Category: Investment

Malaysian venture capital firm TinkBig to launch US$30 million fund

Malaysian venture capital firm TinkBig Venture is seeking for potential startups to be part of their US$30 million investment that is said to launch towards the end of 2017.

As for details about TinkBig’s investment verticals, the VC firm’s second vehicle will allocate at least 10 percent for IoT Smart Homes focused companies in 2017.

“We will be targeting regional investment around Asia highly focused on marketing right and royalty deal structuring. We are currently looking into Taiwan and Shenzhen IoT players to bring these products to Southeast Asia market,” serial entrepreneur and TinkBig’s founding partner Andrew Tan said.

Founded in July 2016, TinkBig is a comparatively new venture capital firm in the country. In addition, the VC firm to date has invested about US$2.4 million in eight companies, mostly consumer-based.

Among its investment portfolio, includes BurgieLaw – an intermediary platform between startups and the legal industry, Refash – a Singapore-based pre-loved fashion portal; and GOtixs – a platform for promotion and savings.

For most of its investments, the VC firm had picked up a stake ranging between 7.5 percent to 15 percent while maintaining a general ticket size of between RM500k to RM3 million, which translates to approximately US$112k to US$672k.

Likewise, the new US$30 million fund will also maintain a similar ticket size whereby it will be targeting early-stage companies in their seed round which displays a good product/market fit.

Formed by a team of 11 seasoned entrepreneurs, the VC firm is led by Venture Partner Andrew Tan, Principal Partner Jin Tan and Tech Partner Nitin Gupta, who before TinkBig, each have about 20 experiences in business, investment and tech.

The team, through Tinkbig, aims to help startup throughout the process of ideation to commercialisation. Besides, the incubator process also involved a live pitching resembling a reality show which helps prepare startups.

Looking to raise the funds by the third quarter of 2017, TinkBig has completed just about 20 percent of the funding for this new vehicle largely from investors who include entrepreneurs, high net worth individuals, and listed companies.

“The market is getting soft as Limited Partners are getting cautious. However, this reluctance to invest is not because of a scarcity of good investment options,” Andrew Tan, the Principal Partner of TinkBig explained.

In fact, long exit windows and lack of sufficient secondary data to conduct due diligence along with diminishing returns have made limited partners become cautious. “It’s going to be a very challenging moment for 2017 to raise funds from LPs,” Tan adds.

“We are looking into the space of functionally designed prop that essentially becomes your smartphone’s best friend within seconds. Remote-controlled devices such as TV, air conditioner, sound system etc, and the user’s smartphone learns the device and lets the user control it from the phone itself using Bluetooth,” Tan also noted.

Besides, IoT Smart homes which are mostly based in Singapore, Japan, and China are increasingly becoming an area where many want to engage and invest.

“I would say IoT smart homes is a very promising area and billion dollar market,” Tan noted. “I believe 2017 will be the year that IoT is going to be one of the hottest topics in the investment scene with functional IoT devices that are going automated and provide convenient to daily lifestyle.”

TinkBig intends to fill the gap in Malaysia for a VC fund which not only supports its investments via a holistic approach but also to create an ecosystem for success rather than just providing capital.

“If we find interesting startups we will introduce them to relevant corporate partners. For example, we would introduce an IoT company who specialise in energy saving product we would connect them to our developer partners who have a lot of industry experience that can be leveraged to help the startup fine-tune its product,” he said.

With a focus on Southeast Asia, the firm has a strong foothold in Malaysia, Indonesia, Singapore, and Thailand. The company is also currently exploring opportunities in Vietnam.

By Vivian Foo, Unicorn Media

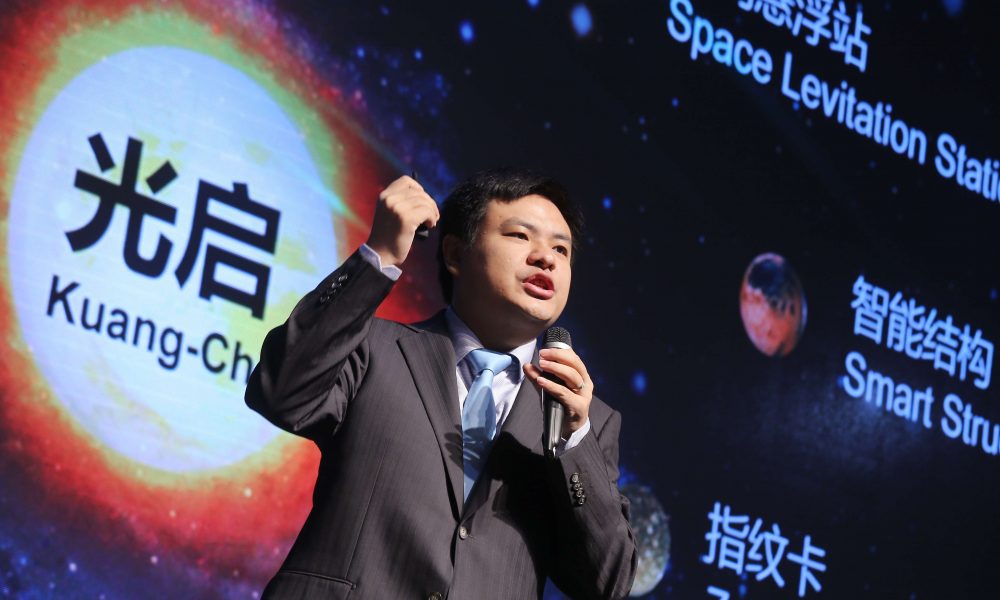

China-based tech corp Kuang-Chi launches US$250 Global Tech Fund

Shenzhen-based Chinese technology conglomerate Kuang-Chi Group announced on January 11 that is has launched a US$230 million fund that will be used to invest in global technology companies.

The fund is known as Global Community of Innovation (GCI) Fund II and is accompanied by the opening of its Israel-based International Innovation Headquarters.

As one of the first Chinese fund of its kind, GCI Fund is targeted at Israel technology companies that are looking to collaborate with local Chinese firms for entry and expansion into their domestic markets.

GCI Fund II will invest US$250 million in global technology companies active in sectors of smart city and home, computer vision,Internet of Things (IoT), artificial intelligence, VR/AR and robotic.

The selected startups will be supported by a new China-based incubator, established by Kuang-Chi to help bring its portfolio companies to the Chinese market.

“We were able to quickly deploy the US$50-million GCI Fund I in exceptional companies that operate in sectors we know well and we’d like to build on this momentum with Fund II,” said Dr. Liu Ruopeng, the chairman of Kuang Chi.

“Working with our partner in Israel, we’ve identified a wealth of opportunities to expand our portfolio and give our joint investment team an expanded strategic and financial mandate,” he added.

Earlier, the first GCI fund established in 2016, has seen stakes in several Israeli companies, including computer vision pioneer eyeSight, voice analytics developer Beyond Verbal, and video intelligence and analytics provider AgentVi.

Besides, the fund has also invested in Norwegian biometric authorization innovator Zwipe, Canadian aviation company SkyX, SolarShip and Australia’s Martin Jetpack.

“We have moved from success to success in Israel, and I’m delighted by the pace of our good progress showed in our recent investments in eyeSight, AgentVi and Beyond Verbal,” the Kuang-Chi co-founder and CEO of KuangChi Science, Yangyang Zhang said.

Within six months of its investment, Kuang-Chi and eyeSight jointly built a local team in China to provide markets with the most advanced embedded computer vision solutions currently available.

While in December, Beyond Verbal signed its first cooperation agreement in China, with the Second Affiliated Hospital Zhejiang University School of Medicine in Hangzhou.

“GCI portfolio companies will share access to cutting-edge technology that includes over 2,000 patents and R&D from around the world. Each of these investments comes with an opportunity to expand their business in China and establish relationships with global market leaders across multiple industries,” added Liu.

Founded in 2010 by a five-person team, Kuang-Chi has created a Global Community of Innovation of more than 2,600 employees which spread through 18 countries and regions.

The fund is dedicated to disruptive innovation and principal investment in cutting-edge technology sectors including communications, metamaterials, and space technology.

By Vivian Foo, Unicorn Media

Mekong Capital invests in Vietnam-based F88 pawn shop chain

Private equity firm Mekong Capital announced on January 10 that the Mekong Enterprise Fund III (MEF III) has invested an undisclosed amount into Vietnam-based pawn shop chain F88.

The terms and value of the investment were not disclosed, although the fund is said to be an eight digit number and Chris Freund, a partner at Mekong Capital, will join the management board of F88 as part of the deal.

This also marks the third investment made by the PE firm’s US$112.5 million fourth fund since its launch in May 2015. Prior to this financing, MEF III had closed investments in restaurant chain Wrap & Roll and cold chain logistics company ABA Corporation.

Founded in 2013, F88 is a pioneer in Vietnam’s pawn service chain which leverages on a tech platform. It provides transparency in operation and offers an effective alternative to traditional borrowings which brings a reliable financial solution to consumers.

The IT platform within F88 covers data about management tasks, deposited items, and most importantly product valuation. “For this model to work, it is very difficult to agree on the valuation of the products. Our technology solutions are the key to this problem,” said Phung Anh Tuan, the chairman and CEO of F88.

“This combination facilitates us to strengthen our management team, approach to the world’s best practices and improve service quality to ready us for a rapid and sustainable growth,” Phung Anh Tuan added.

F88 currently operates 15 stores in Hanoi and several surrounding provinces while aiming to have 70 outlets in the north of Vietnam by the end of this year and as many as 300 stores across the country by 2020.

“F88’s competitive edge is its entrepreneurial co-founders, professional management team, IT infrastructure, and strong corporate governance. We believe that with Mekong Capital’s well-proven approach towards adding value, called Vision Driven Investing, and our extensive network of international experts and resources, F88 will continue to improve their operations and successfully execute an ambitious nationwide expansion plan,” said Freund, the Mekong Capital partner at F88.

This is said to be an established business model found around the world, according to the fund partner. However, the risk associated with it in the Vietnamese market is how to scale the size of the market opportunities.

Freund also mentioned that the firm’s strategy did not include investing in new disruptive technologies. However, Mekong Capital will continue to search for companies with proven business and strong teams that can successfully execute their models, irrespective of sectors.

The chain currently provides loans on diverse assets such as cars, motorcycles, mobile phones, laptops, and jewellery. With the investment by Mekong Capital, F88 plans to go for an IPO within the next five years.

“We are very proud and excited that F88 is the third investment we’ve announced for the Mekong Enterprise Fund III,” Freund added.

MEF III, which focuses on investments in Vietnamese consumer-driven businesses such as retail, restaurants, consumer products, and consumer services, targeting investments ranging from US$6 to US$15 million each.

By Vivian Foo, Unicorn Media

Japanese investment firm NSSK sets up US$300 million second investment fund – NSSK II

Tokyo-based NSSK, who calls itself a new source of strength for Japan’s regional economy, has raised US$300 million for its secund fund NSSK II (Intl) Investment, according to a report in Private Equity International citing sources.

While the first NSSK fund was entirely raised from Japanese investors, this second investment vehicle has instead received commitments from North American and European investors, as well as new Japanese LPs.

The fund however, is still primarily yen-denominated, and has a target size of 63 billion yen (US$539 million) according to a SEC filing in September 2016. The new fund will be used to back retail, consumer, healthcare and hospitality companies in Japan, supporting them for global expansion.

NSSK, which is short for Nippon Sangyo Suishin Kiko is an alternative-investment firm led by the former private equity company TPG Capital’s Japan head – Jun Tsusaka, who now plays the role of Managing Partner and Chief Executive Officer at NSSK.

Other founders of the firm also include Kaz Tokuyama, a former Merrill Lynch Japan Securities Co. banker, and Nobuhiko Ito, who was previously the CEO of General Electric Co.’s Japan operations.

Founded in September 2014, NSSK focuses on proprietary investments in regionally-focused firms and private companies with succession issues. Its investment strategy is to generate superior returns by applying global investment discipline, operating expertise and human capital to the attractive SME market in Japan.

The investment firm had its first investment in December 2014 when it agreed to pay an undisclosed sum for 70 percent of Mie-prefecture based US.Mart Corporation, a developer of amusement facilities.

Recently, the investment firm has acquired SC Holdings Co Ltd, a leading operator of nursing homes and assisted-living facilities for seniors with a primary presence in the Greater Kanto area of Japan.

By Vivian Foo, Unicorn Media

Beijing-based EasyStack secures US$50 million series C funding led by Cash Capital

EasyStack, one of the leading open source cloud enterprise cloud platform and services provider in China, has announced on Wednesday, that the company has closed a US$50 million Series C funding round led by Beijing-based Cash Capital Investment Management Co, Ltd., an investment arm of the Chinese Academy of Science Holdings.

Other investors also include a number of unnamed RMB funds, which has brought the company’s total venture fundraising to US$68 million, in addition to setting a new record for a single round funding in the open source field in China.

“Improving China’s self-developed cloud computing capabilities is an important part of China’s 13th Five-Year Plan,” said Chen Hongwu, a partner at CASH Capital. “EasyStack has the best team with robust technology expertise, and the company has established a leading position in China’s open source enterprise services market.”

Founded in February 2014 by the core team of IBM China R&D Center, EasyStack is the leading cloud platform and service provider in Asia-Pacific, providing cloud computing services that is open, controllable, stable, and reliable with high performance based on OpenStack for over 100 enterprise clients including China Mobile, China UnionPay, and Lenovo Group Ltd.

“China is one of the most active areas for OpenStack, and many Chinese companies including EasyStack are making great contributions to the community. The Series C investment is a big milestone for EasyStack, and I believe OpenStack will grow fast with the support of successful OpenStack companies and users,” said Jonathan Bryce, the executive director of OpenStack foundation.

Besides, EasyStack adheres to the concept of open cloud computing and contributes to the development of the community. In its newly released Newton Version of the OpenStack, EasyStack takes the lead in China as well as being the eighth in the world in terms of tc-approved commits.

“The core competitiveness of the cloud computing service provider is demonstrated in the R&D capacity of the basic technologies based on the accumulation of the service and implementation experience of the enterprises and the establishment of the threshold of the leading enterprise clients of a certain industry,” said Xilun Chen, the founder and CEO of EasyStack.

Hence, with this new round of financing, EasyStack plans to continue improving its technology and operation, through primarily focusing on the research and development of core open source technologies, eco-investment of the open source cloud enterprises solution, and team building of the enterprise cloud services.

Besides, the firm also looks to expand its market scale in the OpenStack field, continuously enhancing its capacity to offer comprehensive services, improve its advantages in technologies and the operation cost so as to build an open source cloud platform featuring stability, security, high efficiency and controllability for enterprise users.

Prior to this, the company had raised US$2 million in a series A round from Blue Run Ventures in 2014, while in 2015, EasyStack has managed to secure US$16 million in its series B round.

By Vivian Foo, Unicorn Media