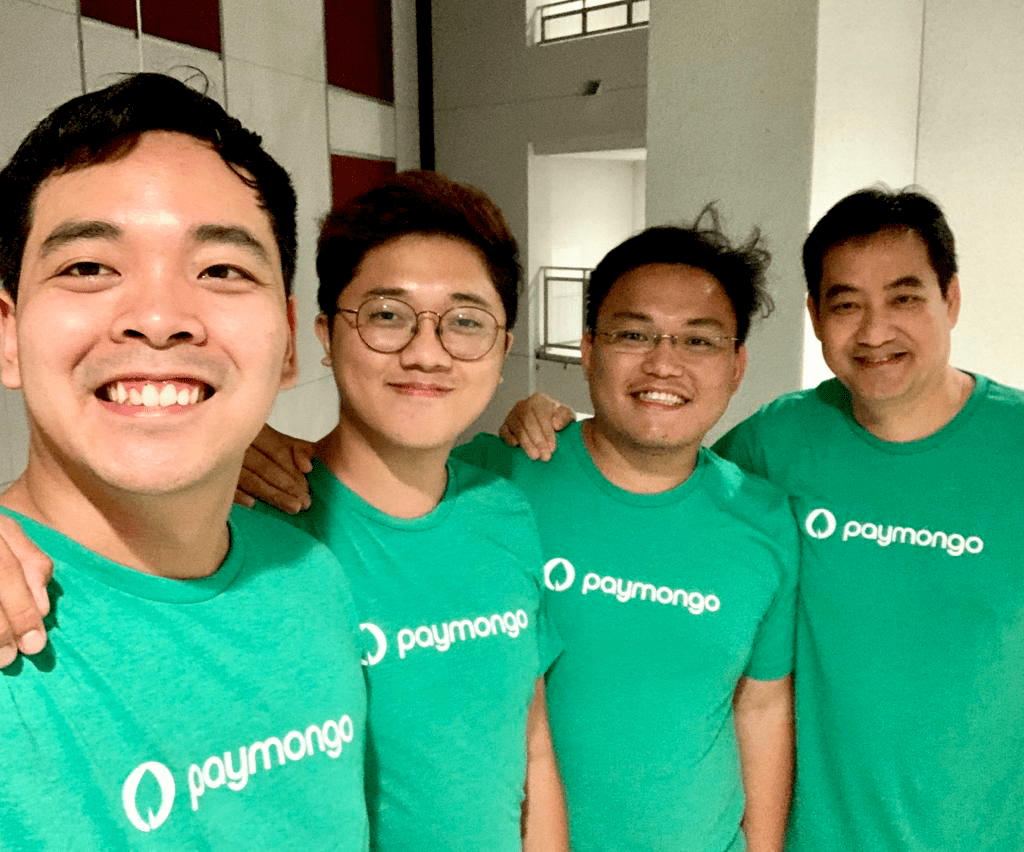

In April 2019, four co-founders, namely Francis Plaza, an MIT engineer; software engineer Jamie Hing II; business entrepreneur Luis Sia; and former Philippines Cabinet official Edwin Lacierda launched PayMongo to facilitate payments for businesses.

The fintech startup is backed by the likes of PayPal co-founder Peter Thiel, payment giant Stripe, and famed Silicon Valley accelerator Y combinator. PayMongo recently announced that it has raised $31-million in a Series B funding round to scale its operations and venture into more financial services. This brings the total investment of the three-year-old startup to nearly $46-million.

PayMongo CEO and co-founder Francis Plaza stated that “With this Series B, we will invest further in our merchant’s successes by giving them more means to move money seamlessly online” in a statement to Forbes. The injection of fresh capital will allow the company to build more products inter alia disbursements, capital lending, BNPL, subscriptions, and recurring payments. The firm has also stated its intention to expand its business beyond the Philippines in the broader Southeast Asian region.

In 2019, the startup raised $2.7-million in seed funding while the latest Series B round comes less than a year after PayMongo raised $12-million in a Series A funding round led by Stripe.

PayMongo said it has achieved a 4x growth in monthly transaction volumes and a growth of 3x in merchant base.

The company works with businesses of all sizes. However, the company targets micro, small, and medium-sized businesses, in particular, by enabling them to accept different forms of payments, including online wallets, credit cards, and over-the-counter payments.

Small and medium-sized businesses account for 99% of businesses in the Philippines and have been historically been underserved by traditional payment providers. PayMongo’s API delivers a consistent checkout experience by lowering the integration time to a few lines of code. Onboarding and fraud detection systems are also featured on its payment platform.

Leave a Reply