Category: Startup

Indonesian financial e-commerce provider Cermati closes its Series A extension from Orange Growth Capital

Indonesia’s financial e-commerce provider, Cermati on February 2 announced that it has raised a seven-digit USD funding from Orange Growth Capital (OGC), a venture capital firm focused on fintech.

This investment by Orange Growth Capital, a European fintech VC and backer of peer-to-peer platform Zopa and online trading platform BUX follows as an extension to the Series A round previously announced in September 2016, which was led by East Ventures with the participation of Beenos Plaza.

Additionally, Cermati will also become OGC’s first investment portfolio in Asia, adding to the 12 portfolios which are all running in the field of finance such as loans, fraud prevention, investment payments to insurance among some. Established in 2013, the VC firm has three offices located in Amsterdam, London, and Singapore.

This latest round also sees Hams de Back, a partner at Orange Growth Capital joining Cermati’s board. Speaking on the investment, Hans de Back said, “We are delighted to invest in Cermati and to partner with Andhy and the team. This business has a great growth potential as Indonesia is the largest market in Southeast Asia.”

“In Indonesia, there is growing disposable income amongst the population and a regulator supportive of the growth of the financial services industry, where today there are only at approximately 36 percent of Indonesians that are customers of financial institutions. We are looking forward to working with Cermati to build a top tier financial e-commerce portal in Indonesia,” he added.

Founded in April 2015, Cermati is an online platform that helps customers research and acquires financial products, such as credit cards, auto loans, personal loans, and mortgages. It claims to have become the most visited financial e-commerce site in Indonesia, posting 3.2 million monthly visits in December 2016 and facilitating over IDR 100 billion worth of consumer loans in 2016.

Oby Sumampouw, the CTO and cofounder of Cermati, said: “We are focused on building a financial technology platform to provide the most streamline and easy to use experience for Indonesians to discover and get financial products.”

The latest investment will be used for product development and further technical enhancements, to improve the state-of-the-art technology, data science as well as analytical tools. Besides, the firm will also be opening more opportunities for tech talents to join their company.

Speaking on the investment, Andhy Koesnandar, the CEO and cofounder of Cermati said, “We are very pleased to partner with OGC, which brings deep experience in building FinTech businesses. We look forward to capitalizing on OGC’s experience in Indonesian market opportunities. This investment will accelerate our progress to achieve our mission of making financial products more accessible to many more Indonesians.”

By Vivian Foo, Unicorn Media

Japanese Xtreme Design raises pre-Series A worth US$620k led by Freebit Investment

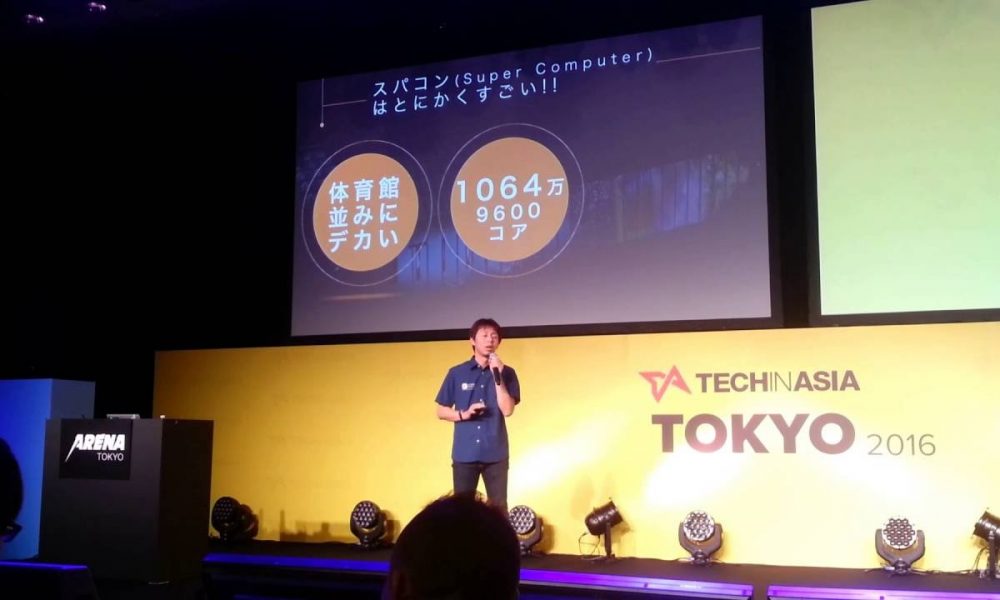

Xtreme Design, a Tokyo-based startup providing the cloud-based virtual supercomputing-on-demand service known as Xtreme DNA, has on Tuesday announced that it has fundraised 70 million yen (about US$620,000) in its pre-Series A round.

The round was led by Freebit Investment and individual investors which include the former Vice President of Japanese mobile game developer Colopl, Kotaro Chiba and the CEO of Takamatsu-Kotohira Electric Railway, Yasumasa Manabe.

With this funding round, it is said that there would be a probable business synergy between Xtreme Design and Freebit, the parent company of Freebit Investment which businesses involves the provision of Infrastructure as a Service (IaaS).

This financing round also follows the round conducted last January and March by the firm’s founders and angel investors worth 30 million yen (about US$260,000).

Founded in February 2015, Xtreme Design is a platform development company for the democratization of supercomputing. In November 2016, the startup has presented its flagship product Xtreme DNA at the global supercomputer conference SuperComputing 2016.

Xtreme DNA is an unmanned service of operations which is capable of monitoring the dynamic changes of configuration in order for an effective system utilization of supercomputers through the deployment of virtual supercomputers on the cloud.

It is available for Microsoft Azure, supporting InfiniBand as well as applicable on AWS (Amazon Web Service). According to CEO Naoki Shibata, the functions of Xtreme DNA have been attracting a lot of attention as IaaS from enterprise users.

Despite Xtreme Design focus on back-end technologies, it appears to be switching gears for the next stage, releasing “Xtreme DNA 2.0.” in which Shibata explains is an attempt to supplement the visualization with well-designed UI/UX to Xtreme DNA.

“We plan to develop our service to be used not only in genome or simulation analysis but also in various fields such as IoT, image analysis or stock price prediction in fintech. The purpose of UI/UX implementation is to make it easier to be used by a wide range of users,” said Shibata.

Although a few startups in the United States also provide seemingly competitive services, Shibata expects that Xtreme Design can win out if a good product with UI/UX can be offered.

With a vision to dominate the global market, the brand-new Xtreme DNA is scheduled to be exhibited at the SXSW Trade Show which will be held in Austin, Texas on March 10th.

By Vivian Foo, Unicorn Media

Travel site Ixigo secures US$15 million funding round participated by Fosun, Sequoia Capital

Chinese conglomerate Fosun has decided to participate in a US$15 to US$20 million financing round in travel search site Ixigo, a deal that is expected to mark the investment firm’s first venture transaction in India.

The US$15 to US$20 million round was first reported by the Economic Times in December to be led by marquee venture capital firm Sequoia Capital, with Fosun coming on board as a co-investor.

This Ixigo financing round also follows a US$18.5 million funding round last raised in August 2011 by SAIF Partners and MakeMyTrip which has acquired 56.7 percent and 19.9 percent respectively.

While in June 2015, phone maker Micromax has picked up a stake in the company by investing about US$4 million. However, the three existing investors did not participate this time around in the last Series B round.

Founded in 2007 by Bajpai and Rajnish Kumar, Ixigo acts like a meta search engine for online travel agents such as MakeMyTrip and Goibibo. The company is said to have processed transactions worth Rs 300 crore during the financial year of 2015.

Besides, the Gurgaon-based company has also recently started taking bookings through its app as well as entering the cabs metasearch space where it works with Ola, Uber, among other to find the best options for commuters.

Fosun, on the other hand, has set up its India team last year to invest in domestic firms. Raisurana, an ex-MD at Standard Chartered Private Equity, Tej Kapoor, former Naspers executive, and Ajay Lakhotia, who was earlier India head of Vertex Venture, are leading the investment team for the Chinese group in India.

The Shanghai-based group, however, has earlier endeavored in the travel industry, acquiring French holiday group Club Med in 2015 and making an investment in Thomas Cook and its public market position, MakeMyTrip.

The new team will look to make early-stage tech investments signing cheques for up to US$5-10 million, as well as take picks among more mature companies in both private and public markets.

By Vivian Foo, Unicorn Media

Japanese Enechange raises US$4.4 million from Opt Ventures, IMJ for marketing and overseas projects

Tokyo-based energy price comparison service Enechange has closed a funding round estimated at 500 million yen (about US$4.4 million) from Opt Ventures and IMJ Investment Partners.

This round follows a 400 million yen (about US$3.5 million) investment from Energy & Environment Investment and TSE-listed Hitachi in February last year. With this funding, the collective capital raised by the firm has reached US$7.9 million.

Launched in April 2015, Enechange offers a power supplier switch service for enterprises and SIM card comparison site for companies and consumers. The startup also provides consulting services for electric companies in Japan, having partnered with UK-based SMAP Energy.

Its platform (https://enechange.jp/) is an energy price comparison site under the same name which was released in September 2015.

Since the deregulation of energy supply that occurred in April 2016, the Japanese electricity industry has seen the entry of major corporates like Softbank and Rakuten establishing subsidiaries to tap into this market.

With this, Japan’s market for electricity retail to small-scale users which was previously dominated by 10 major power companies that monopolised their respective regions has seen deregulation which led to more than 300 new entrants to the power retail market from various non-electricity sectors, including companies like SoftBank and Tokyo Gas.

However, with most customers of the new suppliers concentrated in the greater Tokyo area and the Kansai region, this limited number of market entrants may serve to limit the growth prospect of Enechange.

With the latest funding round, Enechange plans to expand its businesses overseas, deploying its businesses in countries like UK and Dubai among some.

Additionally, the capital will also be used to strengthen its marketing via the production and release of mass advertisement centered on TV commercials. The commercials will begin in the Kansai area starting January 25

By Vivian Foo, Unicorn Media

Japanese video production startup Viibar secures US$3.5 million strategic investment from Nikkei

Viibar, a Tokyo-based video production service has announced on 17 January that it has received a US$3.5 million investment from Nihon Keizai Shimbun, a leading business newspaper widely known as Nikkei.

As part of the deal, both parties will enter a partnership to come out with new services and advertisement products for Nikkei’s new digital marketing organisation, N Brand Studio.

Additionally, Viibar will also participate in building a team to develop and provide new services and advertising products in addition to the company’s current main role of supporting content marketing for companies.

In the spring of 2017, the two companies will launch a new media project known as Nikkei Style, which will be managed by Nikkei.

Established in 2013 and led by CEO Yuta Kamisaka, Viibar is popular as a crowdsourced video production service, specialising in all things video production.

Viibar, who originally supported the crowdsourcing of video materials for companies, in these past few years, has undertaken a new development, venturing in investments and corporate alliance with the media.

The company provided new options for video production, riding the crowdsourcing wave by gathering creators online and streaming production through their production platform.

Since its inception in 2013, the startup has assembled about 3,000 online creators with the number of companies using their service climbing to 600.

“Media is a collection of content,” Kamisaka said. “We have a commitment to creating an environment where it is possible to focus on creative pursuits. We are not just intermediaries matching creators with projects, but through evaluating creators, and paying attention to various results, we have been able to confirm that this is the correct direction to take.”

From the onset, they did not simply provide crowdsourcing for video production, but also dabbled in the media, using the funds received from Yahoo Japan in their previous round, and Bouncy, their version of distributed contents.

Along with this business partnership, Viibar will also receive approximately 400 million yen (around US$3.5 million) in the latest funding round from Dentsu Digital Holdings and Globis Capital Partners as well as Nikkei.

With this, Viibar is looking to use its brand-name media and distribution to move to a new stage. In turn, this then becomes a test of whether they can expand as a business by taking this next step away from a production platform.

“I think it comes down to whether or not we can make a strong brand. A strong brand means that the media has a fan base and its cost per acquisition (CPA) is low, and if this is solid, then it does not matter whether the content is offered via a platform or via our own media,” Kumisaka explains

The company is planning to expand their team of about 40 to 100 people.

By Vivian Foo, Unicorn Media