Startup

-

Aspiring Southeast Asian Unicorns to Watch: Vietnam’s E-commerce Startup Sendo

Sendo operates both business-to-business and consumer-to-consumer models, serving more than 300,000 sellers and 10 million buyers.

-

Google Report predicts 70 Aspiring Unicorns including iflix, Zilingo

There’s some good news despite the slowing global economy as Google, Temasek, and Bain & Company has recently released its “e-Conomy SEA 2019” report that now values Southeast Asia internet economy at US$100 billion. The…

-

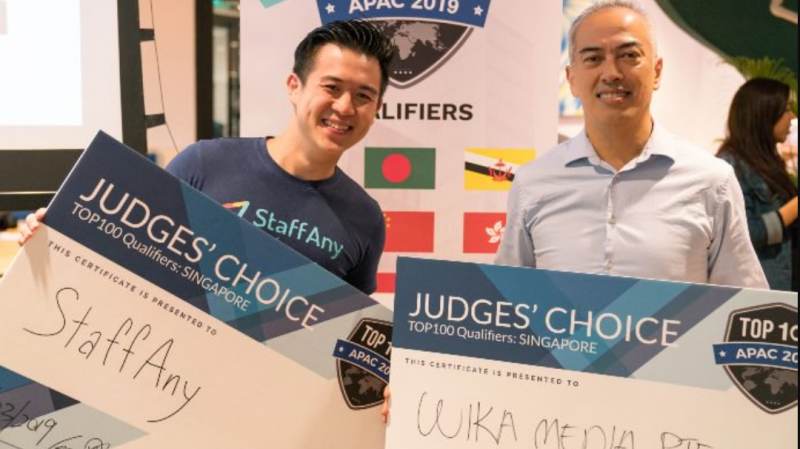

Top 5 Startups in Singapore to Watch

Singapore TOP100 winners were recently revealed and we took a chance to see who are these startups and which next big idea turns out to be the most promising. On March 7th, 110 startups attended…

-

Grab vs. Go-Jek: The Battle for Ride-hailing Market Domination

The fight for domination in the ride-hailing market is heating up as ride-hailing giants Singapore’s Grab and Indonesia’s Go-Jek are forging new financial services alliance. With Go-Jek’s Singapore entry closing in, the Indonesian ride-hailing giant…

-

First Coffee Unicorn of China: Luckin Coffee Raises US$200 million to take on Starbucks

The Chinese startup Luckin Coffee had raised a US$200 million GIC-backed round which raised its valuation to US$1 billion.