Author: vivian

Gaming and eCommerce unicorn Sea’s revenue doubles in Q3 2020

Sea Ltd, the gaming and e-commerce unicorn in Southeast Asia has been one of the biggest beneficiaries of the COVID-19 pandemic, reporting its total revenue of US$1.2 billion for the third quarter of 2020, with a 98.7% percent increase year-on-year.

Their Q3 figure revenue was boosted by the growth in digital entertainment and its eCommerce service Shopee and the sales of goods.

Listed on the New York stock exchange board, the Singapore-headquartered company has also seen its market capitalization more than quadrupled from the beginning of the year, topping US$80 billion and now being Southeast Asia’s largest listed company by market value.

In a mid-October report, Morgan Stanley had already made an optimistic forecast of Sea’s Q3 total revenue at US$1.47 billion, while Japanese investment bank Daiwa had forecasted a total revenue of US$1.16 billion for the firm in an August report.

In reality, Sea reported an EBITDA amount of US$120.4 million during the July-September period, which is its total adjusted earnings before interest, tax, depreciation, and amortization. This amount beat Morgan Stabley’s forecast of US$22 million and is a huge swing from the US$30.8 million loss in the quarter from last year.

For the first nine months of the year, Sea also posted total revenue of US$2.81 billion, and that is currently in line with the full-year total revenue forecasts from CGS-CIMB at US$3.96 billion while its highest forecast stands at US$5.38 billion from Morgan Stanley.

COVID-19 Pandemic Impact on Gaming

Sea benefits from the lifestyle and work changes that have been caused by the global COVID-19 pandemic and subsequent lockdowns. The period has seen an increase in demand for eCommerce, digital payments, and home entertainment which includes online gaming.

Unlike many industries, gaming is considered counter-cyclical, and an increase in the unemployment rate and lockdown has boosted the time for users to play online games.

For the digital entertainment segment, Sea’s games offerings and bookings climbed to US$944.7 million, which is a 109.5 percent increase year-on-year, while its revenue under generally accepted accounting principles (GAAP), came in at US$569 million, that is a year-on-year increase of 72.9 percent.

Currently, the digital entertainment division reported a revenue of US$1.32 billion for the nine-month period, and that compares with Daiwa’s full-year forecast for US$1.89 billion, Morgan Stanley’s US$2.85 billion, and DBS’ US$3 billion.

The unicorn’s quarterly paying users also more than doubled to 65.3 million, with an average number of bookings per user coming at US$1.7, as compared to US$1.40 last year.

One of Sea’s titles Free Fire was the highest-grossing mobile game in Latin America and Southeast Asia in the quarter.

Sea’s eCommerce Division Shopee

On the other hand, Sea’s eCommerce division Shoppee has reported a GAAP revenue of US$618.7 million, which is a 173.3 percent increase year-on-year. This has way exceeded Daiwa’s revenue estimation of US$585 million and is close to Morgan Stanley’s projected revenue for the segment at US$617 million. As a whole, Sea’s eCommerce segment posted a nine-month revenue of US$1.12 billion.

There was also an increase in the adoption of Sea’s mobile wallet services in October with more than 30 percent of Shopee’s total gross orders paid using the service.

Sea said this signaled a strong growth in the SeaMoney division, with total payment volume topping US$2.1 billion and a totla of 17.8 million paying users in the quarter.

Despite that, the adjusted Ebidta loss for digital financial services has grown to US$149.26 million for the quarter, an increase from US$33.63 million in the same period from last year. Shopee however is looking to further increase this number as they offer users shipping incentives for using the e-wallet.

Meanwhile, in surveys conducted among urban Indonesians by Morgan Stanley, Shopee has become Indonesia’s most popular eCommerce site, representing around 50 percent of Shopee’s gross merchandise value.

The same survey also states ShopeePay is Indonesia’s third most popular e-wallet. The Morgan Stanley report said it views the data as validation of its projection that Shopeepay was set to take around 20 percent of the country’s fintech market by 2025.

Sea’s Q3 Revenue doubles, but its loss also widens

Despite this increase in revenue, the online gaming and eCommerce group also reports a net loss of US$425.3 million in the quarter, which is up from the US$206.1 million in the same period from last year due to heavy investments in the Southeast Asia market expansion

The company reported higher sales and marketing, administrative expenses, and an increase in the research and development budget. Other contributions also include higher interest expenses and foreign exchange.

For the full year, Sea remains optimistic, expecting its digital entertainment segment’s strong performance will continue. Sea’s chairman and group CEO Forrest Li told Nikkei Asia that, “we expect our very strong performance in the third quarter to sustain through the fourth quarter. ”

The company projects its digital entertainment bookings to exceed US$3.1 billion for the entire year, which would make it a 75% increase year-on-year, and also an increase from the previous guidance of US$1.9-2 billion.

For its eCommerce segment, Sea said it now expects GAAP revenue plus sales incentives net-off to top US$2.3 billion, which is a 144 percent year-on-year increase, and up from the previous guidance of US$1.7 to US$1.8 billion.

With the COVID-19 pandemic accelerating the adoption of digitalization in Southeast Asia as reported by Google-Temasek 2020 report, Sea is expected to be a big winner from this pandemic, and in the coming years ahead,

Google-Temasek Report: Southeast Asia Digital Payments Reach US$620 Billion during COVID-19 Pandemic

The COVID-19 pandemic has led to big shifts across the region. So far this year, digital payment in Southeast Asia has already exceeded the US$600 billion record last year and is currently at US$620 billion, according to the 2020 Google-Temasek report.

This report jointly launched by Google, Singapore’s state investment firm Temasek, and Bain & Co. also highlighted that the region has registered 40 million new online users during the pandemic which now brings the total number to 400 million.

On average across the Southeast Asia region, one in three digital service consumers is said to have registered the service due to the COVID-19 pandemic.

In fact, a huge number of new digital consumers mainly come from non-metropolitan areas in countries including Malaysia, Indonesia, and the Philippines.

Shockingly, this trend of new consumers coming online also extends to Singapore, a country where we had long thought to have high internet penetration, also see a 30 percent increase of new digital consumers.

“COVID-19 has changed people’s daily lives in fundamental ways. The digital adoption that was projected to happen over several years has accelerated,” said Stephanie Davis, the vice president of Google Southeast Asia.

That’s not all. What really stands out is not just the increased adoption, but the report also notes that nine out of 10 of these digital consumers have responded that they will continue or plan to continue using digital services moving forward, even post-pandemic.

The report also predicts the gross merchandise value (GMV) of Malaysia’s internet economy to see a significant increase to US$30 billion in the next five years, from its US$11.4 billion in 2020 so far.

In Malaysia, the average time people spent on the internet daily is recorded at 4.8 hours at the height of the lockdown, compared to the usual 3.7 hours pre-COVID-19. This statistic is above the region’s average as Southeast Asians spent on average an hour more every day on the internet due to the lockdown.

Overall, the region’s internet economy continues to grow at an unprecedented rate, exceeding US$100 billion this year and is on track to cross US$300 billion by 2025.

Meanwhile, the report also shows major shifts in contributing verticals. Unsurprisingly, the eCommerce sector is now the largest vertical with a 63% growth to US$62 billion from US$38 billion in 2019. This trajectory is expected to grow positively and hit US$172 billion in 2025.

Other winners in the sector that have also seen exponential growth, including health tech which usage has grown four times this year, and edtech have seen the highest record growth where usage has grown three fold from 6 million to 20 million new users.

On the other hand, the travel vertical was seriously impacted by the lockdowns and travel bans, resulting in a contracted 58 percent to US$14 billion.

Investment increases for smaller, non-unicorn investment

In terms of funding activity, the report notes that the regional tech investment landscape has continued to flourish with an increase of 17% in the number of deals between the first half of 2019 and 2020.

The total deal value however declined slightly from US$7.7 billion over the same period, as attributed to the slowdown for large ticket unicorn investments.

Fundings for unicorns in mature sectors such as eCommerce, transport, food, and travel all slowed down due to uncertainties from investors and only amount to US$3 billion in the first half of 2020 as compared to US$5.1 billion of the same time period last year.

Smaller, non-unicorn investments however continue to grow and even made up more than half of the total deal value, which stands at 53% compared to the preceding 34% in 2019.

So despite the challenging circumstances of the COVID-19 pandemic, the internet economy in Southeast Asia remains more robust than ever, and in fact, accelerated which poised as a great investment ground for both ventures and entrepreneurs.

You can download the report – At Full Velocity: Resilient and Racing Ahead here or watch the video down below to get an overview.

Indonesian omnichannel sales platform iSeller raises Series A for business expansion

iSeller, an Indonesian omnichannel sales SaaS startup has raised its Series A funding round co-led by Openspace Ventures and Mandiri Capital, the VC arm of Bank Mandiri in Indonesia.

Financial details of the funding were not disclosed, however, it is known that the funding will mainly go towards business expansion, which will be used to accelerate the process of merchant acquisition and onboarding.

Additionally, iSeller will also be doubling down on technology development to further add more omnichannel merchant solutions and features.

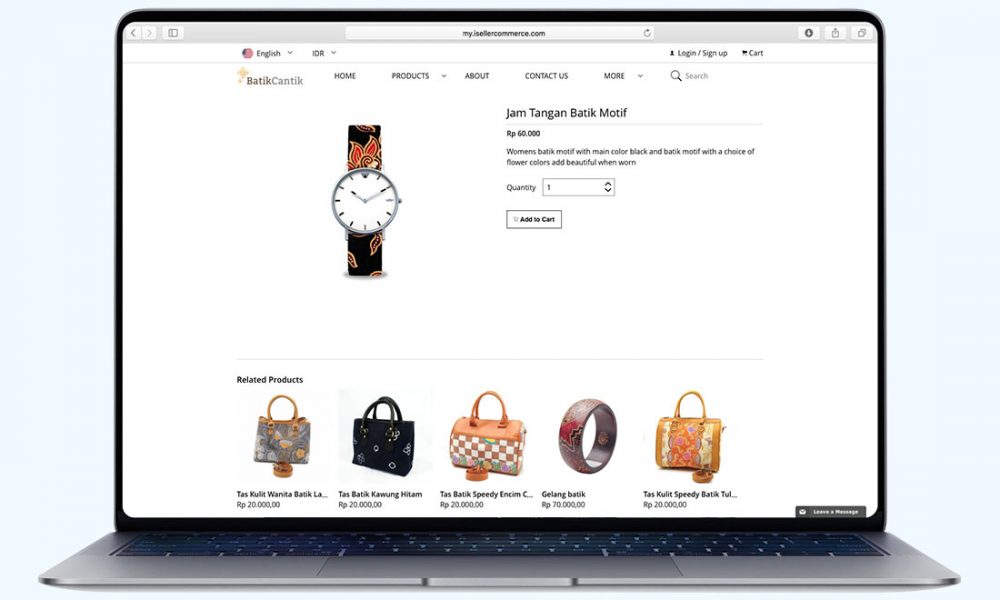

Founded in 2017 by Jimmy Petrus, iSeller operates a cloud-based platform for omnichannel businesses. The platform integrates in-store point of sale, online storefront, payment processing, order fulfillment, and inventory management within a single interface.

“Our goal is to empower small and medium business owners with an end-to-end digital ecosystem that allows them to manage and scale their businesses easier, faster, and smarter, particularly in this challenging time,” said Jimmy Petrus, the CEO and founder of iSeller.

According to iSeller, the startup has so far doubled its revenue and active merchant pool year-on-year. Driven by an increased volume of online transactions during the COVID-19 period, the startup currently processes more than five million transactions in a month.

“Since the CODID-19 lockdown in March, we have seen a rapid increase in demand, particularly for our online solutions such as retail online stores, F&B online ordering, and e-menus,” said Kevin Ventura, iSeller’s Chief Commercial Officer.

Shane Chesson, Openspace Ventures Founding Partner, said the omnichannel sales software opportunity in Indonesia and the region is ripe for growth.

“COVID-19 has irreversibly accelerated the adoption of digital payments and the importance of smooth online integrations to multiple partners. We look forward to lending our support to iSeller’s expansion,” said Chesson.

One of Southeast Asia’s most prolific and active venture capital firms that invests in early-stage startups across the Series A and B stages, Openspace Ventures has been investing in SaaS since 2015, including Tradegecko which has been recently acquired by Intuit.

Some of its other portfolio companies include Indonesia ride-hailing super app Gojek, health tech firm Biofourmis, fintech startup Finaccel, and Filipino online entertainment app Kumu.

Meanwhile, Mandiri Capital is the venture capital arm of Bank Mandiri in Indonesia. This time, its collaboration with iSeller is a strategic one, aimed at creating a comprehensive digital business ecosystem.

“In addition to our investment, we trust that strategic collaboration with our merchant ecosystem and Mandiri business groups will help iSeller to achieve massive growth and pave the way to profitability,” said Eddi Danusaputro, the CEO of Mandiri Capital Indonesia.

Aside from capital investment, their partnership will also cover product and payment integration, as well as bundled merchant services targeting Mandiri’s 200,000 MSMEs and large enterprises in Indonesia.

Google, Temasek makes US$350 million investment in Tokopedia

Tokopedia, an Indonesia-based eCommerce marketplace is likely to receive a US$350 million investment from Google and Temasek Holdings, according to a Bloomberg report.

The deal is yet to be formally concluded but it has been revealed that the Alphabet Inc. unit and Singapore’s state investment would be signing the funding agreement soon. This major cash infusion is expected to help bankroll Tokopedia’s expansion amidst this COVID-19 pandemic.

Despite the COVID-19 outbreak, which has disrupted almost all business sectors in the country, it has had a positive impact on the eCommerce sector as the virus has created a new normal in online shopping habits.

This applies to Tokopedia as well, which saw a surge in online shopping during the pandemic with a lot of new consumers going online to buy fast-moving consumer goods (FMCG).

Health, household supplies, and food and beverages have been the top-selling categories since March, said Tokopedia’s external communication senior lead Ekhel Chandra Wijaya.

Based on the e-Conomy SEA 2019 report by Google, Temasek, and Bain & Company, it is even predicted that Indonesia’s internet economy was well on track to cross the US$130 billion mark by 2025.

At this time, the backing of Google and Temasek certainly acts as a strong vote of confidence for Indonesia’s biggest e-commerce operators. The Indonesian unicorn was also said to have held talks with United States internet giants including Facebook Inc., Microsoft Corp, as well as Amazon.com Inc.

America’s largest internet corporations have increasingly look toward the Asia market for growth and opportunities as development in the United States and Europe has reached a standstill.

Looking to tap into the region’s growing smartphone-savvy population, Facebook has bought a stake in India’s Jio Platforms, while its Whatsapp unit has signed a deal to invest in Gojek, which operates a popular digital payment service called GoPay.

Earlier in September 2020, Tokopedia has introduced Dhanapala, an independent peer to peer (P2P) fintech lending platform which is available for download to Android users.

Eat Just partners with Proterra to launch new Asia subsidiary and plant-based food factory in Singapore

Eat Just, a plant-based food tech startup is launching a partnership with Proterra Investment Partners Asia to form a new Asian subsidiary. The agreement includes building Eat Just’s first factory in Asia, which will be based in Singapore.

Eat Just said that Singapore has already provided a conducive environment for the project with support from the Singapore Economic Development Board (EDB).

“It is increasingly important for us to invest in novel sustainable agri-food technology, such as alternative proteins, to meet the world’s future needs for food and nutrition,” said EDB executive vice president Damian Chan. “This will allow us to better cater to the needs of the Asian markets while creating exciting opportunities for Singapore.”

The deal will also see Proterra, the private equity firm spun from agricultural giant Gargill Inc, investing up to US$100 million in the facility while Eat Just will invest US$20 million. Once completed, this first factory will add to the company’s large-scale protein facilities in North America and Germany to generate thousands of metric tons of protein.

The new subsidiary, known as Eat Just Asia, will also focus on creating a fully integrated supply chain to serve manufacturing and distribution partners of Eat Just’s flagship products across Asia. This includes its plant-based egg alternative called Just Egg, which is created using mung beans and turmeric.

At present. Its existing distribution partners in the Asia market region include South Korea’s SPC Samlip, Thailand’s Betagro, and a partnership in Mainland China that has yet to be announced.

In addition to Just Egg, Eat Just and Proterra are also in talks expand their partnership to include the development of cultured meat, which is made from lab-grown cells as a substitution of slaughtered animals.

In Asia, demand for plant-based protein foods has grown exponentially during the COVID-19 pandemic, due in part to concerns about the safety of meat production and as consumers become more careful about nutrition and the environment. This has prompted various investments in alternative food companies.

Other plant-based food startups focusing on Asian markets include Impossible Foods, which announced funding of US$500 million in March to expand in Asia; Karana, a Singaporean startup that makes meat substitutes from jackfruit; and Malaysian-based Phuture Foods, which uses a variety of plants to make pork substitutes.

Relatedly, another Singapore biotech company looking to develop sustainable food alternatives is TurtleTree Labs. It is the first biotech company in the world that can recreate real milk from all mammals using cell-based technology. The startup’s goal is to produce high-value human breast milk.