Startup

-

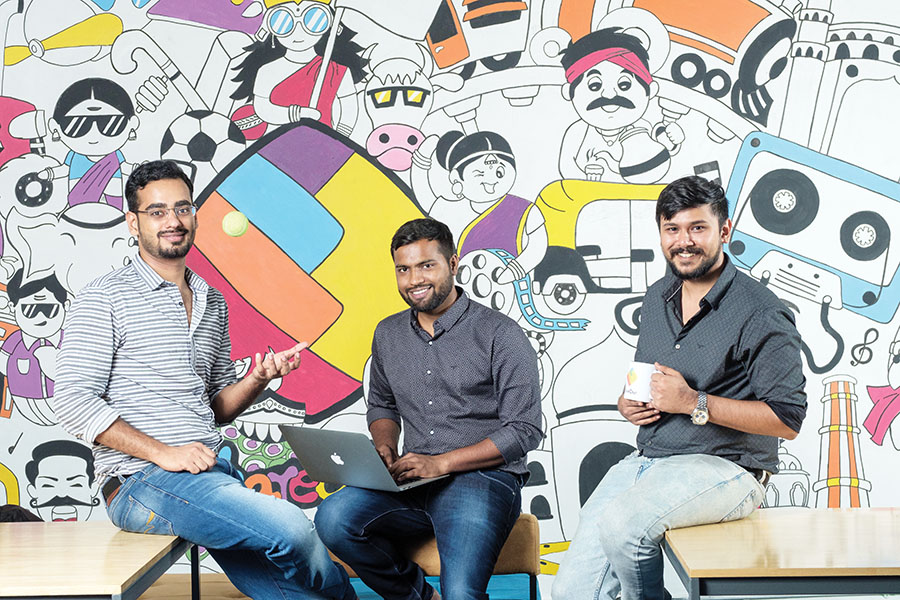

India’s ShareChat in advance talks with Google, and Temasek to close $300-million funding with $5-billion valuation

According to reports from Reuters, Indian-based ShareChat’s parent firm Mohalla Tech has raised nearly $300-million from Google, Indian media conglomerate Times Group, and the Singapore government’s Temasek Holdings. This latest funding puts the value of…

-

India’s unicorn startup, Cars24 cuts 600 jobs

The used car e-commerce platform, Cars24 backed by investors in the likes of SoftBank and Alpha Wave Innovation, has asked 600 of its employees to leave, even as it pushes ahead with its international expansion…

-

Japanese payment processing firm Opn obtains unicorn status after raising $120-million

Digital payment processor Opn, which was formerly known as Synqa, said it has raised $120-million in a Series C+ funding round, earning itself a unicorn status. Some investors that have participated in the funding round…

-

Indian instant grocery startup nears unicorns status after raising $200-million

In the latest funding round led by Y Combinator, an instant grocery startup – Zepto has raised $200-million in a Series D fundraise, which takes its valuation to around $900-million just shy of a unicorn…

-

Singapore-founded Biofourmis raised a whopping $300 million in Series D funding to earn a unicorn status

Biofourmis, a startup developing digital therapeutics and artificial intelligence to remotely monitor patients conducted a Series D funding round led by General Atlantic which raised $300-million to bring its valuation to $1.3-billion. The funding round…