IPO

-

Indonesia’s GoTo Group Plans Fundraising Before IPO Launch In 2021

Last week, two of Indonesia’s largest startup companies, Gojek and Tokopedia confirmed that they will be merging to form GoTo Group with a deal of US$18 billion to US$22 billion. The merger is said to be…

-

China Youran Dairy to raise up to $800 million in HK IPO

China Youran Dairy Group has started briefing investors on Tuesday as it looks to raise up to $800 million in its Hong Kong initial public offering (IPO), according to two sources with direct knowledge of…

-

10 Indian startups joins unicorn club in 2020 despite COVID-19 pandemic

While the COVID-19 pandemic is severely impacting businesses across various sectors and countries, the startup scene in India is singing a different tune having seen 10 new startups reaching the $1 billion valuations in 2020.…

-

Vincom Retail launches Vietnam’s largest IPO worth up to US$713 million

This could become Vietnam’s largest ever-share sale in the private sector.

-

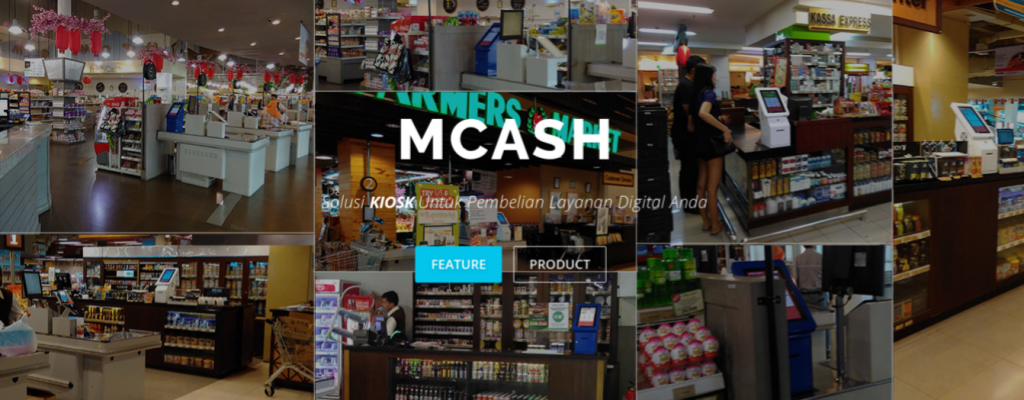

Indonesia startup M Cash Integrasi set to IPO in November

M Cash Integrasi plans to go IPO first surfaced in May.