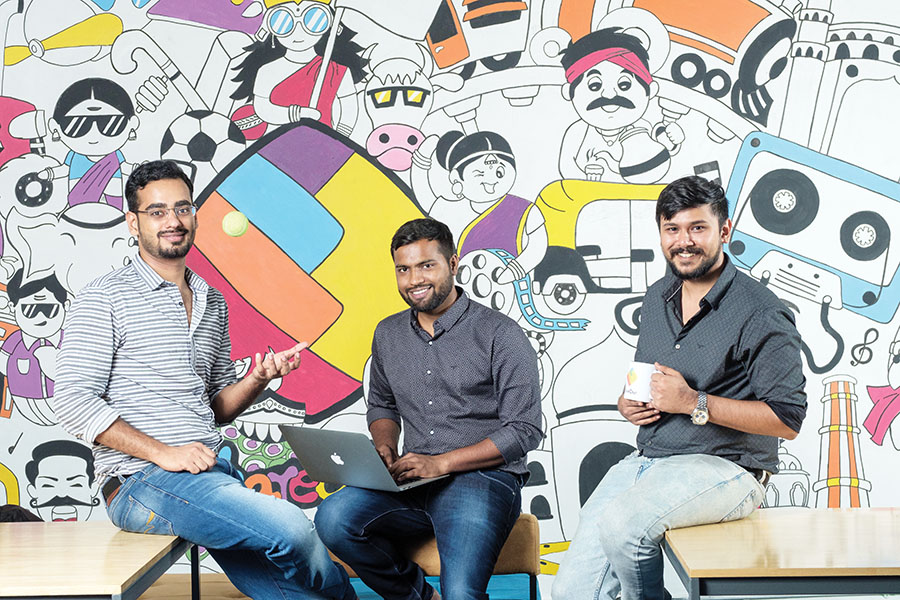

India’s ShareChat in advance talks with Google, and Temasek to close $300-million funding with $5-billion valuation

According to reports from Reuters, Indian-based ShareChat’s parent firm Mohalla Tech has raised nearly $300-million from Google, Indian media conglomerate Times Group, and the Singapore government’s Temasek Holdings. This latest funding puts the value of…

-

India’s unicorn startup, Cars24 cuts 600 jobs

The used car e-commerce platform, Cars24 backed by investors in the likes of SoftBank and Alpha Wave Innovation, has asked 600 of its employees to leave, even as it pushes ahead with its international expansion…

-

India’s Latest Unicorn, Rebel Foods, Enters The Club After Raising $175m

Cloud kitchen startup Rebel Foods has entered the unicorn club after raising $175 million in its Series F funding round that was led by sovereign wealth fund Qatar Investment Authority (QIA), with a valuation of…

-

AirAsia Thai Subsidiary To Undergo Restructuring Amidst $100.41mil Investment

Thai AirAsia, a subsidiary of Asia Aviation Public Company Ltd (AAV) under the low-cost airline AirAsia Group Bhd has approved its capital restructuring plan. The Thai unit of AirAsia will be seeing a $100.41 million (3.15billion…