Category: Funding Rounds

Baby Pictures mobile app Qinbabao closes Series B funding led by China’s Fosun Group

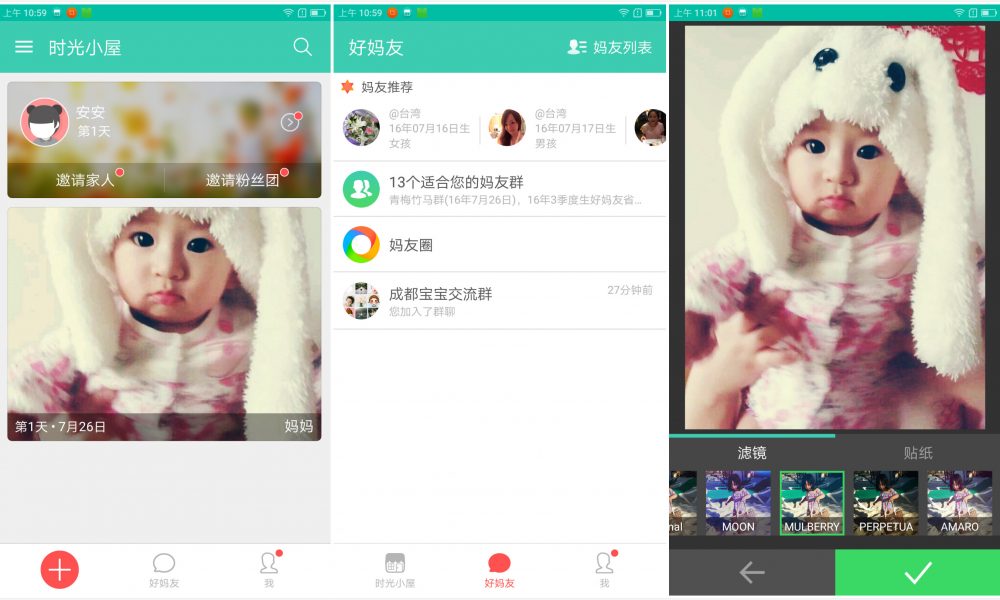

Qinbabao, a mobile app that allows users to post, share and store baby pictures or videos, has recently raised its series B funding round led by China’s global investment firm, Fosun Group.

Existing investor ShunWei Capital, a China-focused venture capital fund who has invested in iQiyi and online learning platform, 17zuoye has also participated in the round, which is reportedly said to be in tens of millions of U.S. dollars.

“Family expenditure surrounding children will be the biggest driver of China’s future consumption market,” said Li Rui, a partner at Shunwei Capital. “Qinbaobao can create multiple family consumption entry points based on its child-centric business model, affording it great potential.”

Founded in 1992, Shanghai-based Fosun Group has been involved in a number of industries segments which include health, lifestyle, property development, and mining. This latest investment follows the Chinese investment firm’s US$450 million funding in Babytree, a Chinese parenting portal in November 2016.

Commenting on the investment, Guo Guangchang, the chairman of Fosun Group said, “Since 2015, Fosun’s investments have been focused on business-to-family projects. Services tailored to children is undoubtedly the most important part of this space.”

Since 2007, its holding company Fosun International has been listed on the Hong Kong Stock Exchange (HKEX), and the investment firm focuses on capital provisions not only in China but on the global level as well. The company, to date, has investments in over 50 projects worldwide.

Besides, Fosun International Ltd has made a number of acquisitions in the past few years investing in the likes of Club Mediterranee SA, a French resort chain and Studio 8, a Hollywood movie producer. Additionally, it has been the first Chinese firm to invest in a state-owned high-speed railway project.

Launched in 2013, Qinbaobao claims to have 20 million users, who share and store baby pictures and videos. The mobile app also provides a networking platform, forming a mobile community of young families.

Besides, the Chinese mobile app also features parenting guides such as expert tips on baby care, nutritional recipes, storage for baby records as well as fairytales and nursery rhymes for toddlers.

With the latest proceeds from the new round, QinBaoBao will use it to improve its mobile application, marketing, and user expansion as well as for new approaches to monetisation.

By Vivian Foo, Unicorn Media

Taiping Assets Management leads US$309 million round in Shouqi Car Rental

Taiping Asset Management Co., Ltd., an investment arm of Hong Kong-headquartered China Taiping Insurance Group, has become the lead investor in an RMB 2.15 billion (about US$309 million) funding round in Shouqi Car Rental.

Other investors include Tianan Property Insurance Co., Ltd., CCB International and several unnamed investors have also contributed in the latest proceeds which will be used to expand the automobile firm’s fleet, as well as improve on marketing and technology

The funding round followed a US$120 million in November 2015 which was led by Jiashi Fund Management and an earlier round of US$150 million from Beijing Tourism Group and parent Shouqi Group in early 2015.

Founded in 1992, Beijing-based Shouqi Car Rental is a subsidiary of Beijing-based automobile transportation and logistics company Shouqi Group, which is best known for operating limousine fleets for Chinese political leaders and visiting dignitaries.

The company is said to be the third largest car rental fleet in China, with 18,000 cars and a network of 230 service stations in 56 Chinese cities. The automobile subsidiary also operates via iZuChe.com and mobile apps, providing short-term and long-term car leasing, mobile app-based chauffeured ride and carpool services.

On a related matter, Volkswagen Group China announced it has signed an agreement of potential partnership with Shouqi Group to provide sustainable mobility solutions to help expand the car-sharing business in China.

Formerly known as China Insurance Group Assets Management, Taiping Assets Management is based in Hong Kong and invests in public equity, fixed income, as well as alternative investment markets.

By Vivian Foo, Unicorn Media

Taiwan’s Next Entertainment raises US$25 million in Series A round led by China live streaming app Inke

Taiwan-based global live broadcasting platform Next Entertainment has raised US$25 million in its Series A financing round for its newly launched flagship app, MeMe.

The capital is intended for global expansion as Next Entertainment aims to export and mirror the success of its predecessor Inke beyond China. This will also include hiring talents in San Francisco, Tokyo, Taipei and Beijing.

Founded by Internet entrepreneur and FunPLus founder Andy Zhong, Next Entertainment was incubated by Inke, the Chinese mobile live streaming giant which is also the round’s lead investor.

Other Series A participants also include game developer FunPlus, leading Chinese venture capital company GSR Ventures, San Francisco-based investment company Mayfield, as well as Signia Venture Partners.

“As an investor in Inke, we saw its incredible growth in China. Their partnership with a proven east-west entrepreneur like Andy is very exciting, and we’re thrilled to be able to work with them both again,” GSR’s managing director, Richard Lim said.

As part of the funding agreement, Next Entertainment plans to leverage Inke’s experience in the live streaming market to deliver more tailor-made and interactive services to global users.

“There’s a revolution happening in the entertainment industry, and we’re happy that our partners at Inke and our Series A investors are part of it.” the Founder and CEO of Next Entertainment, Andy Zhong said.

“We’re excited about live streaming as a form,” Andy Zhong adds. “By building ways for content creators to engage and interact with their fans in real time and to earn money doing it, Inke has changed people’s lives. We’re going to expand that globally.”

MeMe is a live streaming platform that enables anyone to stream, interact with their audience, build a following and get paid to do it. With MeMe, livestreamers can do live performances such as singing or talking in a very funny way.

Audiences on MeMe can also interact with live streamers and other viewers, showing their support, strengthening their profile and increasing their own following along the way.

“As far as monetization goes, you can think about this as digital tips for performers who have hyper-local appeal,” said Mayfield managing director Tim Chang. “If you bid high enough, you might be the preferred fan or the one who gets to make a request. It mimics real-life behavior at clubs, where you buy someone a bottle of champagne.”

The service was launched in Taiwan in October 2016 and is slated to launch in other territories in 2017.

By Vivian Foo, Unicorn Media

Backed by Chinese Rock Star Wang Feng, China’s FIIL to be the next Beats by Dr. Dre

Chinese rock star Wang Feng is recreating a Dr. Dre phenomenon with his headphones brands – FIIL. Like Beats, the Beijing-based FIIL designs are fashionable but still high-fidelity.

Rising to fame in China in the late 1990s, Wang Feng is a rock veteran who is involved in a lot of trades, from working on his headphone startup, launched last year to holding the position as one of the panelists on China’s version ofThe Voice.

Leon Wu, FIIL’s CTO with a decade of experience in audio engineering, name-checks Beats and Bose as brands that the startup admires and model after. “We try to absorb good things from both,” he said.

“The Beats marketing strategy,” Wu adds, “…is also one of the things FIIL would like to emulate.”

Looking at Dr. Dre’s array of product placement, indeed FIIL has its own version, as Wu told, “During the 24th birthday celebration of Hong Kong singer G.E.M., Wang gave her a pair of FIIL headphones. She put the headphones on in front of a bunch of reporters, and it attracted a lot of attention and a boost in sales.”

Since then, FIIL has been in the hype, benefiting from a ton of free and glamorous publicity from Wang Feng’s celebrity friends when they wear them in front of paparazzi or when the company’s first product, the FIIL Wireless, won design awards from Red Dot.

A majority of FIIL’s users are from mainland China, but like a number of young startups across the nation, the audio equipment maker is also looking to advance onto the international platform in the hope of replicating the success of DJI, Xiaomi, and One Plus.

A step to accomplish the feat, FIIL has recently launched itself on Kickstarter on December weekend, testing the waters with Carat Pro, a set of wireless headphones that comes with some sporty features.

The wireless buds do real-time heart-rate monitoring, audio coaching, and tracking of distance, steps and workout duration – a first for the startup to blend a fitness tracker with its earphones.

“We want to go above and beyond the scope of traditional earbuds with the FIIL Carat Pro earbuds,” said FIIL president and Rock Star Wang Feng.

FIIL Carat Pro earbuds also include Valencell’s PerformTek biometrics, to create a high-tech sports earbud that is said to be not only fashionable but even more accurate and advanced than smartwatches and fitness trackers.

The earbuds are also modeled by actress Zhang Ziyi, star of Crouching Tiger, Hidden Dragon who was married to Wang Feng last year.

As per details of the project, the Kickstarter project targets a pledge to raise US$50,000 in 40 days and will end on Jan 15, next year. To date, the project has reached half the funds backed by 189 backers.

At present, there are only five types of FIIL headphones on the market: FIIL, FIIL Wireless Bluetooth, FIIL Bestie headphones, FIIL Diva Pro Headphone and FIIL’s Carat Pro. The headphones cost between 599 and 1,999 yuan (about US$ 86.20 and US$ 287.80).

In 2015, FIIL has received a US$10 million seed funding. Looking into the future, FIIL’s plan to cover not just headphone, but to extend its reach to speakers and even smartphones as well.

By Vivian Foo, Unicorn Media

Indonesia-based reinsurer Marein to raise US$41 rights issue in 2017

Maskapai Reinsurance Indonesia (Marein), one of only four local reinsurance companies in the country, has made plans to raise US$41 million from a rights offering in 2017.

The company said it will sell up to 130 million new shares in a right issue by June 2017 in order to strengthen its existing capital.

Reinsurers provide insurance for other insurance companies, Marein along with Reasuransi Indonesia Utama, Reasuransi Nasional Indonesia, and Tugu Reasuransi Indonesia are the only four local reinsurance companies in Indonesia.

Local firms often lack capital compared to their larger foreign reinsurance peers, forcing Indonesian insurance firms to seek coverage for big insurance policies abroad.

However, when local insurance firms pay for premium overseas coverage, it will complicate government efforts to balance the country’s current account.

Hence, Financial Services Authority (OJK) has requested the four reinsurers, Marein and its rivals to increase their capacity to cover more clients.

“In order to increase the capacity, we have to raise capital,” said Marein president director Robby Loho to Jakarta Globe.

“The company is expected to reap IDR 1.5 trillion in premium income this year, with an increment of 40 percent from last year’s IND 1.07 trillion”, said Yanto J. Wibisono, Marein’s finance director.

Besides, the premium income at Marein has also reached IDR 907 billion in the first nine months this year, increasing by 29 percent from the same period in 2015. This was driven by a double-digit growth in life and general reinsurance segments this year.

Fitch Ratings, one of the big three credit rating agencies affirmed Marein’s national insurer financial strength with an A+, as well as its international IFS rating of BB back in August.

Fitch said that the rating reflects Marein’s high business concentration in catastrophe-prone Indonesia, its modest market position, and despite its long operating record, small asset size compared with some of its local and regional peers.

By Vivian Foo, Unicorn Media.