Category: Economy

China Wants to Accelerate Blockchain Adoption. Here are Some of the Country’s Blockchain Projects

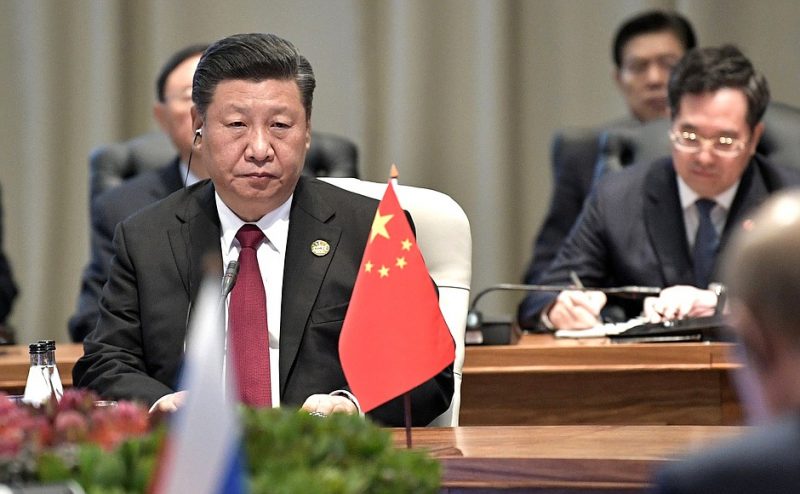

China’s President Xi Jinping, speaking during a group study session for members of the Politburo last Thursday, said that the country “must clarify the main direction, increase investment, focus on a number of key core technologies, and accelerate the development of blockchain technology and industrial innovation”. Additionally, he stressed that blockchain would play “an important role in the next round of technological innovation and industrial transformation”.

While certain Chinese government officials have made comments and statements on blockchain in the past, Xi’s comments are likely the highest-profile public endorsement of blockchain technology for China to date. As it turns out, even as Xi called for more adoption of blockchain technologies in China, there are already hundreds of enterprise blockchain projects being developed in the country, led by some of China’s biggest industry players.

According to the Cyberspace Administration of China, which requires every entity developing blockchain technologies in the country to register with it for oversight, there were 309 such blockchain projects listed for the month of October alone. Some of the information gleaned from the list is that those currently involved in blockchain projects include some of China’s largest banks and commercial tech conglomerates, alongside many public sectors and government projects.

All four of China’s tech titans, Alibaba, Baidu, Tencent, and Huawei, are competing to see which one would be able to develop and provide China’s most advanced blockchain cloud services. According to registration data, all four tech giants have filed blockchain white papers that detail information about their blockchain cloud services as infrastructure providers for third parties.

Alibaba has been particularly busy in the field of blockchain, having filed 90 patent applications for projects that are focused on blockchain-related technologies. Tencent has been developing its own range of blockchain services as well, having filed registrations for its Tencent Blockchain and Tencent Cloud TBaaS Blockchain. As for Chinese search engine Baidu, some of its projects that were registered on the list include Token, which makes use of blockchain to protect intellectual property rights, and Baidu Blockchain Engine which is a cloud services provider. Baidu has also registered and patented its Super Chain, which is focused on providing foundational infrastructure for blockchain services.

On the trade finance and banking side, six banks including ICBC and Ping An Bank have registered a total of 14 blockchain projects. Industrial and Commercial Bank of China (ICBC), which is one of China’s big four state-owned commercial banks and the largest bank in the world by total assets, has registered two blockchain projects: ICBC Financial Services and ICBCXi Blockchain Service, which are projects aimed at improving and facilitating transactions for its clients and customers. Ping An Bank has adopted FiMax, a blockchain network, to improve security and privacy and increase efficiency in transactions and supply chain financing.

The Chinese government is also applying blockchain technologies to a variety of services, such as tax collection, matters of legal arbitration and land development use cases. Blockchain is innovating the legal landscape in China with the introduction of Internet courts. These courts are authorized to deal with a number of internet-related cases such as small loan contract disputes, online intellectual property disputes, and online financing, with all legal processes being conducted online. Both the Beijing and Guangzhou Internet Courts have registered their respective blockchain-based platforms. Some other examples of blockchain projects being utilized by the government sector include Cross-Border Transactions Platform for the State Administration of Foreign Exchange and Blockchain Electronic Invoice for the State Administration of Taxation Shenzhen branch.

Looking forward the number of blockchain projects to be developed and implemented in China is only going to grow at a tremendous rate. Blockchain technologies will play an important and crucial role in China’s industrial and technological innovation and transformation.

Is Vietnam the next leading startup ecosystem in Southeast Asia?

When you think of the startup scene in Southeast Asia, you might think of regional leaders like Singapore and Indonesia which are home to six of eight unicorns.

However, a country in Southeast Asia, Vietnam is quickly following suit. Home to over 95 million people, the country is one of the region’s fastest-growing economies with an average GDP of US$68.78 billion from 1985 until 2017.

In fact, the Nikkei Asian Review has reported that Vietnam’s startup sector is growing at a rapid pace despite a global economic slump, and quickly closing its gap with the regional leaders.

The vibrant startup landscape can be attributed to the support fuelled by the government and accelerators as they aggressively promote entrepreneurship through legal and financial support. In the first quarter of 2017 alone, the country sees 39,580 startups entering the ecosystem.

And according to the joint research by Singapore’s Cento Ventures and Ho Chi Minh city-based venture capital ESP Capital, the first six months of 2019 has recorded the country’s startup investment to reach US$246 million this year through 56 deals.

Investment is also forecasted to exceed US$800 million by the end of the year, which would represent a rise of at least 80% over last year’s US$444 million.

When tracking the investments based on the destination country, Vietnam accounted for 17% of startup investments in the region, increasing 5% for all of 2018, behind Indonesia at 48% and Singapore at 25%.

As a matter of fact, the startup investment in Vietnam began to increase last year, with the online retail, payments and education sectors attracting huge capital injections.

Among startups that raised the lion’s share of funding last year was e-payment app Momo, which raised about US$100 million from American private equity company Warburg Pincus, making it one of the largest single rounds ever raised by a Vietnamese startup.

Other up-and-coming startups in Vietnam like ecommerce platform Tiki has also secured a large injection of funding. Based on ESP-Cento, the round raised US$75 million in March and was led by Singapore private equity firm Northstar Group.

Then, of course, there’s its home-grown unicorn VNG Corporation, which specializes in digital content, online entertainment, social networking, and ecommerce. The startup behind Zal, a communication application with more than 100 million, also recorded a US$29 million investment from Temasek.

Looking at these statistics and moving trends, it seems like Vietnam is in the bare minimum cash-ready and the bet of various investors as the region’s next leading startup ecosystem.

Number of Chinese unicorns surged to 202 in Q1 2019

Hurun Research Institute, the firm which creates China’s wealthiest individual lists has released its country-wide unicorn index for the first quarter of 2019 on May 7.

The new report titled “Hurun Greater China Unicorn Index 2019 Q1” mentions that China added 21 new unicorns in the first quarter, that is twice as many unicorns as in Q4 2018.

Among these 21 new unicorns, fashion clothing ecommerce Shein, apartment management platform Danke Apartment, IoT solutions provider Tuya Smart, autonomous driving startup Pony.ai, and media company XinChao are leading with over US$10 billion valuations.

The report also notes that the unicorns mostly derived from both AI and logistics fields, such as autonomous driving startup Pony.ai and B2B logistics startup Lalamove.

Hurun, the Chairman and Chief Investigator of the institution noted that “the number of unicorns in China has surprising exceeded 200, which is almost ten times that of India. At this time, China should be the first place in the world in terms of the number of unicorns.”

Rupert Hoogewerf, a.k.a Hurun – Chairman and Chief Investigator of Hurun Report

Of course, this wouldn’t have been so successful without capital funding from investors. In terms of unicorns breeders, Sequoia Capital has been the most successful with 53 unicorns in its portfolio. This is followed by Tencent and IDG, with each having invested in 31 and 25 unicorns respectively.

In terms of exits, the Hong Kong Stock Exchange and Nasdaq board have also witnessed the most listings of China’s unicorns in the first quarter of this year.

A total of five unicorns listed successfully on the list, including Maoyan Entertainment, Futu Securities, CStone Pharmaceuticals, Tiger Broker, and Weimob.

China now has 202 unicorns

Hurun Greater China Unicorn Quarterly Index from 2018

The biggest news after all, is that China now has a total of 202 unicorns. Among the startups, the total valuation of internet services companies topped the list with over 1.6 trillion yuan (about US$232 billion).

From the 202 Chinese unicorns, 42 are involved in the internet services sector, including ecommerce giant Alibaba’s Ant Financial with a US$1+ trillion valuation, Bytendance with a US$500+ billion valuation, and Didi with US$300+ billion valuation.

But aside from the Unicorn Index, the startup has also published its first Hurun China Future Unicorns 2019 Q1 listing another 70 high-growth enterprises from emerging industries.

These seventy potential unicorns are most likely to be valued at US$1 billion in the next three years, with 66 percent of the startups coming from Beijing and Shanghai.

In 2018, Hurun reported that a new unicorn was minted approximately every 3.8 days in China, making for a total of 97 new startups worth US$1 billion.

Though everything is looking to be on a good start with the results from the Q1 2019 report, Hurun said not to be overly optimistic as he estimates that 20% of current unicorns could eventually fail.

Also, Hurun’s methods of calculating unicorns aren’t exactly undisputed. By contrast, China Money Network’s calculations noted the number of new unicorns in 2018 at just 25.

A March Credit Suisse report also warned that despite the prominence of tech unicorns in China, the percent of firms in advanced fields including AI, big data, and robotics still well lagged behind US figures.

India welcomes two new unicorns before mid-2019

The venture ecosystem in India is off to a great start in 2019.

It’s not even mid-way into the year, and the country has already seen the addition of two internet startups achieving the much-coveted unicorn status, with another reportedly close to the billion dollar valuation milestone.

Just this Monday, BigBasket has secured a US$150 million Series F financing round led by Mirae Asset-Naver Asia Growth Fund, CDC Group, and Alibaba.

Chinese giant Alibaba is an existing backer, which had also led the Series E round in BigBasket last year. It remains the largest investor in the company, owning up to 30 percent stake.

Meanwhile, April also saw India’s first gaming unicorn Dream11. The startup reached a valuation exceeding US$1 billion, after a secondary investment by London and Hong Kong-based asset manager Steadview Capital.

“These developments proof that investment activity and the pace of growth has picked up in the Indian startup space,” said the vice president of consultancy Everest Group Yugal Joshi to Quartz India.

India’s Startups are Coming of Age

The rise of BigBasket and Dream11 are the continuous reflection of evolution in Indian internet business, following the footsteps of existing Indian unicorns like Flipkart and Ola.

“The companies that we are talking about, be it BigBasket or Dream 11, are not overnight stars,” said Sanchit Vir Gogia, the founder and CEO of Greyhound research.

These startups have been working their way up quietly for some time. Eight-year-old BigBasket, for example, has been investing in the supply chain, logistics and technology for long to reach where it is now.

The online grocer sells more than 20,000 products ranging from groceries and pet foods, operating in 25 Indian cities.

“BigBasket offers a transformational and convenient experience to its consumers, which makes it a preferred grocery platform,” said Ashish Dave, the head of India Investments for Mirae Asset Global Investments.

Meanwhile, Dream11 which was co-founded by University of Pennsylvania alumni Harsh Jain and his friend Bhavit Sheth in 2008 has also been experimenting with the product-market fit before it found success.

The startup adopts a data-driven culture and strategy to reach its current 50 million registered users, which it claims is the tip of the iceberg in a market with more than 850 million cricket viewers on television.

Their success with cracking their segments was what boost global investors confidence, enough to give birth to both success stories… and the trend is likely to continue.

Eyes on India Maturing E-commerce Market

Investors see India, now at a US$2000 gross domestic product per thousand people, set for consumer-spending led acceleration in the online economy.

The country offers large opportunities for startups and ventures that bridge offline needs with online access-based supply chains.

Startups like BigBasket is answering exactly this, as it is reengineering the supply chain to allow for faster delivery to resellers and to reduce the time from farm to customers.

With its new funding, the company is ready to contend with competitors on multiple fronts, from the micro-delivery ventures like dairy-focused Milkbasket to food delivery venture Swiggy.

It will also be looking to expand its operations and scaling up its supply chain capabilities, against bigger competitors like Amazon and Walmart which is expanding in India.

“We have a unique opportunity to build one of the largest grocery businesses in the country in the country and we expect the capital raised in this round to continue to enable us to do just that,” VS Sudhakar, co-founder of BigBasket said.

According to analytics firm Tracxn, India’s retail market is valued at more than US$900 billion and is increasingly attracting the attention of VC funds and more than 882 operational players since 2014.

More Unicorns to Come

2018 was an eventful year for the India startups ecosystem. India added eight unicorns in 2018 alone, as compared with the nine unicorns in a span of 6 years from 2011 to 2017.

It is most likely 2019 will follow suit, as we begin seeing the host of promising startups crossing the US$1 billion valuation mark. Besides Dream11 and BigMarket, some of the investors’ top pick according to Fortune India include:

- Online ticketing site BookMyShow

- Health and fitness startup curefit

- Ecommerce-focused delivery provider Delhivery

- Eyewear retailer Lenskart

- Digital payments company MobiKwik

- Surface transport firm Rivigo

- Online discount brokerage firm Zerodha

However, most likely it’s not going to be a joyride for these startups. Because with the gigantic successes in India, internet ventures today may be pressed for profits more than earlier years.

Indonesian Government launches NextICorn Foundation to breed more unicorns

This week, Indonesian IT Minister Rudiantara has launched the NextICorn (short for Next Indonesian Unicorns Foundation) as part of an effort to boost the country’s growing digital ecosystem.

The foundation is intended to establish long-term cooperation between the government and key ecosystem stakeholders in Indonesia, which is expected to assist and accommodate the development of the country’s startup companies moving forward.

Besides connecting startups with venture capitalists, the NextICorn Foundation would also offer support related to business models and technology implementation.

“The NextICorn Foundation represents the government’s commitment to the sustainable development of a digital ecosystem,” Rudiantara explained.

He said the government had the obligation to facilitate the country’s startups to grow and achieve the much-coveted unicorn, or even the decacorn status

This news came after ride-hailing app Go-Jek became Indonesia’s first decacorn when its valuation hit US$10 billion, according to the CB Insights research institution.

4 out of 10 SEA Unicorns

Southeast Asia has produced a total of 10 unicorns to date, of which 4 are from Indonesia. These homegrown unicorns include Go-Jek, Traveloka, Tokopedia, and Bukalapak,

Of the four, Go-Jek is the lead unicorn and one of the most talked about startups in Southeast Asia, especially recently with its newly achieved decacorn status.

The four unicorns have also attracted many big-name investors into the country. Tokopedia has backing from Alibaba and Softbank Group, Traveloka’s investors include Expedia and JD.com, while Bukalapak investors include Singapore’s GREE Ventures.

In fact, Indonesia owes a huge part of the growth of its digital economy to these local startups.

Not only have they brought upon a positive impact on the national economy through the provision of employment, but the startups have also contributed largely in terms of economic growth.

The ride-hailing app, for example, has contributed US$3.13 billion to Indonesia in just 4 to 5 year according to Minister Rudiantra.

Indonesian startups are also innovating and creating new business models. For instance, ride-hailing firm Go-Jek is more than just an Uber clone. They have Go-Med (medicine delivery); Go-Play (akin to Netflix) and Go-Clean (housekeeping services), while Traveloka now earns more from shopping vouchers than it does from trip bookings.

Disrupting and Improving the Way of Life

![]()

Looking at these unicorns, they are all examples of how rapid development in digital technology has not only disrupted businesses but improving Indonesian lives

Go-Jek, the country’s first decacorn has changed everything from online transportation to food delivery. Go-Jek has now become the go-to app for people when they are hungry or looking to travel.

20 New Unicorns by 2025

With such hype and optimism, Indonesia is very likely to see more unicorns in the next couple of years, but before that let’s look forward to one this year.

The communications minister has also told media reports last year that it is expecting 5 unicorns in 2019.

He also added that the most promising sectors are expected to be educational, healthcare, and fintech.

Really, with a supportive climate and Indonesia’s internet company growing at a healthy rate, it looks as if the country is moving towards high-scale startups or even more unicorns in the near future.