Author: Sheldon

Indonesian Payments Platform Xendit Raises $300-million in Series D Funding

Indonesian-based payment platform Xendit recently announced that the firm has raised $300-million in fresh funding. The company hit unicorn status in its last round of funding in September 2021 but did not disclose the company’s valuation after the recent funding round.

The funding round was led by Coatue and Insight Partners with participation from investors such as Accel, Tiger Global, Kleiner Perkins, EV Growth, Amasia, Intudo, and Justin Kan’s Goat Capital.

The latest funding round has seen the total funds raised by the company since 2015 to $538-million.

The latest funds raised will be used to bring fresh capital to continue the expansion of the firm’s digital payments infrastructure across the region. According to the company, part of the funding will be used to expand into new markets, like Thailand, Malaysia, and Vietnam. The company which bills itself as “the Stripe of Southeast Asia” also plans to add value-added services in addition to payments, like working capital loans.

Xendit claims it has more than 3,00 customers including the likes of Samsung Indonesia, GrabPay, Ninja Van Philippines, Qoala, Unicef Indonesia, Cashalo, and Shopback.

Over the last year, the company tripled annualized transactions from 65-million to 200-million and increased total payments value from $6.5-billion to $15-billion. The company recently invested in Bank Sahabat Sampoerna, a private bank in Indonesia that focuses on micro and SME business, as well as banking-as-a-service for technology-enabled businesses. Additionally, the company complements its expansion into the Philippines by making strategic investments in the local payment gateway, Dragonpay.

Xendit was founded in 2015 by chief executive officer Moses Lo and chief operating officer Tessa Wijaya.

Southeast Asia is a compelling backdrop for investing, innovation and disruption, with 61% of 670-million people under 35 years old. The next generation of entrepreneurs is quickly moving online and the surge in growth is creating higher living standards and increasing consumer demand, especially in e-commerce, fintech, travel, and transportation.

Tessa Wijaya also went on to explain why the payment landscape in Southeast Asia is different than in the US. Wijaya stated that “ while the U.S. builds everything around credit cards, you just cannot do that in Southeast Asia. Credit card penetration is extremely low, especially in countries like Indonesia, so we have to help merchants offer alternative payment methods.”

Xendit was the first Indonesian tech startup to pass through the acclaimed incubator YCombinator and is the top Southeast Asian company on the YCombinator Top 100 list.

Australian corporate education content hub Go1 raised over $100-million in a funding round backed by SoftBank

Go1, an Australia-based corporate education hub for on-demand training and resources, announced on Monday that it has raised over $100-million in its latest funding round closed in May.

The round saw the company’s valuation increase to over $2-billion with the company’s total funding now at over $400-million.

The recent funding – which closed in May was co-led by AirTree Ventures and Five Sigma, with participation from the likes of SoftBank Vision Fund 2, Salesforce Ventures, Blue Cloud Ventures, Larsen Venture, Scott Shleifer, and John Curtius from Tiger, TEN13, M12 (Microsoft’s venture fund), Madrona Venture Group, SEEK, and Y Combinator also participating.

Online education continues to get a lot of attention in the wake of Covid-19 and the paradigm shift that it brought to change traditional means of education. Go1, being one of the rising stars in the world of enterprise learning, is at the forefront of this shift from traditional channels of education.

Go1 has also recently seen the appointment of a few top executives such as Marc Havercroft as president, Ashleigh Loughnan as chief people officer, Ben Allen as chief marketing officer, Antony Ugoni as chief data officer, and Jared Goralnick as senior vice president of product management.

The firm is also looking to expand its reach and scope by acquiring Coorpacademy to enter the European market and its expansion into Southeast Asia with offices in Malaysia and Singapore. Additionally, the Australia-based platform also bought professional workshop provider Education Changemakers.

Go1 said that the new capital will help Go1 accelerate its journey to reach a billion learners with upskilling, reskilling, and knowledge tools that empower workers across the globe.

Chief Executive Officer of Go1, Andrew Barnes said in a statement that “Leading organizations are recognizing the need to future-proof their workforces by providing comprehensive learning and development opportunities. The incredible team at Go1 has made huge strides in expanding our capabilities and offerings to ensure users have access to education that supports their growth. These recent investments allow Go1 to build on that momentum to explore new content and resources, enabling our platform to meet the needs of every organization and employee, and brings us closer to our goal of supporting one billion learners globally.”

Another area where the firm would like to use its investment is to bring more technological innovations into the Go1 platform. One of these is likely to be more technological innovations in the Go1 platform. One of these is likely to be more VR-based learning. Additionally, another direction of the company is to build out more live streaming to complement the existing catalog, which is based today around asynchronous content.

India’s ShareChat in advance talks with Google, and Temasek to close $300-million funding with $5-billion valuation

According to reports from Reuters, Indian-based ShareChat’s parent firm Mohalla Tech has raised nearly $300-million from Google, Indian media conglomerate Times Group, and the Singapore government’s Temasek Holdings.

This latest funding puts the value of the social media firm at nearly US$5-billion with the deal set to be announced as early as next week.

This is Google’s second investment in India’s short video sector with Google previously investing in other short video apps, having previously invested in VerSe Innovation which runs a short-video company named Josh which is already valued at US$5-billion, that competes with ShareChat’s sister firm Moj.

ShareChat’s app is available in 15 languages and currently has 180-million monthly active users and more than 32-million creators according to their website.

ShareChat was last valued at US$3.7-billion in a US$266-million funding round from investors including Alkeon Capital and Temasek in 2021. The firm also includes the likes of Twitter and Snap among its investors.

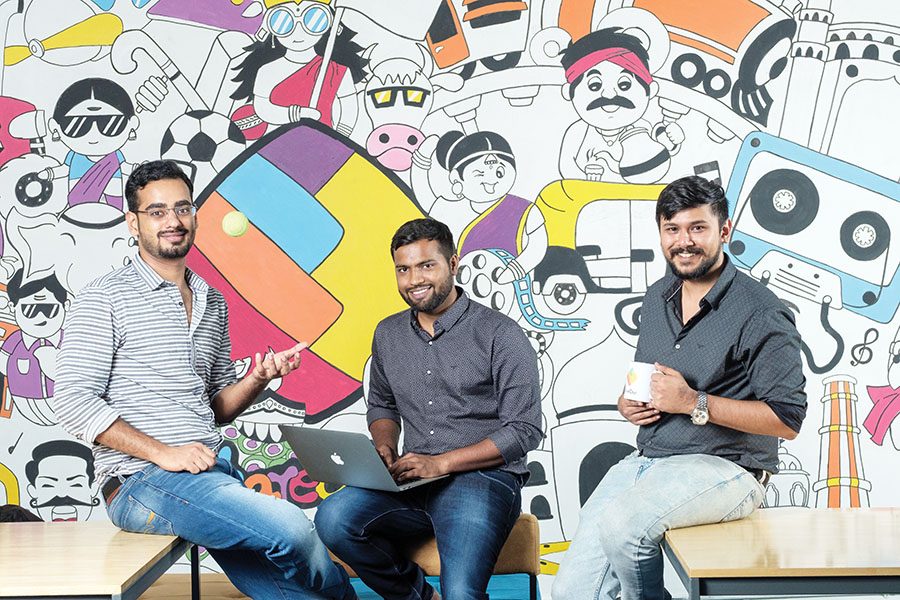

The social media firm is backed by the likes of Snapchat, Tiger Global, and Twitter. ShareChat was founded in 2015 by three Indian Institute of Technology graduates – Ankush Sachdeva, Bhanu Pratap Singh, and Farid Ahsan.

Short video apps like Moj and Josh shot up in popularity after India 2020 banned their Chinese competition ByteDance’s TikTok and Helo etc, following a border clash with China. India’s short-video market is expected to reach 650-million monthly active users by 2025.

India’s unicorn startup, Cars24 cuts 600 jobs

The used car e-commerce platform, Cars24 backed by investors in the likes of SoftBank and Alpha Wave Innovation, has asked 600 of its employees to leave, even as it pushes ahead with its international expansion plans and attempts to steer through the gloomy market conditions.

The Cars24 layoff, which represents about 6% of the startup’s workforce, affects staff across multiple divisions. A spokesperson for Cars24 insisted in a statement that “THis is business as usual as these are performance-linked exits that happen every year.”

In December last year, Cars24 closed a $400-million round of funding, including a $300-million Series G equity round alongside a $100-million debt from diversified financial institutions such as SoftBank, Alpha Wave Global, and DST Global among its backers.

The $400-million injection of funding saw the platform being valued at $3.3-billion, about double its previous round in September 2021.

The company has recently announced the launch of seven ‘Mega Refurbishment Labs’ (MRLs) in India which is an industry first, and one MRL in the UAE which is among Dubai’s largest ever commercial leasing deals.

Vikram Chopra, Co-founder & CEO of Cars24 said that “As we continue to build the best infrastructure for the future with an end-to-end digital customer experience, we are confident that this will delight our customers with our high-touch industry experience.”

The recent layoff by Cars24, however, did not come as a surprise as investors are advising startups to cut their costs and increase the runway by as much as three years as plenty of funding rounds that were getting finalized a few weeks ago are increasingly being renegotiated, stalled or canned.

This sentiment by investors saw Indian edtech Vedantu letting go over 620 people in recent weeks, whereas Cars24’s chief rival, Unacademy, has fired about 1000 individuals. Other startups like Meesho, OkCredit, Trell, Furlenco, and Lido have also cut several roles within their firms in recent weeks.

Japanese payment processing firm Opn obtains unicorn status after raising $120-million

Digital payment processor Opn, which was formerly known as Synqa, said it has raised $120-million in a Series C+ funding round, earning itself a unicorn status.

Some investors that have participated in the funding round include government-backed JIC Venture Growth Investments, Mitsubishi UFG Financial Group, and tech investors Mars Growth Capital which has brought Opn’s total raised capital to date to $222-million.

Opn, which has its registered headquarters in Tokyo and operational headquarters in Bangkok, said that the fresh capital will support the firm to continue developing services and product line-up while also pushing further into Southeast Asia as it rides the growth of digital payments in the region.

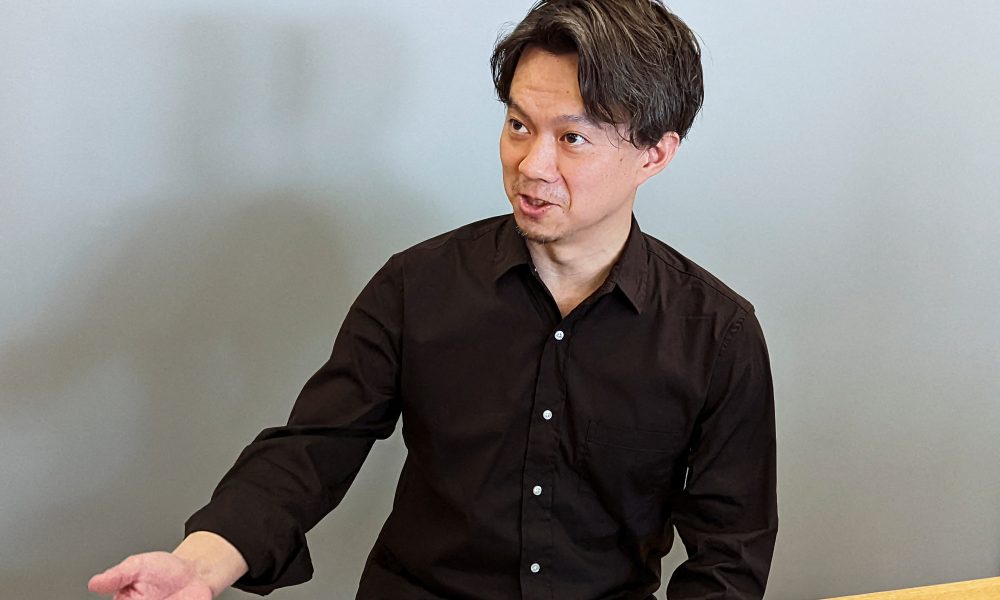

The company while targeting to expand its geography also targets Japan, where digital transformation is a buzzword in government circles and companies are looking for help in processing cross-border payments. Jun Hasegawa, Opn founder, and CEO stated that: “They need a one-stop solution…that’s something we can provide.”“We are extremely excited and proud to bring on board this high-quality investment, allowing us to accelerate the development of our core payment solutions, while also expanding into new territories within our core markets of Southeast Asia and Japan and beyond,” as stated by Jun Hasegawa.

He also continued to state: “As we approach 10 years since we started as a payment gateway company, and now customized fintech solutions to help businesses grow, we have continued to obsess over how to make payments ever more seamless for both businesses and the people they serve. Through our fintech solutions, we are realizing our vision of enabling access to the digital economy for everyone.”

Opn, was founded in 2013 in Bangkok by Jun Hasegawa and co-founder Ezra Don Harinsut. The company is one of Japan’s five unicorns, including news app operator SmartNews and biotech firm Spiber. Japan has a growing number of startups and foreign investors are becoming more common in funding round. However, it still lags behind countries like South Korea and Singapore with 12 and India which has more than 60 unicorns.