iSeller, an Indonesian omnichannel sales SaaS startup has raised its Series A funding round co-led by Openspace Ventures and Mandiri Capital, the VC arm of Bank Mandiri in Indonesia.

Financial details of the funding were not disclosed, however, it is known that the funding will mainly go towards business expansion, which will be used to accelerate the process of merchant acquisition and onboarding.

Additionally, iSeller will also be doubling down on technology development to further add more omnichannel merchant solutions and features.

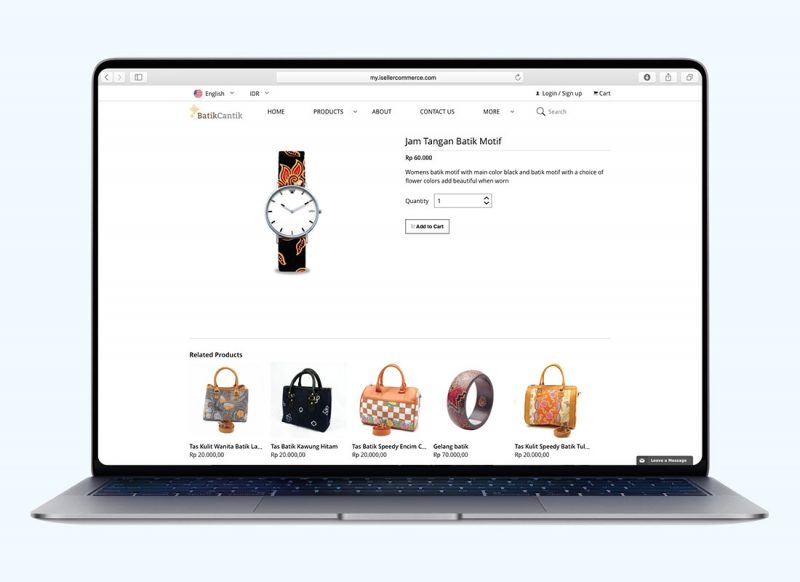

Founded in 2017 by Jimmy Petrus, iSeller operates a cloud-based platform for omnichannel businesses. The platform integrates in-store point of sale, online storefront, payment processing, order fulfillment, and inventory management within a single interface.

“Our goal is to empower small and medium business owners with an end-to-end digital ecosystem that allows them to manage and scale their businesses easier, faster, and smarter, particularly in this challenging time,” said Jimmy Petrus, the CEO and founder of iSeller.

According to iSeller, the startup has so far doubled its revenue and active merchant pool year-on-year. Driven by an increased volume of online transactions during the COVID-19 period, the startup currently processes more than five million transactions in a month.

“Since the CODID-19 lockdown in March, we have seen a rapid increase in demand, particularly for our online solutions such as retail online stores, F&B online ordering, and e-menus,” said Kevin Ventura, iSeller’s Chief Commercial Officer.

Shane Chesson, Openspace Ventures Founding Partner, said the omnichannel sales software opportunity in Indonesia and the region is ripe for growth.

“COVID-19 has irreversibly accelerated the adoption of digital payments and the importance of smooth online integrations to multiple partners. We look forward to lending our support to iSeller’s expansion,” said Chesson.

One of Southeast Asia’s most prolific and active venture capital firms that invests in early-stage startups across the Series A and B stages, Openspace Ventures has been investing in SaaS since 2015, including Tradegecko which has been recently acquired by Intuit.

Some of its other portfolio companies include Indonesia ride-hailing super app Gojek, health tech firm Biofourmis, fintech startup Finaccel, and Filipino online entertainment app Kumu.

Meanwhile, Mandiri Capital is the venture capital arm of Bank Mandiri in Indonesia. This time, its collaboration with iSeller is a strategic one, aimed at creating a comprehensive digital business ecosystem.

“In addition to our investment, we trust that strategic collaboration with our merchant ecosystem and Mandiri business groups will help iSeller to achieve massive growth and pave the way to profitability,” said Eddi Danusaputro, the CEO of Mandiri Capital Indonesia.

Aside from capital investment, their partnership will also cover product and payment integration, as well as bundled merchant services targeting Mandiri’s 200,000 MSMEs and large enterprises in Indonesia.

Leave a Reply