Business

-

Bukalapak to become the Alibaba or Amazon for Middle East’s Muslims

The Indonesia cross-border ecommerce operator is looking to bring halal food and fashion beyond Asia.

-

Here’s Why You Have Not Found a Thai Unicorn yet

Take a look into the startup ecosystem in Thailand and what it holds in the future.

-

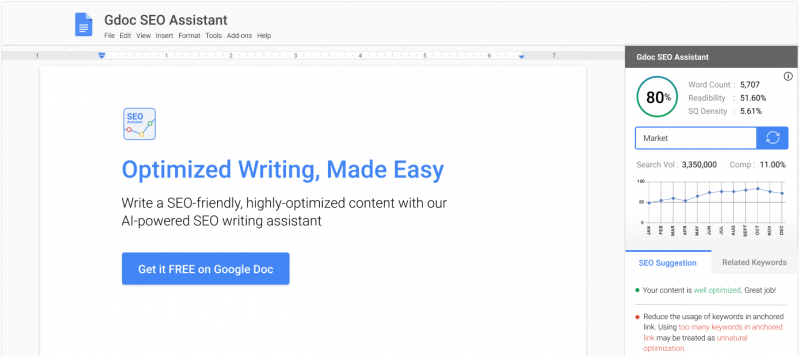

New Google Docs SEO Add-On Helps Content Writers Become SEO Writing Experts

GDoc SEO Assistant is designed to strengthen your content with profound SEO optimization.

-

Uber IPO-ed and here’s what it means for Grab and Go-Jek

Uber and Lyft bumpy journey in going public is a telling sign for the ride-hailing market.

-

India welcomes two new unicorns before mid-2019

The venture ecosystem in India is off to a great start in 2019. It’s not even mid-way into the year, and the country has already seen the addition of two internet startups achieving the much-coveted…