India Deep Tech Alliance IDTA, which officially launched in September. It has begun to construct an impressive coalition of international investors, with over seven major U.S. and Indian investors, including Accel, Blume Ventures and Qualcomm. So far, the IDTA has already locked down over $1 billion in commitments. Its objective is to fuel the development of India’s fast emerging deep-tech sector over the next five to ten years. Celesta Capital, a hybrid venture and mission firm with roots in both Silicon Valley and India, is leading this effort. It’s intended to be a major source of capital, mentorship, and network access for high-potential Indian startups.

The IDTA’s formation aligns with the Indian government’s Research, Development and Innovation (RDI) scheme, approved earlier this year and rolled out by Prime Minister Narendra Modi. The RDI scheme is happy to sport a ₹1 trillion corpus. This fund, recently infused with $12 billion, is focused on funding projects in key areas including energy security, quantum computing, robotics, space technology, biomanufacturing and AI.

The IDTA partners plan to leverage the RDI scheme to enhance their investment strategy while collaborating closely with the government on policy initiatives. Today, this partnership plays a pivotal role in bridging the funding gap that deep-tech startups from India typically experience.

So far in 2024, India’s deep-tech funding is on pace for a stunning 78% YoY increase, totaling $1.6 billion. The IDTA’s collaborative approach is meant to help close this funding gap even more and attract the world’s attention to India’s burgeoning startup ecosystem.

Sriram Viswanathan, the founding managing partner of tech investment firm Celesta Capital, wants to see more collaboration within the investment community. He is a founding executive council member of the IDTA.

“We’re collaborating to share knowledge, to share deal flow, and all of that,” – Sriram Viswanathan, founding managing partner of Celesta Capital.

Viswanathan stressed that the IDTA is more than just a fund, but an investor coalition of like-minded actors.

“This alliance is not a fund. There’s no obligation, no allocation, if you will, of any deal,” – Sriram Viswanathan.

The IDTA represents a broad cross-section of American companies. It includes notable Indian venture capital firms as Activate AI, Chiratae Ventures, InfoEdge Ventures, Kalaari Capital, Singularity Holdings and YourNest Venture Capital. Collectively, these investors are hoping to leverage their expertise to redefine and accelerate India’s deep-tech ecosystem through creating partnerships and encouraging innovation.

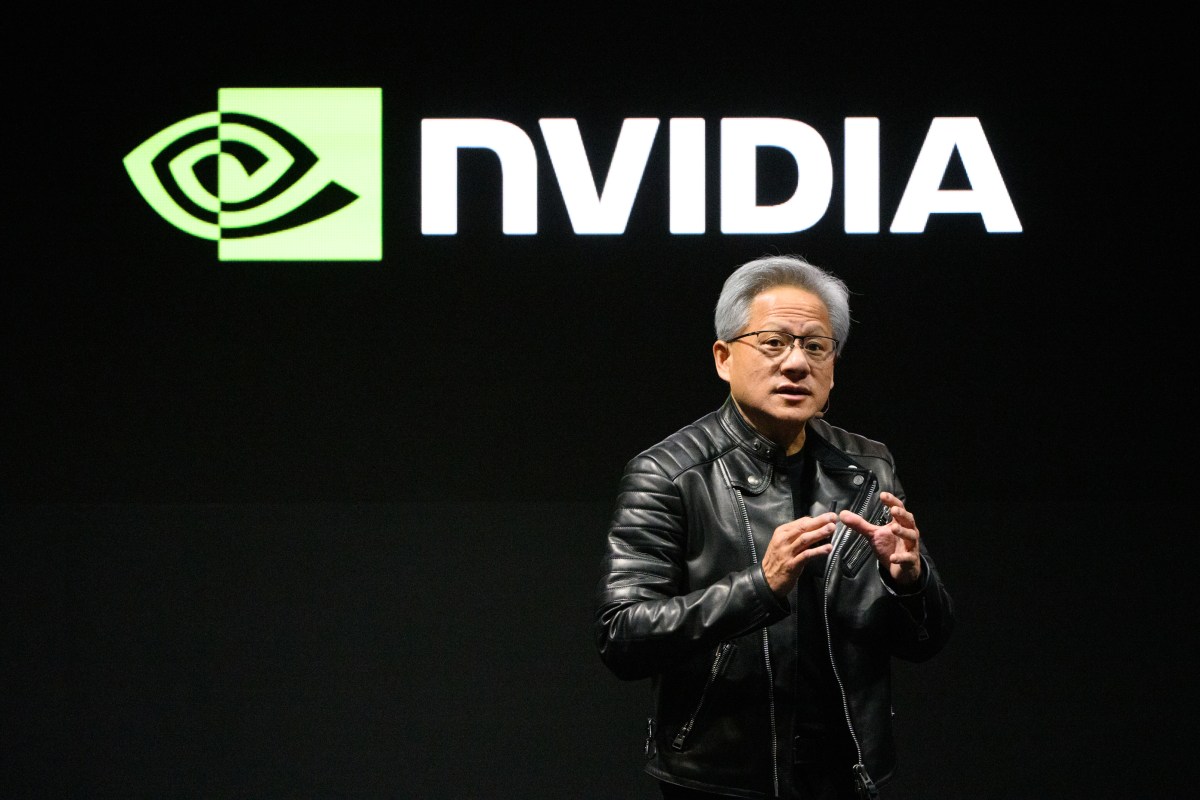

NVIDIA’s participation goes a long way to bring another touchstone of credibility to the IDTA’s mission. NVIDIA is dedicated to guiding Indian startups on effective strategies for leveraging its AI and accelerated computing platforms. In addition to these activities, the company will play a leading role in policy engagement that supports India’s deep-tech agenda.

Vishal Dhupar, South Asia managing director for NVIDIA, stressed the importance of collaboration among venture capitalists. He stressed the need to ensure that their work complemented the priorities of government.

“If you are like minded and other VCs have allocated certain portion of their resources, dollars, time, and network, it helps each other,” – Vishal Dhupar.

Qualcomm is also contributing to this initiative. Rama Bethmangalkar, India managing director at Qualcomm Ventures, was the first person to answer the question about fostering role models within the ecosystem.

“What we need are role models to begin with,” – Rama Bethmangalkar.

Ingram’s enthusiasm for India deep-tech startups was shared by Bethmangalkar. He’s convinced that in a decade’s time, these firms will be the new captains of industry on today’s leading stock exchanges.

“In ten years, you’ll start seeing these as the companies listed on the main boards of our exchanges — deeply science- and tech-oriented firms,” – Rama Bethmangalkar.

India is a hive of entrepreneurial activity, having quickly grown to more than 180,000 startups and over 120 unicorns. Looking ahead, the IDTA is prepared to attract even greater investment and innovation. The initiative envisions increasing capital for emerging business creators in the deep-tech space. Further, it will put robust support structures in place to ensure they flourish.

Leave a Reply